Best Lithium Brokers 2025

Looking to trade lithium? We’ve pinpointed and ranked the top lithium brokers for 2025, based on real testing and deep research.

-

1Founded in 2006, AvaTrade is a top forex and CFD broker trusted by over 400,000 traders. Regulated in 9 regions, it handles more than 2 million trades monthly. AvaTrade offers platforms like MT4, MT5, and WebTrader, with over 1,250 instruments. Traders of all levels can explore CFDs, AvaOptions, and AvaFutures for short-term trading. AvaTrade provides excellent education and 24/5 multilingual customer support for a complete trading experience.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.5 eToro is a highly-rated platform that offers trading services in numerous CFDs, stocks, and cryptoassets. Established in 2007, it is used by millions of traders worldwide and is regulated by top-tier governing bodies such as the FCA and CySEC. eToro is well-known for its extensive social trading platform. Through eToro USA LLC, crypto trading is available. Investments are subject to market risk, and the initial invested principal may be lost. CFDs are not offered in the U.S In the UK and some EU countries, investing in cryptoassets is highly volatile and unregulated, with no consumer protection. Profits may be subject to tax. Some retail CFD traders lose money. -

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.6 Admirals is a regulated broker that allows trading in a variety of leveraged instruments such as forex, stocks, indices, ETFs, commodities, and cryptocurrencies. It offers the MetaTrader 4, MetaTrader 5, and TradingCentral platforms. Offering both spread betting and CFDs, and with thousands of instruments to choose from, Admirals offers greater flexibility compared to other brokers.

Compare The Best Brokers For Trading Lithium Across Key Features

Our team put the leading lithium trading platforms to the test—see how they measure up across crucial categories:

How Safe Are The Leading Lithium Trading Platforms?

When real money is on the line, broker security counts. Here’s how top platforms protect your assets:

Top Mobile Apps For Lithium Trading – Reviewed

Mobile trading is increasingly popular. We evaluated the best apps for lithium trading so you can stay in control wherever you are:

Are These Top Lithium Brokers Suitable For Beginners?

Just starting out in lithium trading? These brokers offer easy-to-learn platforms, training resources, and beginner-friendly features:

Are These Lithium Brokers Equipped For Advanced Traders?

Experienced traders need precision and speed. See how these brokers stack up when it comes to professional-level lithium trading:

Accounts Comparison

Compare the trading accounts offered by Best Lithium Brokers 2025.

Detailed Ratings: Best Brokers For Trading Lithium

Browse our full breakdown of the highest-rated lithium brokers:

Trading Fees & Spreads – Full Comparison

We crunched the numbers on fees, spreads, and commissions to find which lithium brokers offer the best value:

Which Lithium Trading Brokers Are Most Popular?

Curious where lithium traders are going? Explore the platforms attracting the most attention from active users:

| Broker | Popularity |

|---|---|

| eToro |

|

| AvaTrade |

|

| Admiral Markets |

|

Why Trade With AvaTrade?

AvaTrade provides traders with essential tools: an intuitive WebTrader, strong AvaProtect risk management, a quick 5-minute sign-up, and reliable support for fast-paced markets.

Pros

- AvaTrade's support team did well in tests, responding within 3 minutes and providing local support in major regions like the UK, Europe, and the Middle East.

- The WebTrader performed well in our tests, featuring an easy-to-use interface for beginners and strong charting tools, including 6 chart layouts and over 60 technical indicators.

- Years later, AvaTrade is still among the few brokers with a custom risk management tool, AvaProtect, which insures losses up to $1M for a fee and is simple to use on the platform.

Cons

- The AvaSocial app is satisfactory but could be better. Its design, usability, and navigation between strategy providers and account management need improvement to compete with top platforms like eToro.

- Signing up is easy, but AvaTrade doesn't offer an ECN account like Pepperstone or IC Markets, which provides raw spreads and fast execution that many traders want.

- While the deposit process is smooth, AvaTrade doesn't support crypto payments, unlike TopFX, which caters to crypto-focused traders.

Why Trade With eToro?

eToro's social trading platform ranks highly due to its excellent user experience and active community chat, useful for beginners seeking trading opportunities. The platform also offers competitive fees on a vast selection of CFDs and actual stocks, alongside beneficial rewards for skilled strategy contributors.

Pros

- Investment portfolios are available, focusing on traditional markets, tech, crypto, and more.

- eToro now offers EUR and GBP accounts, reducing conversion fees and offering a trading experience tailored to local preferences.

- The broker offers excellent services for beginners, including commission-free stock trading, a low minimum deposit, and an unlimited demo account.

Cons

- The absence of extra charting platforms like MT4 may reduce the appeal for experienced traders used to third-party software.

- The minimum withdrawal amount is $30 with a $5 fee, impacting beginners with little capital.

- There are no guaranteed stop-loss orders, which would be a helpful risk management feature for beginners.

Why Trade With Admiral Markets?

Admirals is a suitable choice for beginner to intermediate traders seeking a reliable, regulated broker. It offers a broad variety of markets, tight spreads, and no commission.

Pros

- Low minimum deposit from $100

- Beginners may find the low initial deposit, partial shares, and simple three-step sign-up procedure for trading appealing.

- Offering a variety of investments such as cryptocurrencies and spread betting options available for traders.

Cons

- Monthly inactivity fee

- The demo account is valid for 30 days.

- US traders not accepted

Filters

How We Identified the Top Lithium Brokers

To build this list, we dug into our extensive broker database to uncover platforms offering lithium trading through contracts for difference (CFDs), futures, and other instruments.

We scored each broker using a custom-built rating model based on 200+ data points across eight core areas – ranging from platform performance to trading costs and market access.

From there, we ran hands-on evaluations to see how these brokers’ trading software really perform – so you get insights based on actual use, not just marketing claims.

How To Choose A Top Broker For Trading Lithium

After years reviewing hundreds of trading platforms, we’ve learned what makes a lithium broker truly stand out. These are the features worth prioritizing:

Market Access

Does the broker give you complete access to the lithium market? Because if they don’t, the other factors lose significance.

Thanks to its critical role in electric vehicle batteries and renewable energy storage, lithium has become one of the most closely watched commodities on the planet. But getting proper exposure to it can be tricky, as not all brokers are up to the task.

Ideally, you want direct access to lithium futures contracts — especially those traded on major global exchanges like the Chicago Mercantile Exchange (CME) or the London Metal Exchange (LME). Futures offer transparency, real-time pricing, and strong liquidity.

If that’s unavailable, the next best thing is trading lithium-linked exchange-traded funds (ETFs) or contracts for difference (CFDs) that track lithium producers or benchmark indices. These synthetic routes can still give you meaningful exposure, as long as you’re working with a regulated broker that knows what it’s doing.

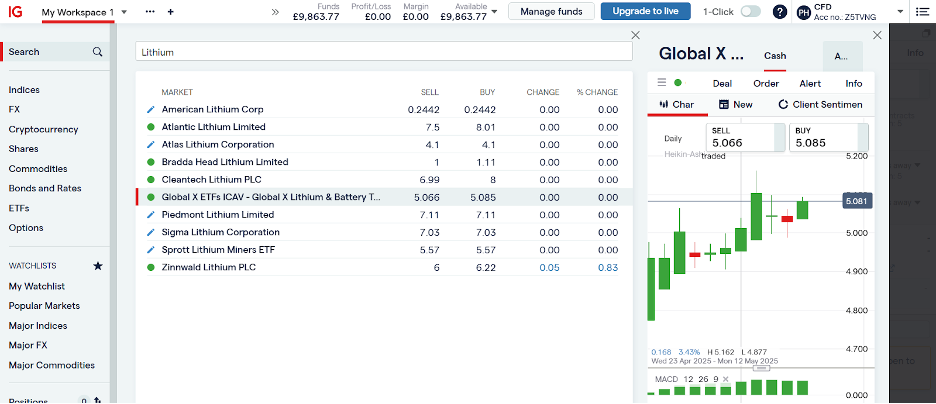

Top Pick: We tested popular brokers and found that IG is one of the rare platforms that provides genuine access to lithium futures through CME listings, as well as a substantial range of lithium-related ETFs and CFDs tied to leading global miners.

We discovered how easy it was to find and trade these instruments during our testing. Everything was laid out clearly. We didn’t have to dig for obscure tickers or wade through generic commodity lists. We could open and monitor positions quickly, which makes a huge difference when trading a fast-moving market like lithium.

It took us seconds during testing to navigate to IG’s wide selection of lithium trading instruments

Lithium-Specific Research and Insights

Once you’ve locked in access to the right markets, the next big question is: Can the broker help you understand what’s driving lithium prices?

Because this isn’t like trading gold or oil, the lithium market is fast-evolving, deeply tied to emerging technologies, and often moved by factors you won’t catch in a basic market summary.

We’re talking about complex, interconnected forces: the pace of electric vehicle adoption, global battery production capacity, shifts in mining activity across Australia and Latin America, and the ripple effects of geopolitical tension in major producing regions like China and Chile.

We’ve seen that even the slightest news on lithium export restrictions or new discoveries in Argentina can send the market spinning. You need a broker that stays ahead of that curve and keeps you in the loop.

When we evaluate research offerings, we specifically seek clear, well-organized commodities research, not just a generic news feed. We want to see detailed reports on lithium supply chains, trends in EV battery demand, and commentary that connects macro events to price movement.

And the truth? Most brokers we’ve tested are hit-and-miss here. A few offer solid educational content, but when it comes to lithium-specific insights, they are usually buried or too shallow to act on.

Top Pick: Admiral Markets surprised us in a good way. While it’s not as flashy as some other platforms, its in-house research team publishes genuinely helpful commodities commentary. We noticed a particular focus on emerging market dynamics and battery metals.

We found several updates connecting the dots between EV policy developments in China and spot price movements, which is precisely the context you need to make informed calls. And as a live trader, you get a free subscription to their Premium Analysis service.

If you’re the kind of trader who relies on a strong fundamental view, especially if you care about what’s happening across key regions like Brazil, Argentina, or Australia, Admiral Markets offers a research setup well worth plugging into.

Execution Speed and Reliability

When you’re trading fast-moving metals like lithium, speed and stability aren’t luxuries; they’re essential. Prices can spike or drop in seconds, especially when there’s a surprise shift in inventory data or a breaking macro headline out of China, Chile, or the US.

We’ve seen lithium and related metals like nickel whip around violently on a single announcement, and if your broker can’t keep up, your strategy — and your P&L — takes the hit.

This is where execution infrastructure matters. You want a broker with rock-solid servers, minimal latency, and a reputation for delivering trades at the price you clicked, not a few pips later. Slippage is real, and in our testing, it’s something we always keep a close eye on.

Top Pick: AvaTrade impressed us with consistently fast and stable execution, even during highly volatile trading windows. We didn’t experience significant slippage, and orders filled quickly at or near expected prices, which is exactly what you want when chasing or defending positions in a surging market.

Their web platform is optimised for speed, and it shows. In addition to that, they support MT4 and MT5, which are known for precision execution, and you have a serious advantage when it comes to trade reliability.

If you’re planning to trade lithium in real time — not just set-and-forget ETF positions — execution speed is a make-or-break factor, and AvaTrade handled it better than most.

AvaTrade offers a fast, dependable platform for trading lithium based on testing

Data Feeds and Charts

If you’re serious about trading lithium, you already know that data is everything. The ability to react quickly, spot patterns early, and anticipate shifts in sentiment all start with the quality of your market data and charting tools.

At a minimum, we expect a broker to offer real-time pricing from major exchanges like the London Metal Exchange (LME) and the Chicago Mercantile Exchange (CME).

But beyond that, the real advantage comes from having access to live inventory data, detailed market depth, and pro-grade charting tailored to commodities, not just generic forex or equity overlays.

During our testing, we want to see how well the platforms handle live metals data, especially for more niche contracts like lithium futures or nickel as a proxy.

We also closely examine the technical analysis tools available — volume overlays, momentum indicators, and custom timeframes that suit a commodity trader’s mindset.

Top Pick: IG offers one of the most substantial data and charting setups available in the lithium space. Their platform offers real-time pricing from CME and LME and deep access to global commodities markets, including metals inventories and related macro news.

But where IG excels is in its charting. Their proprietary web platform, along with integrations for MetaTrader, gives you clean, intuitive access to a full suite of technical indicators: MACD, RSI, Bollinger Bands, Fibonacci levels, you name it. And crucially, the data feed is fast and reliable, with no noticeable lag even during high-traffic sessions.

We found it easy to customize charts for the specific timeframes and patterns we watch when trading lithium ETFs, whether intraday momentum plays or longer trendline setups.

IG offers dozens of indicators and chart settings for analyzing lithium prices

Margin and Leverage Options

Leverage is one of the big attractions in trading commodities like lithium. But it’s also where a lot of new traders get burned.

That’s why it’s critical to understand how your broker handles margin and leverage, especially when you’re trading futures or CFDs.

What you want is transparency and flexibility. You should be able to clearly see what margin is required for each position, how it adjusts with volatility, and what kind of leverage you’re getting, not just the headline figure.

We’ve seen some brokers offer high leverage but hide the fine print on margin calls or quietly restrict position sizes when markets heat up.

Top Pick: When we test lithium trading platforms, we pay close attention to how leverage works in practice, not just what was promised in the marketing. Admiral Markets came out ahead here, offering competitive leverage on commodities CFDs, including those linked to lithium producers and nickel.

Just as importantly, they’re upfront about the risks and requirements, with transparent calculators, margin tables, and automatic stop-out levels to help you manage exposure.

Regulatory Oversight and Broker Credibility

Trading lithium isn’t like punting meme stocks. You’re in a complex global market, influenced by real-world supply chains, geopolitical risks, and institutional flows. You can’t afford to trade with a sketchy or unregulated broker, not even for a better spread.

We recommend choosing a broker licensed by a top-tier regulator, like the CFTC (US Commodity Futures Trading Commission), FCA (UK Financial Conduct Authority), ASIC (Australian Securities and Investments Commission), or CySEC (Cyprus Securities and Exchange Commission).

Regulation doesn’t just protect your money; it ensures the broker follows strict rules around client funds, leverage limits, trade execution, and transparency.

Top Pick: Many lithium trading brokers we’ve evaluated, but IG stands out for its longstanding reputation in metals trading and oversight from multiple top-tier authorities, including the FCA and ASIC. They’ve been around for decades, and their commitment to professional-grade execution and compliance is hard to beat.

In our experience, when trading something as volatile and globally sensitive as lithium, going with a broker like IG, which has deep roots in the commodities space, gives you peace of mind you can’t put a price on.

Fees and Commissions

Lithium trading can be volatile and fast-paced, but the margins on each trade are often razor-thin. That’s why your broker’s fees and commissions matter more than you think.

Whether scalping intraday moves on lithium-related CFDs or holding a longer position in a lithium ETF, high trading costs can quietly eat into your gains.

We always look at two things here: spreads and commission structures. Ideally, you want tight spreads on lithium-linked products and transparent fees with no hidden charges buried in the small print.

Unfortunately, that’s not always the case; some brokers we’ve examined widen spreads significantly during volatile periods or sneak in inactivity and withdrawal fees.

Top Pick: After testing several platforms, eToro stands out for its zero-commission model on a wide range of assets, including lithium-focused ETFs and mining stocks. While spreads vary slightly depending on market conditions, we found them consistently competitive.

We like that all trading costs are listed upfront before placing a trade—no guesswork, no surprises. If you want to minimize trading friction and keep your positions lean, eToro offers one of the more cost-efficient setups for retail lithium traders, especially those using synthetic instruments.

Risk Management Tools

The lithium market doesn’t sleep. Add supply disruptions, EV-related announcements, and policy shifts in key producing countries, and price swings can be sudden and vast. Strong risk management tools aren’t optional; they’re a must.

We look for brokers that offer a full suite of protections: stop-loss and take-profit orders, custom price alerts, volatility notifications, and ideally, the ability to set these up quickly right from the trade ticket. You shouldn’t have to jump through hoops just to limit your downside.

Top Pick: In our hands-on tests, AvaTrade impressed us here. Their platform makes it easy to set tight risk parameters from the start, and they offer a negative balance protection feature by default so that you won’t owe more than your deposit in a worst-case scenario.

We also like their alert system, which pings us on key price levels and even warns of upcoming high-volatility windows based on scheduled economic events. The trading calculator is also an essential feature.