Trust Score

Selecting a reliable broker is essential to protect your trading capital. Find out how our Trust Score makes that easy.

With the prevalence of scams and questionable trading practices, it’s not always easy to know who to trust.

To address this, we’ve created a simple, transparent scoring system that plays a key role in our broker review process and helps traders identify trustworthy brokers.

This is called our Trust Score.

What We Evaluate

Our Trust Score is based on several key factors:

- Regulatory status – Is the broker licensed by a top-tier regulator?

- Track record – Does the broker have a clean history without regulatory violations?

- Transparency – Does the broker clearly disclose its trading conditions?

- Expert opinion – How confident is our expert team in the broker’s integrity?

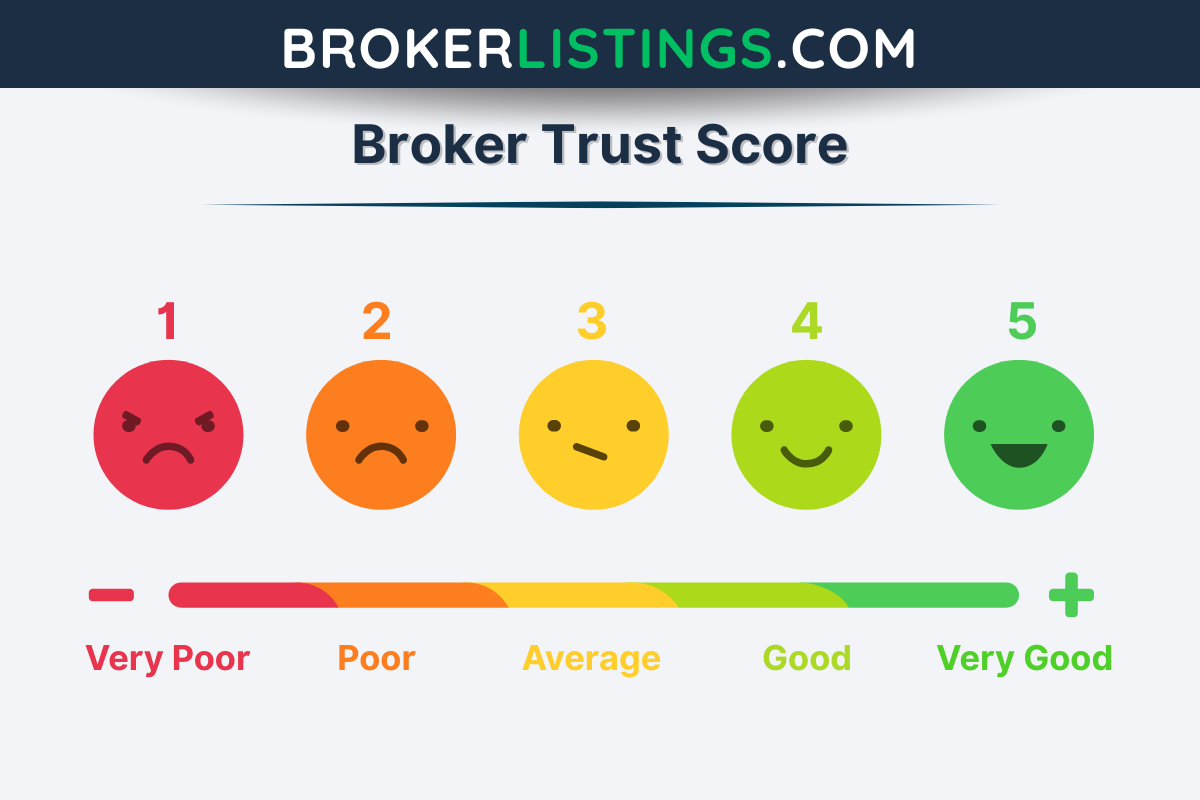

1-5 Rating

Based on our evaluations of these factors, we score each broker a rating from 1 to 5, with the most trusted brokers scoring 4 and above.

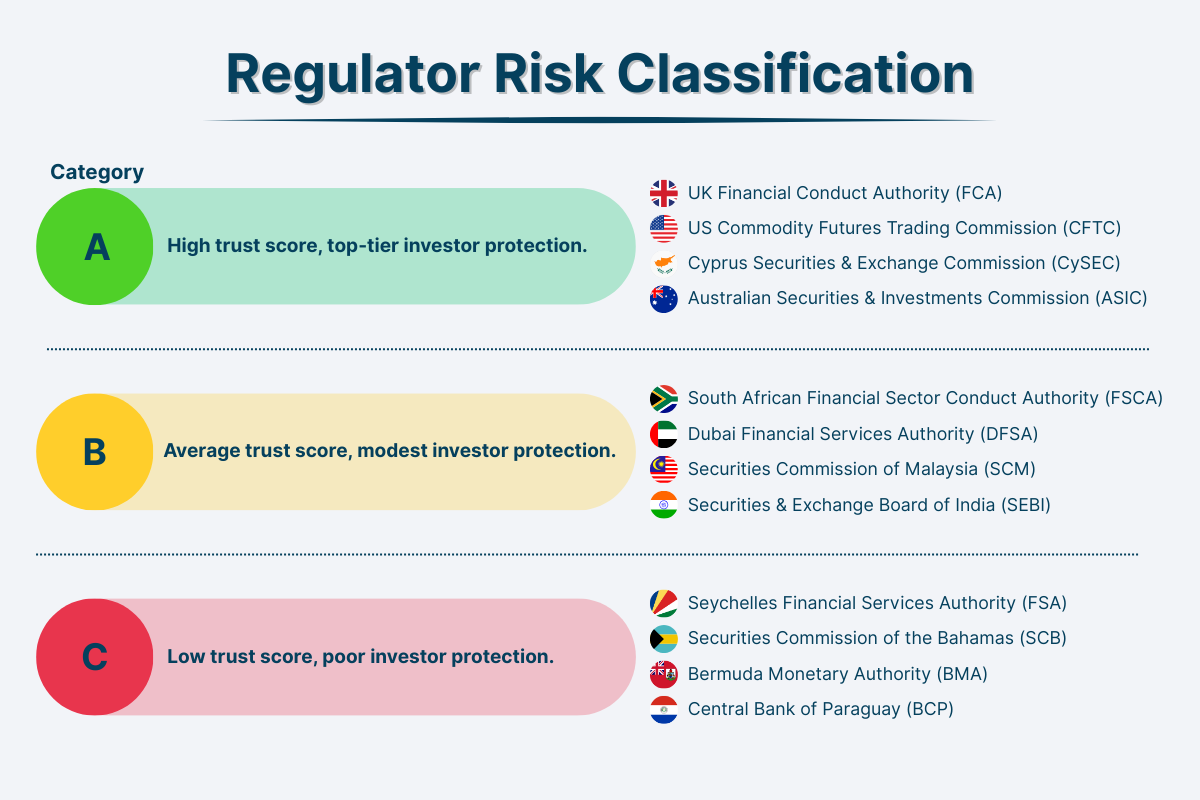

Regulator Risk Classification

One of our main priorities when evaluating brokers is assessing their regulatory status, which helps determine how fair and transparent the brokerage’s trading environment is.

This includes investigating the number of licenses that a broker holds, and crucially, whether they are from credible regulators.

To help with this, we’ve assigned each broker regulator in our evolving database one of three risk classifications:

- Category A – Most trusted

- Category B – Averagely trusted

- Category C – Not trusted

Category A Regulators

Category A regulators offer the highest level of regulatory oversight and financial protection, such as negative balance protection in regions like the UK and Australia, and we assign the highest trust score to brokers that hold one or more licenses from these regulators.

- Australian Securities and Investments Commission (ASIC) – Australia

- Australian Prudential Regulation Authority (APRA) – Australia

- Australian Transaction Reports and Analysis Centre (AUSTRAC) – Australia

- Reserve Bank of Australia (RBA) – Australia

- Finanzmarktaufsichtsbehörde (FMA) – Austria

- Oesterreichische Nationalbank (OeNB) – Austria

- Financial Services and Markets Authority (FSMA) – Belgium

- National Bank of Belgium (NBB) – Belgium

- Bulgarian National Bank (BNB) – Bulgaria

- Financial Supervision Commission (FSC) – Bulgaria

- Alberta Securities Commission (ASC) – Canada

- Autorité des marchés financiers (AMF Québec) – Canada

- Bank of Canada – Canada

- British Columbia Securities Commission (BCSC) – Canada

- Canadian Deposit Insurance Corporation (CDIC) – Canada

- Canadian Investment Regulatory Organization (CIRO) – Canada

- Canadian Securities Administrators (CSA) – Canada

- Financial and Consumer Affairs Authority of Saskatchewan (FCAA) – Canada

- Financial and Consumer Services Commission (FCNB New Brunswick) – Canada

- Financial Transactions and Reports Analysis Centre (FinTRAC) – Canada

- Manitoba Securities Commission (MSC) – Canada

- Northwest Territories Office of the Superintendent of Securities – Canada

- Nova Scotia Securities Commission (NSSC) – Canada

- Nunavut Securities Office – Canada

- Office of the Superintendent of Financial Institutions (OSFI) – Canada

- Office of the Superintendent of Securities Newfoundland and Labrador – Canada

- Office of the Superintendent of Securities Prince Edward Island – Canada

- Office of the Yukon Superintendent of Securities – Canada

- Ontario Securities Commission (OSC) – Canada

- Croatian Financial Services Supervisory Agency (HANFA) – Croatia

- Croatian National Bank (HNB) – Croatia

- Central Bank of Cyprus – Cyprus

- Cyprus Securities and Exchange Commission (CySEC) – Cyprus

- Danish Financial Supervisory Authority (Finanstilsynet) – Denmark

- Danmarks Nationalbank – Denmark

- Eesti Pank (Bank of Estonia) – Estonia

- Finantsinspektsioon (FSA) – Estonia

- European Securities and Markets Authority (ESMA) – Europe-wide

- Bank of Finland (Suomen Pankki) – Finland

- Finanssivalvonta (FIN-FSA) – Finland

- Autorité de contrôle prudentiel et de résolution (ACPR) – France

- Autorité des marchés financiers (AMF) – France

- Banque de France – France

- Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) – Germany

- Deutsche Bundesbank – Germany

- Bank of Greece – Greece

- Hellenic Capital Market Commission (HCMC) – Greece

- Magyar Nemzeti Bank (MNB) – Hungary

- Central Bank of Ireland – Ireland

- Banca d’Italia – Italy

- Commissione Nazionale per le Società e la Borsa (CONSOB) – Italy

- Istituto per la Vigilanza sulle Assicurazioni (IVASS) – Italy

- Bank of Japan – Japan

- Financial Services Agency (FSA) – Japan

- Bank of Latvia (Latvijas Banka) – Latvia

- Financial and Capital Market Commission (FKTK) – Latvia

- Bank of Lithuania (Lietuvos bankas) – Lithuania

- Banque centrale du Luxembourg (BCL) – Luxembourg

- Commission de Surveillance du Secteur Financier (CSSF) – Luxembourg

- Central Bank of Malta – Malta

- Malta Financial Services Authority (MFSA) – Malta

- Autoriteit Financiële Markten (AFM) – Netherlands

- De Nederlandsche Bank (DNB) – Netherlands

- Financial Markets Authority (FMA New Zealand) – New Zealand

- Reserve Bank of New Zealand (RBNZ) – New Zealand

- Komisja Nadzoru Finansowego (KNF) – Poland

- Narodowy Bank Polski (NBP) – Poland

- Autoridade de Supervisão de Seguros e Fundos de Pensões (ASF) – Portugal

- Banco de Portugal – Portugal

- Comissão do Mercado de Valores Mobiliários (CMVM) – Portugal

- Autoritatea de Supraveghere Financiară (ASF) – Romania

- National Bank of Romania (BNR) – Romania

- Monetary Authority of Singapore (MAS) – Singapore

- National Bank of Slovakia (NBS) – Slovakia

- Bank of Slovenia – Slovenia

- Securities Market Agency (ATVP) – Slovenia

- Bank of Spain (Banco de España) – Spain

- Comisión Nacional del Mercado de Valores (CNMV) – Spain

- Finansinspektionen (FI) – Sweden

- Sveriges Riksbank – Sweden

- Swiss Financial Market Supervisory Authority (FINMA) – Switzerland

- Swiss National Bank (SNB) – Switzerland

- Bank of England – UK

- Financial Conduct Authority (FCA) – UK

- Prudential Regulation Authority (PRA) – UK

- Board of Governors of the Federal Reserve System (Federal Reserve) – USA

- Commodity Futures Trading Commission (CFTC) – USA

- Federal Deposit Insurance Corporation (FDIC) – USA

- Financial Crimes Enforcement Network (FinCEN) – USA

- Financial Industry Regulatory Authority (FINRA) – USA

- National Credit Union Administration (NCUA) – USA

- Office of the Comptroller of the Currency (OCC) – USA

- Securities and Exchange Commission (SEC) – USA

Category B Regulators

Category B regulators can provide good regulatory oversight, but may not offer the same level of scrutiny or financial safeguards as Category A regulators.

- Central Bank of Bahrain (CBB) – Bahrain

- Banco Central do Brasil (BCB) – Brazil

- Comissão de Valores Mobiliários (CVM) – Brazil

- Conselho de Controle de Atividades Financeiras (COAF) – Brazil

- Conselho Nacional de Seguros Privados (CNSP) – Brazil

- Superintendência Nacional de Previdência Complementar (PREVIC) – Brazil

- Superintendência de Seguros Privados (SUSEP) – Brazil

- China Securities Regulatory Commission (CSRC) – China

- Hong Kong Monetary Authority (HKMA) – China

- Insurance Authority (IA Hong Kong) – China

- Mandatory Provident Fund Schemes Authority (MPFA) – China

- National Administration of Financial Regulation (NAFR) – China

- People’s Bank of China (PBC) – China

- Securities and Futures Commission (SFC Hong Kong) – China

- State Administration of Foreign Exchange (SAFE) – China

- Insurance Regulatory and Development Authority of India (IRDAI) – India

- International Financial Services Centres Authority (IFSCA) – India

- Pension Fund Regulatory and Development Authority (PFRDA) – India

- Reserve Bank of India (RBI) – India

- Securities and Exchange Board of India (SEBI) – India

- Bank of Israel – Israel

- Capital Market, Insurance and Savings Authority (CMISA) – Israel

- Israel Securities Authority (ISA) – Israel

- Capital Markets Authority (CMA Kuwait) – Kuwait

- Central Bank of Kuwait (CBK) – Kuwait

- Bank Negara Malaysia (BNM) – Malaysia

- Labuan Financial Services Authority (LFSA) – Malaysia

- Securities Commission Malaysia (SC) – Malaysia

- Finanstilsynet (Financial Supervisory Authority of Norway) – Norway

- Norges Bank – Norway

- Capital Market Authority (CMA Oman) – Oman

- Central Bank of Oman – Oman

- Qatar Central Bank (QCB) – Qatar

- Qatar Financial Centre Regulatory Authority (QFCRA) – Qatar

- Qatar Financial Markets Authority (QFMA) – Qatar

- Capital Market Authority (CMA Saudi Arabia) – Saudi Arabia

- Saudi Central Bank (SAMA) – Saudi Arabia

- Financial Sector Conduct Authority (FSCA) – South Africa

- Prudential Authority – South African Reserve Bank (SARB) – South Africa

- South African Reserve Bank (SARB) – South Africa

- Bank of Korea – South Korea

- Financial Services Commission (FSC Korea) – South Korea

- Financial Supervisory Service (FSS Korea) – South Korea

- Central Bank of the UAE (CBUAE) – United Arab Emirates

- Dubai Financial Services Authority (DFSA) – United Arab Emirates

- Financial Services Regulatory Authority (FSRA, ADGM) – United Arab Emirates

- Securities and Commodities Authority (SCA UAE) – United Arab Emirates

Category C Regulators

Category C regulators are high-risk and should be approached with caution. These regulators are less credible and may offer little to no financial safeguards or legal protections if your broker faces financial difficulty.

Some regulators in this category may not actively oversee brokers, which means traders will be more exposed to misleading trading practices and potential scams.

- Da Afghanistan Bank (DAB) – Central bank & financial supervision – Afghanistan

- Albanian Financial Supervisory Authority (AFSA) – Albania

- Bank of Albania – Albania

- Bank of Algeria – Algeria

- Commission d’Organisation et de Surveillance des Opérations de Bourse (COSOB) – Algeria

- Autoritat Financera Andorrana (AFA) – Andorra

- Banco Nacional de Angola (BNA) – Angola

- Comissão do Mercado de Capitais (CMC) – Angola

- Banco Central de la República Argentina (BCRA) – Argentina

- Comisión Nacional de Valores (CNV) – Argentina

- Superintendencia de Seguros de la Nación (SSN) – Argentina

- Central Bank of Armenia (CBA) – Armenia

- Central Bank of the Republic of Azerbaijan (CBAR) – Azerbaijan

- Bangladesh Bank – Bangladesh

- Bangladesh Securities and Exchange Commission (BSEC) – Bangladesh

- Central Bank of Barbados – Barbados

- Financial Services Commission (FSC Barbados) – Barbados

- Ministry of Finance – Securities Department – Belarus

- National Bank of the Republic of Belarus – Belarus

- Central Bank of West African States (BCEAO) – Benin

- Regional Council for Public Savings and Financial Markets (CREPMF) – Benin

- Royal Monetary Authority of Bhutan (RMA) – Bhutan

- Autoridad de Supervisión del Sistema Financiero (ASFI) – Bolivia

- Banco Central de Bolivia – Bolivia

- Central Bank of Bosnia and Herzegovina – Bosnia and Herzegovina

- Republika Srpska Securities Commission – Bosnia and Herzegovina

- Securities Commission of the Federation of Bosnia and Herzegovina – Bosnia and Herzegovina

- Bank of Botswana – Botswana

- Non-Bank Financial Institutions Regulatory Authority (NBFIRA) – Botswana

- Autoriti Monetari Brunei Darussalam (AMBD) – Brunei

- Autoriti Monetari Brunei Darussalam (AMBD) – Brunei Darussalam

- Central Bank of West African States (BCEAO) – Burkina Faso

- Regional Council for Public Savings and Financial Markets (CREPMF) – Burkina Faso

- Banque de la République du Burundi – Burundi

- Banco de Cabo Verde (BCV) – Cabo Verde

- National Bank of Cambodia (NBC) – Cambodia

- Securities and Exchange Regulator of Cambodia (SERC) – Cambodia

- Bank of Central African States (BEAC) – Cameroon

- Commission de Surveillance du Marché Financier de l’Afrique Centrale (COSUMAF) – Cameroon

- Cayman Islands Monetary Authority (CIMA) – Cayman Islands

- Bank of Central African States (BEAC) – Central African Republic

- Commission de Surveillance du Marché Financier de l’Afrique Centrale (COSUMAF) – Central African Republic

- Bank of Central African States (BEAC) – Chad

- Commission de Surveillance du Marché Financier de l’Afrique Centrale (COSUMAF) – Chad

- Banco Central de Chile – Chile

- Comisión para el Mercado Financiero (CMF) – Chile

- Superintendencia de Pensiones (SP) – Chile

- Banco de la República (Central Bank of Colombia) – Colombia

- Superintendencia Financiera de Colombia (SFC) – Colombia

- Bank of Central African States (BEAC) – Congo

- Commission de Surveillance du Marché Financier de l’Afrique Centrale (COSUMAF) – Congo

- Banco Central de Costa Rica (BCCR) – Costa Rica

- Superintendencia General de Entidades Financieras (SUGEF) – Costa Rica

- Superintendencia General de Valores (SUGEVAL) – Costa Rica

- Superintendencia de Pensiones (SUPEN) – Costa Rica

- Banco Central de Cuba (BCC) – Cuba

- Czech National Bank (CNB) – Czechia

- Central Bank of West African States (BCEAO) – Côte d’Ivoire

- Regional Council for Public Savings and Financial Markets (CREPMF) – Côte d’Ivoire

- Autorité de Régulation et de Contrôle des Assurances (ARCA) – Democratic Republic of the Congo

- Autorité des Marchés Financiers de la République Démocratique du Congo (AMF-RDC) – Democratic Republic of the Congo

- Central Bank of Congo (Banque Centrale du Congo, BCC) – Democratic Republic of the Congo

- Central Bank of Djibouti (Banque Centrale de Djibouti) – Djibouti

- Eastern Caribbean Central Bank (ECCB) – Dominica

- Eastern Caribbean Securities Regulatory Commission (ECSRC) – Dominica

- Financial Services Unit (FSU Dominica) – Dominica

- Banco Central de la República Dominicana (BCRD) – Dominican Republic

- Superintendencia de Bancos de la República Dominicana (SIB) – Dominican Republic

- Superintendencia de Pensiones (SIPEN) – Dominican Republic

- Superintendencia de Seguros (SIS) – Dominican Republic

- Superintendencia del Mercado de Valores (SIMV) – Dominican Republic

- Banco Central del Ecuador – Ecuador

- Superintendencia de Bancos (SBS Ecuador) – Ecuador

- Superintendencia de Compañías, Valores y Seguros (SCVS) – Ecuador

- Central Bank of Egypt (CBE) – Egypt

- Financial Regulatory Authority (FRA Egypt) – Egypt

- Banco Central de Reserva de El Salvador (BCR) – El Salvador

- Superintendencia del Sistema Financiero (SSF) – El Salvador

- Bank of Central African States (BEAC) – Equatorial Guinea

- Commission de Surveillance du Marché Financier de l’Afrique Centrale (COSUMAF) – Equatorial Guinea

- Bank of Eritrea – Eritrea

- Central Bank of Eswatini – Eswatini

- Financial Services Regulatory Authority (FSRA Eswatini) – Eswatini

- Ethiopian Capital Market Authority (ECMA) – Ethiopia

- National Bank of Ethiopia (NBE) – Ethiopia

- Reserve Bank of Fiji (RBF) – Fiji

- Bank of Central African States (BEAC) – Gabon

- Commission de Surveillance du Marché Financier de l’Afrique Centrale (COSUMAF) – Gabon

- Central Bank of The Gambia – Gambia

- Insurance State Supervision Service of Georgia (ISSSG) – Georgia

- National Bank of Georgia (NBG) – Georgia

- Bank of Ghana – Ghana

- National Insurance Commission (NIC Ghana) – Ghana

- National Pensions Regulatory Authority (NPRA) – Ghana

- Securities and Exchange Commission (SEC Ghana) – Ghana

- Eastern Caribbean Central Bank (ECCB) – Grenada

- Eastern Caribbean Securities Regulatory Commission (ECSRC) – Grenada

- Grenada Authority for the Regulation of Financial Institutions (GARFIN) – Grenada

- Superintendencia de Bancos de Guatemala (SIB Guatemala) – Guatemala

- Central Bank of Guinea (BCRG) – Guinea-Bissau

- Central Bank of West African States (BCEAO) – Guinea-Bissau

- Regional Council for Public Savings and Financial Markets (CREPMF) – Guinea-Bissau

- Bank of Guyana – Guyana

- Guyana Securities Council (GSC) – Guyana

- Banque de la République d’Haïti (BRH) – Haiti

- Autorità di Supervisione e Informazione Finanziaria (ASIF) – Holy See (Vatican City)

- Banco Central de Honduras – Honduras

- Comisión Nacional de Bancos y Seguros (CNBS) – Honduras

- Central Bank of Iceland (Seðlabanki Íslands) – Iceland

- Fjármálaeftirlitið (FSA Iceland) – Iceland

- Bank Indonesia – Indonesia

- Otoritas Jasa Keuangan (OJK) – Indonesia

- Central Bank of the Islamic Republic of Iran (CBI) – Iran

- Central Insurance of Iran (CII) – Iran

- Iraq Securities Commission (ISC) – Iraq

- Bank of Jamaica – Jamaica

- Financial Services Commission (FSC Jamaica) – Jamaica

- Central Bank of Jordan – Jordan

- Jordan Securities Commission (JSC) – Jordan

- Agency for Regulation and Development of the Financial Market (ARDFM Kazakhstan) – Kazakhstan

- Astana Financial Services Authority (AFSA) – Kazakhstan

- National Bank of Kazakhstan – Kazakhstan

- Capital Markets Authority (CMA Kenya) – Kenya

- Central Bank of Kenya (CBK) – Kenya

- Insurance Regulatory Authority (IRA Kenya) – Kenya

- Retirement Benefits Authority (RBA Kenya) – Kenya

- SACCO Societies Regulatory Authority (SASRA) – Kenya

- Ministry of Finance & Economic Development (Kiribati) – Kiribati

- National Bank of the Kyrgyz Republic – Kyrgyzstan

- State Service for Regulation and Supervision of the Financial Market (Kyrgyz Republic) – Kyrgyzstan

- Bank of the Lao P.D.R. (BOL) – Laos

- Lao Securities Commission Office (LSCO) – Laos

- Banque du Liban (BDL) – Lebanon

- Capital Markets Authority (CMA Lebanon) – Lebanon

- Central Bank of Lesotho – Lesotho

- Central Bank of Liberia – Liberia

- Central Bank of Libya – Libya

- Financial Market Authority Liechtenstein (FMA Liechtenstein) – Liechtenstein

- Central Bank of Madagascar (Banky Foiben’i Madagasikara, BFIM) – Madagascar

- Reserve Bank of Malawi (RBM) – Malawi

- Maldives Monetary Authority (MMA) – Maldives

- Central Bank of West African States (BCEAO) – Mali

- Regional Council for Public Savings and Financial Markets (CREPMF) – Mali

- Banking Commission of the Republic of the Marshall Islands – Marshall Islands

- Central Bank of Mauritania (Banque Centrale de Mauritanie) – Mauritania

- Banco de México (Banxico) – Mexico

- Comisión Nacional Bancaria y de Valores (CNBV) – Mexico

- Comisión Nacional de Seguros y Fianzas (CNSF) – Mexico

- Comisión Nacional del Sistema de Ahorro para el Retiro (CONSAR) – Mexico

- Banking Board of the Federated States of Micronesia – Micronesia

- National Bank of Moldova – Moldova

- National Commission for Financial Markets (NCFM Moldova) – Moldova

- Commission de Contrôle des Activités Financières (CCAF) – Monaco

- Bank of Mongolia – Mongolia

- Financial Regulatory Commission of Mongolia (FRC Mongolia) – Mongolia

- Central Bank of Montenegro – Montenegro

- Capital Market Authority of Montenegro (Komisija za Tržište Kapitala) – Montenegro

- Autorité Marocaine du Marché des Capitaux (AMMC) – Morocco

- Autorité de Contrôle des Assurances et de la Prévoyance Sociale (ACAPS) – Morocco

- Bank Al-Maghrib – Morocco

- Autoridade de Supervisão de Seguros e Fundos de Pensões de Moçambique (ASFPM) – Mozambique

- Banco de Moçambique – Mozambique

- Central Bank of Myanmar (CBM) – Myanmar

- Securities and Exchange Commission of Myanmar (SECM) – Myanmar

- Bank of Namibia – Namibia

- Namibia Financial Institutions Supervisory Authority (NAMFISA) – Namibia

- Beema Samiti (Insurance Board of Nepal) – Nepal

- Nepal Rastra Bank (NRB) – Nepal

- Securities Board of Nepal (SEBON) – Nepal

- Banco Central de Nicaragua – Nicaragua

- Superintendencia de Bancos y de Otras Instituciones Financieras (SIBOIF) – Nicaragua

- Central Bank of West African States (BCEAO) – Niger

- Regional Council for Public Savings and Financial Markets (CREPMF) – Niger

- Central Bank of Nigeria (CBN) – Nigeria

- National Insurance Commission (NAICOM) – Nigeria

- National Pension Commission (PenCom) – Nigeria

- Securities and Exchange Commission (SEC Nigeria) – Nigeria

- National Bank of the Republic of North Macedonia (NBRNM) – North Macedonia

- Agency for Supervision of Fully Funded Pension Insurance (MAPAS) – North Macedonia

- Securities and Exchange Commission of North Macedonia – North Macedonia

- Securities and Exchange Commission of Pakistan (SECP) – Pakistan

- State Bank of Pakistan (SBP) – Pakistan

- Financial Institutions Commission (FIC Palau) – Palau

- Palestine Capital Market Authority (PCMA) – Palestine State

- Superintendencia de Bancos de Panamá (SBP) – Panama

- Superintendencia del Mercado de Valores (SMV Panamá) – Panama

- Bank of Papua New Guinea – Papua New Guinea

- Securities Commission of Papua New Guinea (SCPNG) – Papua New Guinea

- Banco Central del Paraguay (BCP) – Paraguay

- Comisión Nacional de Valores (CNV Paraguay) – Paraguay

- Banco Central de Reserva del Perú (BCRP) – Peru

- Superintendencia de Banca, Seguros y AFP (SBS Perú) – Peru

- Superintendencia del Mercado de Valores (SMV Perú) – Peru

- Bangko Sentral ng Pilipinas (BSP) – Philippines

- Insurance Commission (IC Philippines) – Philippines

- Philippine Deposit Insurance Corporation (PDIC) – Philippines

- Securities and Exchange Commission (SEC Philippines) – Philippines

- Bank of Russia (Central Bank of the Russian Federation) – Russia

- Capital Market Authority of Rwanda (CMA Rwanda) – Rwanda

- National Bank of Rwanda (BNR) – Rwanda

- Eastern Caribbean Central Bank (ECCB) – Saint Kitts and Nevis

- Eastern Caribbean Securities Regulatory Commission (ECSRC) – Saint Kitts and Nevis

- Financial Services Regulatory Commission (FSRC St Kitts and Nevis) – Saint Kitts and Nevis

- Central Bank of Samoa (CBS) – Samoa

- Central Bank of San Marino (Banca Centrale della Repubblica di San Marino) – San Marino

- Banco Central de São Tomé e Príncipe (BCSTP) – Sao Tome and Principe

- Central Bank of West African States (BCEAO) – Senegal

- Regional Council for Public Savings and Financial Markets (CREPMF) – Senegal

- National Bank of Serbia (NBS) – Serbia

- Securities Commission of the Republic of Serbia – Serbia

- Bank of Sierra Leone (BSL) – Sierra Leone

- Securities and Exchange Commission Sierra Leone (SEC Sierra Leone) – Sierra Leone

- Central Bank of Solomon Islands (CBSI) – Solomon Islands

- Central Bank of Somalia – Somalia

- Bank of South Sudan – South Sudan

- Central Bank of Sri Lanka (CBSL) – Sri Lanka

- Securities and Exchange Commission of Sri Lanka (SEC Sri Lanka) – Sri Lanka

- Central Bank of Sudan – Sudan

- Financial Markets Regulatory Authority (Sudan) – Sudan

- Central Bank of Suriname (CBvS) – Suriname

- Central Bank of Syria (CBS) – Syria

- Syrian Commission on Financial Markets and Securities (SCFMS) – Syria

- National Bank of Tajikistan – Tajikistan

- Bank of Tanzania (BoT) – Tanzania

- Capital Markets and Securities Authority (CMSA Tanzania) – Tanzania

- Bank of Thailand (BOT) – Thailand

- Office of Insurance Commission (OIC Thailand) – Thailand

- Securities and Exchange Commission, Thailand (SEC Thailand) – Thailand

- Banco Central de Timor-Leste (BCTL) – Timor-Leste

- Central Bank of West African States (BCEAO) – Togo

- Regional Council for Public Savings and Financial Markets (CREPMF) – Togo

- National Reserve Bank of Tonga (NRBT) – Tonga

- Central Bank of Trinidad and Tobago (CBTT) – Trinidad and Tobago

- Trinidad and Tobago Securities and Exchange Commission (TTSEC) – Trinidad and Tobago

- Central Bank of Tunisia (BCT) – Tunisia

- Financial Market Council (CMF Tunisia) – Tunisia

- Banking Regulation and Supervision Agency (BDDK) – Turkey

- Capital Markets Board of Turkey (CMB/ SPK) – Turkey

- Central Bank of the Republic of Türkiye (CBRT) – Turkey

- Central Bank of Turkmenistan – Turkmenistan

- Bank of Uganda (BoU) – Uganda

- Capital Markets Authority (CMA Uganda) – Uganda

- Insurance Regulatory Authority of Uganda (IRA Uganda) – Uganda

- National Bank of Ukraine (NBU) – Ukraine

- National Commission for State Regulation of Financial Services Markets (NCFS Ukraine) – Ukraine

- National Securities and Stock Market Commission (NSSMC Ukraine) – Ukraine

- Banco Central del Uruguay (BCU) – Uruguay

- Superintendencia de Servicios Financieros (SSF Uruguay) – Uruguay

- Capital Market Development Agency of Uzbekistan (CMDA) – Uzbekistan

- Central Bank of the Republic of Uzbekistan – Uzbekistan

- Financial Information and Supervision Authority (ASIF) – Vatican City

- Banco Central de Venezuela (BCV) – Venezuela

- Superintendencia Nacional de Valores (SUNAVAL) – Venezuela

- State Bank of Vietnam (SBV) – Vietnam

- State Securities Commission of Vietnam (SSC) – Vietnam

- Central Bank of Yemen – Yemen

- Bank of Zambia – Zambia

- Pensions and Insurance Authority (PIA Zambia) – Zambia

- Securities and Exchange Commission (SEC Zambia) – Zambia

- Reserve Bank of Zimbabwe (RBZ) – Zimbabwe

- Securities and Exchange Commission of Zimbabwe (SECZ) – Zimbabwe

- Eastern Caribbean Securities Regulatory Commission (ECSRC) – Antigua and Barbuda

- Financial Services Regulatory Commission (FSRC) – Antigua and Barbuda

- Central Bank of The Bahamas – Bahamas

- Insurance Commission of The Bahamas (ICB) – Bahamas

- Securities Commission of The Bahamas (SCB) – Bahamas

- Central Bank of Belize – Belize

- International Financial Services Commission (IFSC Belize) – Belize

- Central Bank of the Comoros (BCC) – Comoros

- Bank of Mauritius – Mauritius

- Financial Services Commission Mauritius (FSC Mauritius) – Mauritius

- Nauru Financial Services Regulatory Commission (FSRC) – Nauru

- Eastern Caribbean Central Bank (ECCB) – Saint Lucia

- Eastern Caribbean Securities Regulatory Commission (ECSRC) – Saint Lucia

- Financial Services Regulatory Authority (FSRA Saint Lucia) – Saint Lucia

- Central Bank of Seychelles (CBS) – Seychelles

- Financial Services Authority (FSA Seychelles) – Seychelles

- Financial Services Authority (FSA SVG) – Saint Vincent and the Grenadines

- Financial Services Commission (FSC Tuvalu) – Tuvalu

- Reserve Bank of Vanuatu (RBV) – Vanuatu

- Vanuatu Financial Services Commission (VFSC) – Vanuatu

- International Financial Services Authentication (IFSA) – Unknown

Bottom Line

Choosing a broker licensed by a Category A regulator in BrokerListings.com’s Trust Score can help protect your trading capital.

That said, safety while online trading is never guaranteed. Your capital remains at risk.