Best National Securities Market Commission (CNMV) Regulated Brokers 2026

We’ve personally tested and ranked the top brokers regulated by Spain’s National Securities Market Commission (CNMV), ensuring high standards of trust and reliability.

-

1

is a leading multi-asset platform offering trading in thousands of CFDs, stocks, and cryptoassets. Established in 2007, it has millions of active global traders and is regulated by top authorities like the FCA and CySEC. It is well-known for its social trading platform. Crypto trading is provided through eToro USA LLC. Investments are subject to market risk, including potential loss of principal. CFDs are not available in the US. Crypto investments carry risk and may not be suitable for retail investors, with a possibility of losing your entire investment. Understand the risks here. 61% of retail CFD accounts lose money.

Compare the Best CNMV-Regulated Brokers

Safety Comparison

Compare how safe the Best National Securities Market Commission (CNMV) Regulated Brokers 2026 are.

Mobile Trading Comparison

Compare the mobile trading features of the Best National Securities Market Commission (CNMV) Regulated Brokers 2026.

Comparison for Beginners

Compare how suitable the Best National Securities Market Commission (CNMV) Regulated Brokers 2026 are for beginners.

Comparison for Advanced Traders

Compare how suitable the Best National Securities Market Commission (CNMV) Regulated Brokers 2026 are for advanced or professional traders.

Accounts Comparison

Compare the trading accounts offered by Best National Securities Market Commission (CNMV) Regulated Brokers 2026.

Detailed Rating Comparison

Compare how we rated the Best National Securities Market Commission (CNMV) Regulated Brokers 2026 in key areas.

Fee and Cost Comparison

Compare the cost of trading with the Best National Securities Market Commission (CNMV) Regulated Brokers 2026.

Broker Popularity

See how popular the Best National Securities Market Commission (CNMV) Regulated Brokers [year] are in terms of number of clients.

| Broker | Popularity |

|---|---|

| eToro |

|

Why Trade With eToro?

eToro's social trading platform ranks highly due to its excellent user experience and active community chat, useful for beginners seeking trading opportunities. The platform also offers competitive fees on a vast selection of CFDs and actual stocks, alongside beneficial rewards for skilled strategy contributors.

Pros

- eToro enhanced social trading in 2025 by incorporating insights from over 10 million Stocktwits users to assess market sentiment.

- Charts use TradingView, providing strong technical analysis features with 9 chart types and 100+ indicators.

- The web platform and mobile app receive higher user reviews and app rankings than leading competitors, including AvaTrade.

Cons

- There are no guaranteed stop-loss orders, which would be a helpful risk management feature for beginners.

- The minimum withdrawal amount is $30 with a $5 fee, impacting beginners with little capital.

- Contact options are limited, except for the in-platform live chat.

Filters

How BrokerListings.com Selected the Top CNMV Brokers

To identify the best brokers regulated by Spain’s CNMV, we took three steps:

- We checked each firm’s regulatory status in CNMV’s database to confirm they hold a license under MiFID II and operate in compliance with Spain’s laws.

- We used our proprietary broker rating framework that looks at over 200 data points, including platform usability, spreads, EUR account options, and client protections.

- We ran hands-on tests to check the brokers deliver not just on regulation, but also performance for active traders.

What Is CNMV?

The Comisión Nacional del Mercado de Valores – more commonly known as CNMV – is the organization tasked with supervising and regulating financial markets in Spain.

Translated as the National Securities Market Commission, the body was established in 1988. It describes its role as “to ensure the transparency of Spanish securities markets and the correct formation of prices, as well as the protection of investors.”

The CNMV takes its lead from the European Securities and Markets Association (ESMA), which establishes and harmonizes regulations across the European Economic Area (EEA). As a consequence, the CNMV is designated a Category A regulator under BrokerListings.com’s broker regulator classification system.

What Powers Does CNMV Have?

The CNMV is in charge of regulating and supervising financial markets, and taking enforcement action where it deems appropriate.

Part of its remit includes issuing licenses for online trading providers to do business, on the condition that they (and individuals that act on their behalf) operate in accordance with local regulations.

The CNMV has a range of tools at its disposal to investigate potential industry misconduct. It can request documentation, conduct on-site inspections and interview suspected persons. Where it deems wrongdoing has occurred, it can issue fines, suspend or curtail companies’ activities, freeze assets, and revoke firms’ licenses.

Pro tip: The CNMV maintains an up-to-date register of penalties it’s issued to persons and companies on its website. Information is kept on the register for five years.

In one of the regulator’s most recent high-profile cases, Deutsche Bank was fined €10 million in February 2025 for mis-selling foreign exchange derivatives products to corporate clients. The regulator said it had discovered “very serious infringements” between 2018 and 2021 – these related to poor product suitability assessments, and a lack of proper risk disclosure.

The CNMV also suspended the bank from carrying out investment advisory activity related to the derivatives for a year.

What Rules Must A CNMV Broker Follow?

Spain is a member of the European Union (EU), meaning the regulator’s rules work in harmony with standards laid down by ESMA. Part of ESMA’s role is “to ensure that investors are effectively protected, with a particular focus on retail investors.”

Pro tip: ESMA’s jurisdiction covers the whole EU bloc of 27 countries along with Liechtenstein, Norway and Iceland, an area known as the European Economic Area (EEA).

Like all national regulators, ESMA’s wide-reaching role is to guarantee that financial markets operate in a fair, effective and transparent manner.

National regulators in the EEA must therefore base their guidelines on ESMA’s Markets in Financial Instruments Directive II (MiFID II), which was introduced in 2018.

To comply with Spain’s regulatory framework, you must as a broker:

- Know your client’s circumstances. Before selling or discussing any product or service, it’s essential to first ascertain their investment goals, tolerance of risk, and their trading knowledge and experience.

- Prioritize your customers’ best interests. This means ensuring all marketing and advertising literature is clear and not misleading, and states the risks associated with the products discussed.

- Be completely transparent. Key information on issues like trading costs, products, and the broker’s services must be disclosed clearly and provided in a timely manner.

- Always seek the best possible result for the customer. This will be based on a range of factors like price, dealing costs, speed of execution and the size of the trade.

- Safeguard clients’ funds. To protect customers in the event of the broker going bust, their assets must be fully segregated from those of the broker.

Avoid conflicts of interest. Clear procedures to identify, manage and prevent conflicts of interest between the company, related individuals, and clients must be established.

This list is a mere taster of the comprehensive protections that CNMV brokers must provide.

How Can I Check If A Brokerage Is CNMV Regulated?

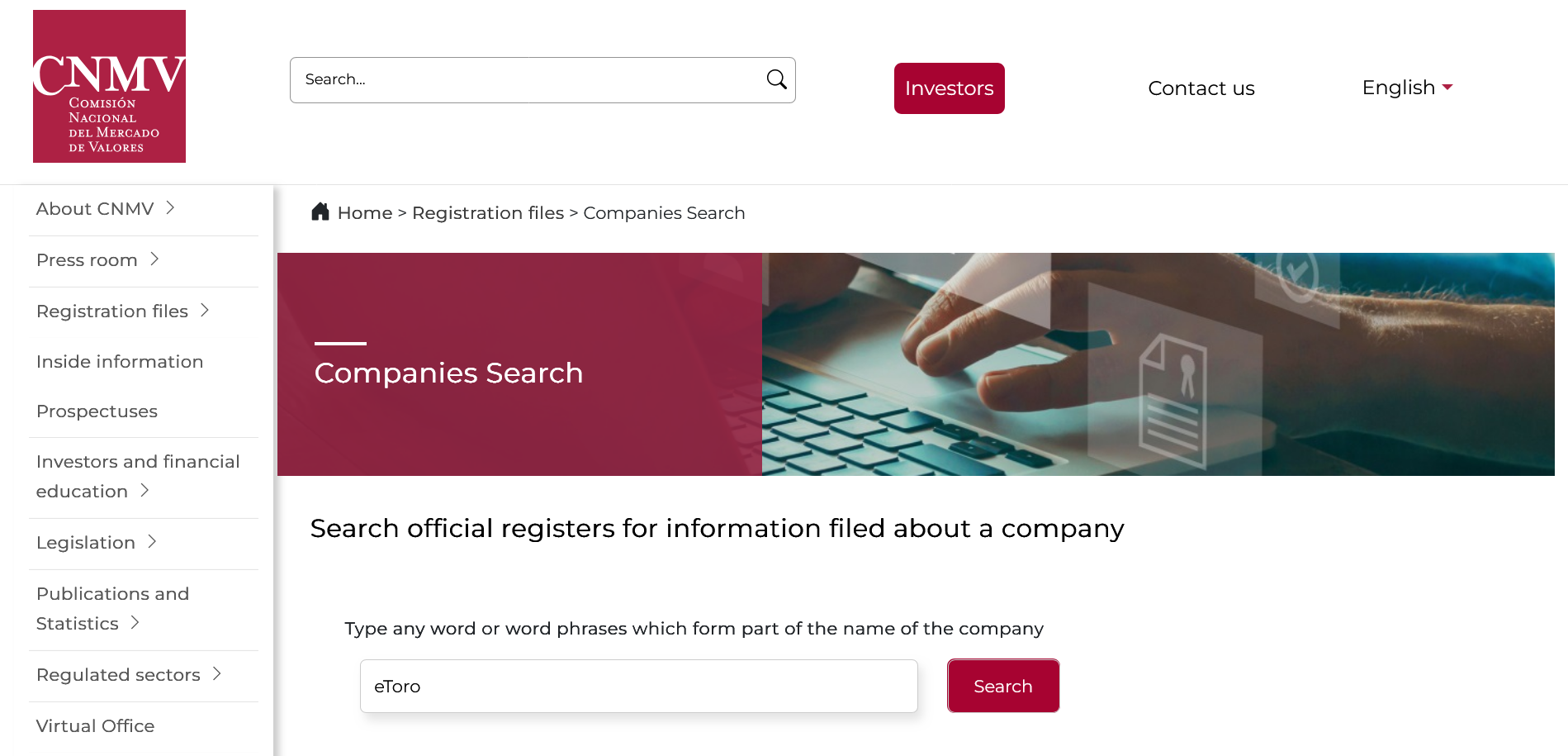

It’s possible to quickly and easily ascertain a broker’s regulatory status using the Companies Search facility on the CNMV website. This is a free resource that’s updated on a regular basis.

Pro tip: Many parts of the CNMV website, including menus, pages and documents, are communicated in English, making it a helpful tool for non-Spanish speakers. Not all information has been translated, however, such as the register of penalties I described earlier.

But thanks to the wonders of modern technology, it’s possible to swiftly overcome this barrier and access the information one needs. A standard browser translation tool (like Google Translate) is an effective way for non-Spanish-speakers to understand text that is published only in the local language.

Let’s say I want to check the regulatory status of eToro in Spain, which I’m planning to use to trade forex. My first task is to go onto the Companies Search, key in the broker’s name and then hit the ‘Search’ button:

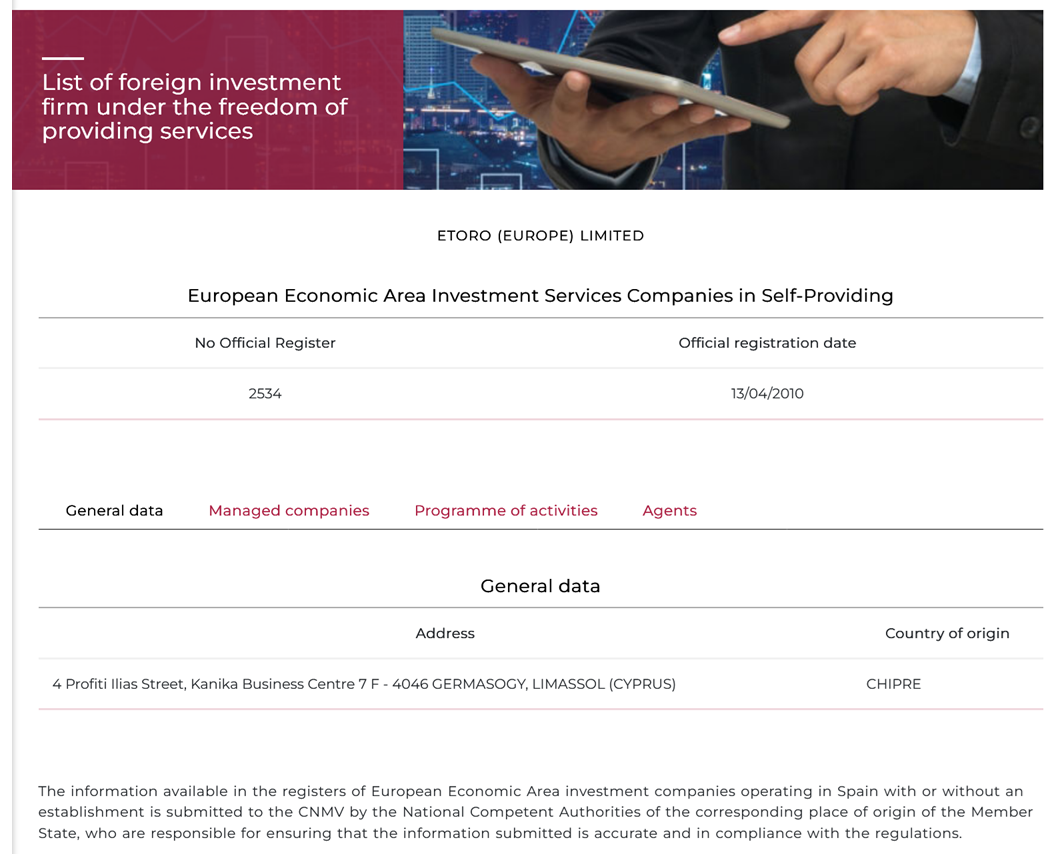

My search brings up two results:

- The first shows that eToro is authorized with the CNMV to provide cryptocurrency-related services in Spain.

- The second shows that eToro is authorized to provide other financial services in Spain under passporting rules.

Using my browser’s translation tool, I can view a broad range of information about eToro, including the EEA national regulator from whom it’s received approval to trade (Cyprus):

Locating eToro’s profile. Source: CNMV

Pro tip: Under passporting rules, financial services companies can operate across the whole of the EEA providing that they have authorization from just one of the territory’s national regulators.

By cycling through the tabs, I can also see eToro’s registered address, when it received regulatory approval from the Cyprus Securities and Exchange Commission (CySEC), which financial instruments it can offer (which includes forex), and the types of services it is authorized to provide.

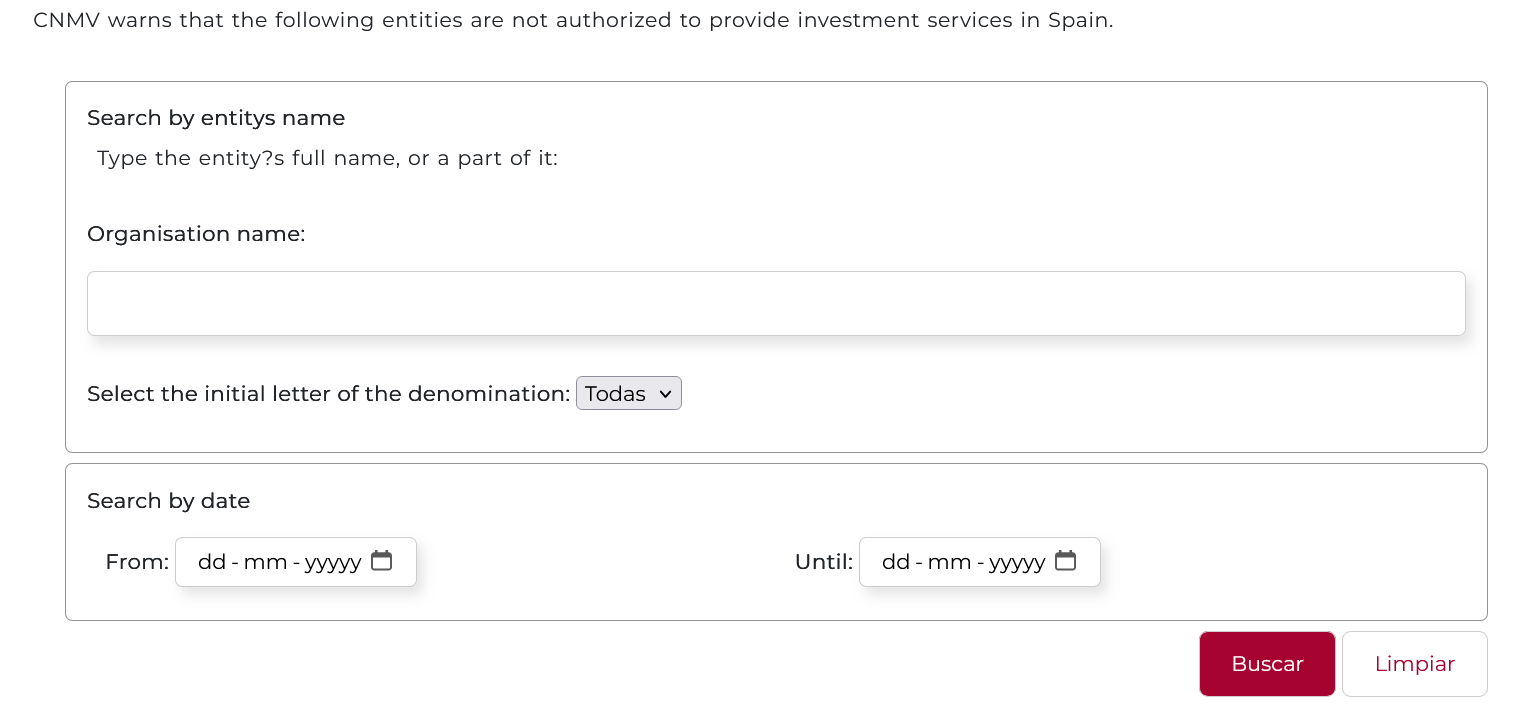

Pro tip: Alongside its registers, the CNMV provides comprehensive warning lists of firms and individuals that have been providing unauthorized investment services in Spain.

If I know the name of a suspicious organization, I can type it into the register to see if a warning has been issued. Or I can select a date range to try and find what I’m looking for:

The warnings search directory. Source: CNMV

Helpfully, the CNMV also provides warning lists from other national regulators in the EEA on its websites. These include warnings related to the provision of unauthorized services as well as for other infractions.

Bottom Line

For decades, traders and investors in Spain have enjoyed robust protections from the country’s national regulator. By aligning itself with ESMA’s regulatory framework, the CNMV ensures that Spain’s financial markets operate in a fair, efficient and transparent manner.

Use our pick of the best brokers regulated in Spain to get started.

Article Sources

Comisión Nacional del Mercado de Valores (CNMV)

European Securities and Markets Association (ESMA)

Public registry of disciplinary penalties imposed by the CNMV – CNMV

Deutsche Bank fined €10mn by Spanish regulator over forex mis-selling – Financial Times

ESMA announces strategic priorities for the next five years – ESMA

Markets in Financial Instruments Directive II (MiFID II)