Best Financial Markets Authority (AMF) Regulated Brokers 2026

We’ve tested and ranked the top brokers regulated by the Financial Markets Authority (AMF) in France, ensuring high standards of trust and reliability.

-

1Crypto.com is one of the biggest names in cryptocurrency trading, developed with the aim to expedite the world's transition to DeFi technologies. The crypto exchange offers token lending, pre-paid cards, NFTs and more. The firm was established in Germany in 2016 and its quality is proven by its 150 million users.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.0 is a leading multi-asset platform offering trading in thousands of CFDs, stocks, and cryptoassets. Established in 2007, it has millions of active global traders and is regulated by top authorities like the FCA and CySEC. It is well-known for its social trading platform. Crypto trading is provided through eToro USA LLC. Investments are subject to market risk, including potential loss of principal. CFDs are not available in the US. Crypto investments carry risk and may not be suitable for retail investors, with a possibility of losing your entire investment. Understand the risks here. 61% of retail CFD accounts lose money. -

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.0 Saxo Markets is a renowned trading brokerage, investment firm and bank. It offers over 72,000 trading instruments, investment products, and managed portfolios, ensuring ample opportunities for clients. It operates under the regulation of more than ten agencies including FINMA, FCA & ASIC, thus providing the best protection. The firm is well-known for its transparent pricing.

Compare the Best AMF-Regulated Brokers

Safety Comparison

Compare how safe the Best Financial Markets Authority (AMF) Regulated Brokers 2026 are.

Mobile Trading Comparison

Compare the mobile trading features of the Best Financial Markets Authority (AMF) Regulated Brokers 2026.

Comparison for Beginners

Compare how suitable the Best Financial Markets Authority (AMF) Regulated Brokers 2026 are for beginners.

Comparison for Advanced Traders

Compare how suitable the Best Financial Markets Authority (AMF) Regulated Brokers 2026 are for advanced or professional traders.

Accounts Comparison

Compare the trading accounts offered by Best Financial Markets Authority (AMF) Regulated Brokers 2026.

Detailed Rating Comparison

Compare how we rated the Best Financial Markets Authority (AMF) Regulated Brokers 2026 in key areas.

Fee and Cost Comparison

Compare the cost of trading with the Best Financial Markets Authority (AMF) Regulated Brokers 2026.

Broker Popularity

See how popular the Best Financial Markets Authority (AMF) Regulated Brokers [year] are in terms of number of clients.

| Broker | Popularity |

|---|---|

| Crypto.com |

|

| eToro |

|

| Saxo |

|

Why Trade With Crypto.com?

Crypto.com is a snug fit for aspiring crypto traders who want to buy, sell and trade over 400 digital tokens. Its strike options and prediction markets spanning financial, economic, election, sport, and cultural events via its CFTC-regulated entity also make it a secure option for US traders interested in binary-style contracts on an intuitive app.

Pros

- The Crypto.com Exchange platform offers sophisticated bots, including Dollar Cost Averaging (DCA), Time-Weighted Average Price (TWAP), and Grid Trading bots. These tools allow traders to automate strategies, including leveraged perpetual trades, minimizing manual effort and slippage.

- Crypto.com has expanded beyond crypto in some regions, offering over 5000 stocks and ETFs for traders looking to build diverse portfolios and opportunities in different sectors.

- The platform supports unified portfolio tracking across cryptocurrencies, stocks, ETFs, and more recently prediction markets, all within a single interface, simplifying asset management for multi-asset traders and providing consolidated insights.

Cons

- Customer support primarily relies on chatbots and email, with limited reliable phone support from our testing. This can lead to delays in resolving urgent issues, such as account access or transaction problems, which can be frustrating for crypto day traders who need quick assistance.

- Withdrawal fees apply to crypto transfers and fiat withdrawals, and these can be significant for active traders making smaller transfers. The minimum withdrawal limits are also relatively high, which restricts flexibility for managing smaller portfolios or quick liquidity needs.

- The app's high bid-ask spreads on many coins can be costly for traders placing market orders. Wide spreads mean the price you pay when buying is noticeably higher than the price you receive when selling, cutting into profits, especially on lower-volume trades.

Why Trade With eToro?

eToro's social trading platform ranks highly due to its excellent user experience and active community chat, useful for beginners seeking trading opportunities. The platform also offers competitive fees on a vast selection of CFDs and actual stocks, alongside beneficial rewards for skilled strategy contributors.

Pros

- Investment portfolios are available, focusing on traditional markets, tech, crypto, and more.

- eToro has expanded its investment options by regularly adding new crypto assets, now offering over 100 digital currencies.

- eToro launched automated crypto staking for easy passive income, except for Ethereum, which requires opt-in.

Cons

- There are no guaranteed stop-loss orders, which would be a helpful risk management feature for beginners.

- Contact options are limited, except for the in-platform live chat.

- The absence of extra charting platforms like MT4 may reduce the appeal for experienced traders used to third-party software.

Why Trade With Saxo?

Saxo is ideal for frequent traders and large-scale investors due to its extraordinary range of tools, high-quality market research, and fee discounts. Moreover, its offering of 190 currency pairs with narrow spreads makes it suitable for forex traders.

Pros

- The ISA account is easily available and adaptable, without any charges for initiating or concluding transactions.

- Premium account levels offer lower trading fees.

- High-quality learning materials like podcasts, webinars, and expert videos are available for traders.

Cons

- The trading accounts require substantial funding.

- Do not accept clients from certain regions, specifically the US and Belgium, for trading activities.

- To view Level 2 pricing, a subscription is necessary.

Filters

How BrokerListings.com Selected the Top AMF Brokers

To determine the best brokers regulated by the AMF (Autorité des Marchés Financiers), France’s primary financial regulator, we followed three key steps:

- Regulatory Verification: We confirmed each broker’s AMF registration via the official database, ensuring compliance with French financial regulations and the broader MiFID II framework.

- Broker Evaluation: Using our in-house broker assessment model, we analyzed over 200 criteria, from execution quality and fee structures to platform stability and client fund protections.

- Practical Testing: Beyond regulatory checks, we carried out hands-on testing to evaluate how these AMF-regulated brokers perform in actual trading conditions.

What Is The AMF?

France’s financial markets are tightly supervised and regulated by the Autorité des Marchés Financiers, or AMF for short.

Translated as the Financial Markets Authority in English, the AMF was created in 2003 to unify the powers of three separate organizations – the Conseil des Marchés Financiers (CMF), the Commission des Opérations de Bourse (COB), and the Conseil de Discipline de la Gestion Financière (CDGF) – under a single body.

The AMF’s remit covers three main areas: “to safeguard investments in financial instruments and other publicly issued securities, to ensure that investors receive material information, and to maintain orderly financial markets.”

Under BrokerListings’ broker regulator classification system, the AMF is categorized as a Category A outfit. This means traders and investors can expect high levels of protection from bad business practices and fraudulent actors.

Part of the regulator’s mandate involves issuing licenses to financial services companies including online brokerages, monitoring their activities, and taking enforcement action if it deems that rules have been broken.

What Powers Does The AMF Have?

The AMF says that its investigators and inspectors “work closely with other French and foreign authorities that supervise the banking and finance industries.” Based on their findings, they can implement settlement proceedings or slap sanctions on individuals and financial services providers.

It has wide ranging powers to make its conclusions, and can seize documents and conduct home visits subject to approval from the custodial judge of the competent court.

The regulator has a range of actions it can initiate based on the outcome of its investigations. These include:

- Serving a statement of objections to the defendant and proposing a settlement.

- Serving a statement of objections to the defendant and opening sanction proceedings.

- Assigning the case to other French or foreign administrative authorities for matters within their jurisdiction.

- Transferring the case to the Public Prosecutor’s Office if the report suggests a criminal offence has taken place.

- Sending a letter of observations to the defendant to remind them of their obligations.

One of the AMF’s most notable cases involved Polish broker X-Trade Brokers Dom Maklerski. In November 2021, it fined the company €300,000 for failures in the marketing and dealing of contracts for difference (CFDs) by its French branch between 2013 and 2020.

Breaches included failing to include clear risk warnings in Google advertisements, and asking insufficient questions about clients’ knowledge and experience.

In 2024, the AMF successfully executed 12 enforcement decisions, resulting in total fines of €34.94 million. It also had the same number of settlement agreements approved, amounting to a total of €2.39 million.

What Rules Must An AMF Broker Follow?

AMF’s regulatory principles follow those laid down in the Markets in Financial Instruments Directive II (MiFID II).

This piece of legislation was introduced by the European Securities and Markets Association (ESMA) during the late 2010s, and was designed to harmonize the regulatory regimes of European Union members including France.

MiFID II rules require that “member States shall require that, when providing investment services or, where appropriate, ancillary services to clients, an investment firm act honestly, fairly and professionally in accordance with the best interests of its clients.”

In practical terms, this means brokerages should strive to:

- Achieve the best result for their customers. This is based on a range of factors including asset prices and trade execution speed.

- Ask appropriate questions to ensure that the product or service discussed is suitable based on the customer’s knowledge and experience.

- Clearly communicate the risks that online trading poses to individuals’ money.

- Ensure that all advertising and marketing material is transparent, fair, and not misleading.

- Separate the firm’s assets from those of the client, so that customers’ capital is protected should the company go bust.

- Establish clear and effective procedures if customers wish to raise a complaint.

- Maintain comprehensive records of the services, trades and other activities conducted on behalf of the client.

How Can I Check If A Brokerage Is AMF Regulated?

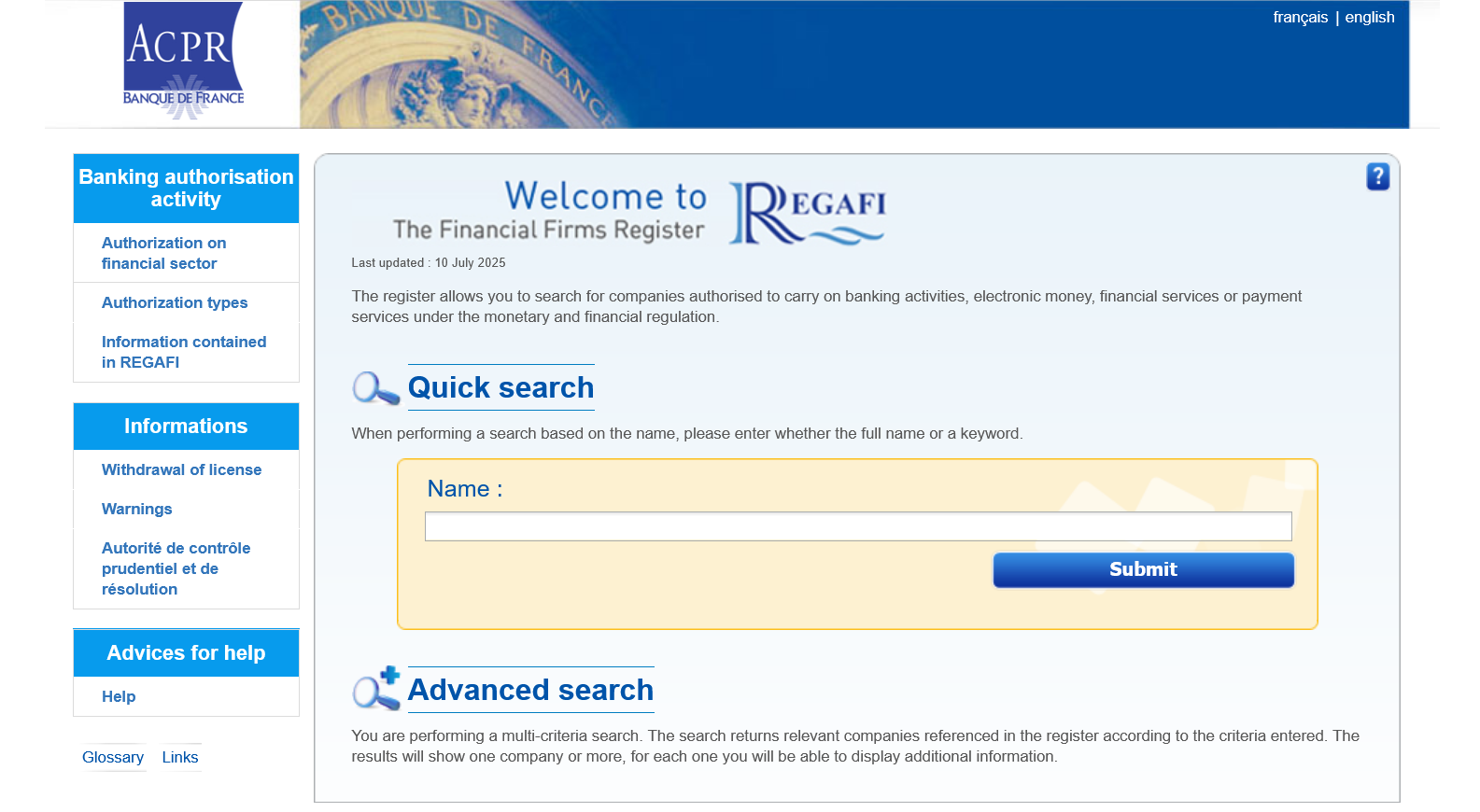

The regulator doesn’t itself operate a catalogue of companies that are licensed to trade. Instead, individuals can check a broker’s regulatory status by using the Registre des Agents Financiers (REGAFI).

The catalogue is maintained by the Autorité de contrôle prudentiel et de resolution (ACPR), which translates as the French Prudential Supervision and Resolution Authority in English. This is an independent administrative authority that receives backing from the Banque de France.

For example, I wanted to check that a brokerage I’m considering – eToro – is authorized by the AMF. I can carry out a quick search, or a more advanced one, using the options below:

The homepage of REGAFI’s online database. Source: ACPR

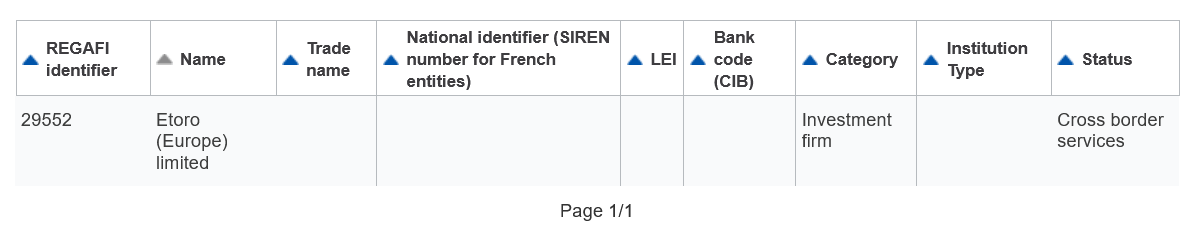

In this case, I used the Quick Search option, punching in the company’s name and then hitting Submit. My investigation yields the following result:

Finding eToro. Source: ACPR

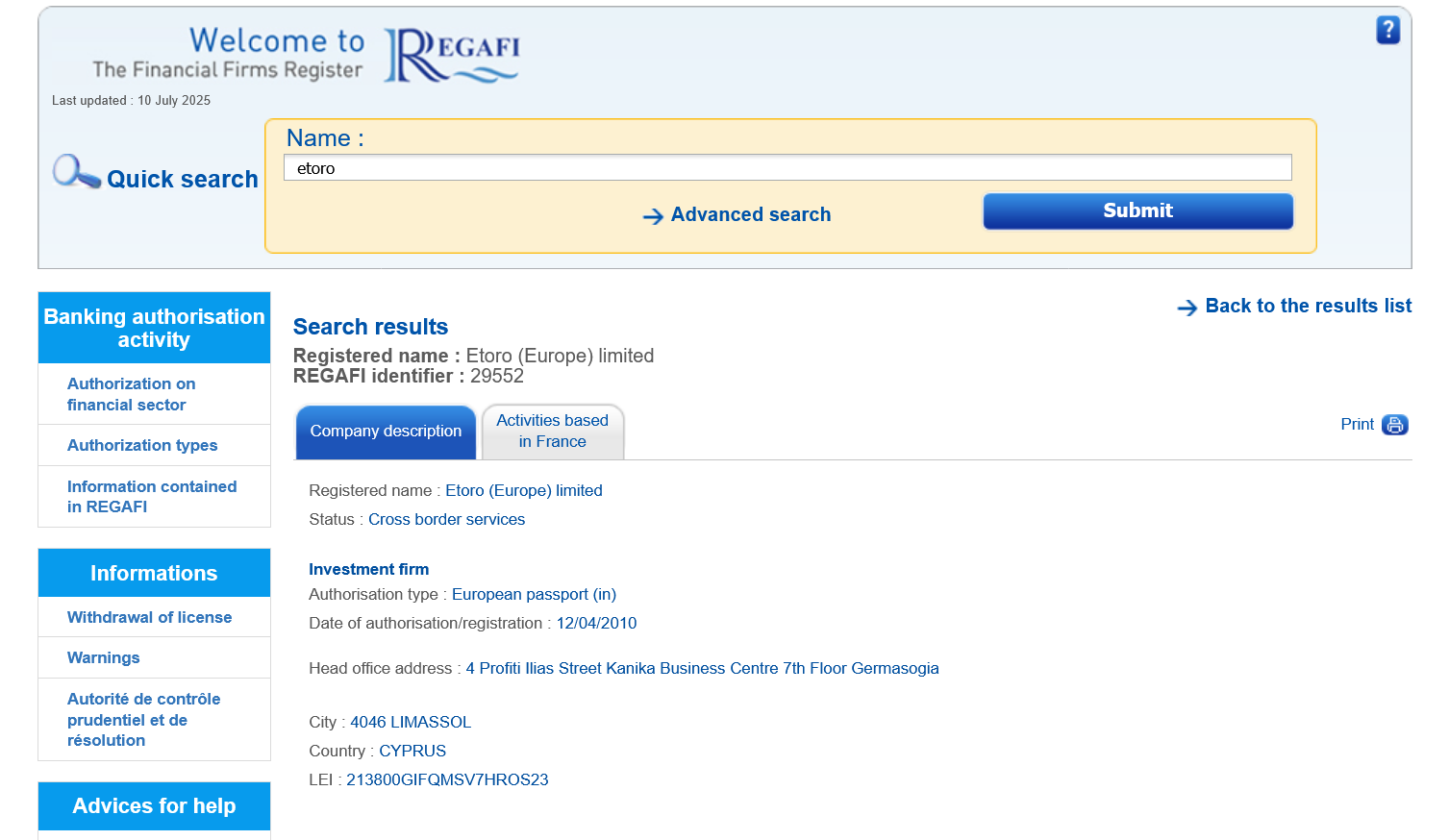

After clicking on ‘Etoro (Europe) limited’ in the name field, I’m greeted with a Company Description providing basic details including date of registration. I can also click on the Activities Based In France tab to find out what functions the broker is authorized to carry out:

eToro’s profile on the REGAFI catalogue. Source: ACPR

The whole process was simple to conduct, and took less than a minute to complete.

Pro tip: The AMF also publishes blacklists of companies and websites online. Individuals can check up-to-date additions to these lists on its webpage, as well as download full lists according to asset class (such as forex and cryptocurrency assets).

The regulator also maintains a warnings page to keep the public informed about possible scams and suspicious activities.

Bottom Line

France’s robust regulatory landscape means investors can expect high levels of protection from AMF-approved brokers. Checking a brokerage’s approval status is simple and quick, and an essential step given the rising threat of financial services fraud.

Article Sources

Autorité des Marchés Financiers (AMF)

Creation of the Autorité des marchés financiers – AMF

The AMF publishes its 2024 Annual Report – AMF

European Securities and Markets Association (ESMA)

Registre des Agents Financiers (REGAFI)