Best Brokers With Demo Competitions 2025

Explore our top brokers offering demo competitions, where you can hone your trading skills in a risk-free environment while competing for real rewards using virtual capital.

-

1CloseOption, based in Georgia, has over ten years of experience in the trading industry. The company provides high/low binary options trading for forex and crypto markets. They offer competitive payouts, introductory bonuses, round-the-clock customer service, and user-friendly trading software.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.6 XM is a well-known forex and CFD broker with over 10 million clients in more than 190 countries. Since 2009, this reliable broker has provided low trading fees on over 1000 instruments. It is highly regulated by bodies such as ASIC and CySEC and offers a complete MetaTrader experience. -

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 RoboForex is a registered online broker since 2009 under the IFSC in Belize. Traders can select from five different account types (Prime, ECN, R StocksTrader, ProCent, Pro). These accounts allow trades starting from 0.01 lots and offer spreads beginning from 0 pips. In addition to the original service, RoboForex has expanded its platform by introducing the trading of CFDs and by developing a stock trading platform, including the CopyFX system. -

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.7 Founded in 2009, Vantage provides trading on over 1000 CFD products to more than 900,000 customers. Forex CFDs can be traded from 0.0 pips on the RAW account using TradingView, MT4 or MT5. Vantage is regulated by ASIC and keeps client funds separate. The company also offers a variety of social trading tools for those interested in copy trading. -

5

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.4 Founded in 2006, FxPro is a reliable non-dealing desk (NDD) broker that offers trading on more than 2,100 markets to over 2 million clients globally. It has won over 100 industry awards for its favorable conditions for active traders.

Top Demo Competition Brokers Compared

Broker Details Comparison

How Safe Are The Leading Demo Competition Brokers?

Explore how demo contest brokers protect your data and ensure fair competition rules:

Best Mobile Apps For Demo Trading Competitions

See which brokers offer top-performing mobile platforms for entering and managing demo contests:

Are The Top Demo Competition Brokers Good For Beginners?

Demo contests can be a great learning tool—see which brokers support new traders best with other features:

Are The Top Demo Contest Brokers Suitable For Pros?

Experienced traders may seek prize value and competitive conditions—but see how else the top brokers measure up:

Accounts Comparison

Compare the trading accounts offered by Best Brokers With Demo Competitions 2025.

Compare Detailed Ratings Of The Best Demo Contest Brokers

Our ratings show how demo competition brokers scored across every core category during testing:

Compare Trading Fees

Most demo contests are free to enter, but here’s how our top providers compare on costs if you switch to real-money trading:

Most Popular Brokers For Demo Competitions

Find out which demo contest brokers attract the most traders—an indicator of reputation:

| Broker | Popularity |

|---|---|

| XM |

|

| Vantage |

|

| CloseOption |

|

| FxPro |

|

| RoboForex |

|

Why Trade With CloseOption?

CloseOption offers traders a user-friendly binary options platform, promising high returns and sign-up bonuses.

Pros

- CloseOption hosts weekly cash-prize trading competitions.

- Free demo account

- Various global payment options are available.

Cons

- Binary options can be traded on both traditional (“fiat”) and digital currencies.

- CloseOption is not overseen by a reputable trading body.

- Customers must deposit over $50,000 to be eligible for the maximum payouts.

Why Trade With XM?

With a $5 minimum deposit, advanced charting on MT4 and MT5, a growing range of markets, and a Zero account with spreads from 0.0, XM offers what traders need. They have even won our 'Best MT4/MT5 Broker' award recently.

Pros

- XM's customer support has proven reliable, offering 24/5 service in 25 languages, response times under 2 minutes, and a growing Telegram channel.

- XM excels in trader education by providing well-organized resources like webinars, tutorials, and live trading sessions via XM Live.

- XM’s Zero account is ideal for trading with spreads from 0.0 pips, 99.35% of orders executed in <1 second, without requotes or rejections.

Cons

- XM is lagging because it doesn’t offer cTrader and TradingView, which are now preferred over MetaTrader for their better user interface and charting tools.

- XM only uses the MetaTrader platforms for desktop trading, offering no in-house downloadable or web-based solutions with unique features for beginners.

- The XM app is user-friendly and offers unique copy trading products, but its technical analysis tools need enhancement for advanced traders.

Why Trade With RoboForex?

RoboForex offers a broad selection of over 12,000 trading markets along with ECN accounts, impressive charting, and loyalty incentives. It is also advantageous for stock traders due to its intuitive R StocksTrader platform, which provides access to over 3,000 shares, lower fees starting at $0.01, and advanced watchlists.

Pros

- RoboForex offers tight spreads starting at 0 pips and low minimum deposits from $10, making it affordable. Trading with micro lots additionally reduces entry barriers for new traders.

- RoboForex offers more than 12,000 instruments for trading. This includes forex, stocks, indices, ETFs, commodities, and futures. Comparatively, this surpasses the trading opportunities available from most online brokers.

- RoboForex won the 'Best Forex Broker 2025' award from DayTrading.com for expanding their FX services, reducing spreads, and increasing availability in multiple countries.

Cons

- RoboForex now only allows USD and EUR as base currencies. This could lead to conversion fees and inconvenience for traders who prefer managing their accounts in other currencies.

- RoboForex provides fair spreads, but some of its account types have high trading commissions up to $20 per lot, which are more expensive compared to more affordable brokers like IC Markets.

- RoboForex, with more than 15 years in the industry, is authorized by the IFSC in Belize, a 'Red-Tier' regulator. This authorization provides a lower level of regulatory protection for traders.

Why Trade With Vantage?

Vantage is a solid choice for CFD traders looking for a strictly-controlled broker that offers the dependable MetaTrader platforms. The registration process is swift and there’s a $50 minimum deposit, making it easy for traders to start quickly.

Pros

- Vantage has a high trust score due to its impressive reputation and robust regulations from FCA and ASIC.

- The ECN accounts offer competitive terms, including spreads from 0.0 pips and a commission of $1.50 per side for traders.

- Vantage has enhanced its algorithmic trading tools by introducing AutoFibo EA. This feature allows proficient traders to detect potential reversals in the market.

Cons

- Unfortunately, some customers may have to sign up with an offshore company, providing less regulation protection.

- To enjoy optimal trading conditions, a significant deposit of $10,000 is required. These conditions include a commission fee of $1.50 per side.

- Test results show that average transaction speeds of 100ms-250ms are slower than other trading options.

Why Trade With FxPro?

FxPro is an excellent choice for traders, offering fast execution in under 12ms, competitive fees reduced in 2022, and outstanding charting platforms like MT4, MT5, cTrader, and FxPro Edge.

Pros

- FxPro uses a 'No Dealing Desk' (NDD) model, providing fast and clear order execution, often under 12 milliseconds, suitable for short-term trading strategies.

- FxPro's Wallet is a key feature that lets traders manage funds securely. By separating unused funds from active trading accounts, it offers extra protection and convenience.

- FxPro provides four reliable charting platforms, including the user-friendly FxPro Edge, which features over 50 indicators, 7 chart types, and 15 timeframes.

Cons

- FxPro offers customer support 24/5 via multiple channels, performing well in tests, but it lacks 24/7 availability, which might be a drawback for traders needing help outside regular market hours.

- There are no passive investment tools like copy trading or interest on cash. While traders may not miss these features, competitors like eToro offer more options for both active and passive investors.

- Despite having a growing Knowledge Hub and a $10M demo account, FxPro is mainly for advanced traders, and beginners might find the account and fee structure complicated.

Filters

Please note that demo trading competitions may change or expire – always review the latest contest details before entering.

How We Chose The Best Brokers For Demo Trading Contests

We thoroughly investigated demo trading competitions at every broker in our evolving database. Only those that met our benchmark for fair, well-structured, and rewarding demo contests made our shortlist.

Then we ranked the remaining brokers by their overall ratings, considering not just the quality of demo competitions, but the platform usability and the overall trading experience based on our hands-on tests.

This ensures our ratings highlight the brokers offering the best demo competitions, alongside an intuitive, first-rate trading environment.

What To Look For In A Trading Broker With Demo Competitions

Some of our team have taken part in demo trading competitions before, so we know what the key things to look for when choosing a provider:

Frequent Demo Contests

Demo competitions are one of the most exciting ways to sharpen your trading skills without putting real money on the line. But not all brokers run them regularly or offer prizes worth your time. Some contests feel more like marketing gimmicks than genuine opportunities to test strategies and get rewarded.

You want consistency; weekly or monthly contests, real incentives, and a fair playing field. That’s where most brokers we’ve tested fall short.

Top Pick: NordFX has carved out a niche for itself when it comes to demo contests that matter. Their flagship “Money Managers” and “Lucky Trader” demo competitions run regularly, usually monthly, offering cash prizes that can be withdrawn.

What’s more, the entry process is easy, and the rules are transparent. You’re not competing against bots or institutional whales; you’re going up against fellow traders on equal footing. Whether you’re trying out new strategies or just want to see how you stack up in a risk-free environment, NordFX keeps the experience competitive and fun.

Realistic Market Conditions

During our investigations, we discovered some brokers dress up their demos to make trading feel way too easy. You’ll see zero slippage, perfect execution, no requotes, and spreads that seem too good to be true. And guess what? They usually are.

These “easy-mode” demos set you up for a rude awakening when you switch to live trading and suddenly everything feels off.

Serious traders want and need a demo environment that mirrors real-world conditions as closely as possible. Slippage, spreads, market depth, volatility, the whole package. That’s how you build habits and strategies that hold up when money’s on the line – I know from my years of trading.

Top Pick: FXCM’s demo trading contests are designed to give you a genuine taste of the live market. The spreads and execution speeds in the demo closely match what you’ll get on a real account. You’ll notice slippage during volatile periods, and trades don’t always fill instantly, just like in actual live trading. That might sound like a downside, but it’s what makes the experience valuable.

You also get access to FXCM’s complete trading environment, including their charting tools, custom indicators, and platform features; everything from Trading Station to MT4. So when you make the jump to live, there are no surprises. It’s a seamless transition.

Leaderboard Transparency

Let’s talk about leaderboards because they are everything in demo trading competitions. It keeps the energy up, the competition fierce, and the motivation high.

But here’s the issue: not every broker is crystal clear about how their leaderboard works. Some don’t update it in real-time, others hide usernames or rankings until the contest ends, and a few even make you question whether the top spots are accurate at all.

If you’re going to spend time competing, you want to see where you stand, trust the system, and know the rules are the same for everyone.

Top Pick: Vantage runs demo contests with a clean, real-time leaderboard that shows exactly who wins, their returns, and how you stack up. You’re not left guessing or waiting until the end to find out if your effort paid off. Every participant is visible (by nickname or account ID), and the performance metrics are there for everyone to see: percentage gains, ranking, and often even trade stats.

They also keep the rules and scoring system upfront and easy to understand. There’s no vague fine print or weird multipliers that skew results. What you see is what you get, which makes the whole experience more competitive and fair.

Meaningful Rewards

If you’re going to compete in a demo contest and spend days or even weeks honing your trades, you want the prize to mean something.

We see too many brokers throw in some branded merch (who wants that, really?), a discount code, or a shiny certificate that’s nice to look at but doesn’t get you closer to real trading goals. That kind of reward might be fine for beginners testing the waters, but it’s hardly motivating for serious traders.

What traders value are rewards that move the needle: cash payouts, funded live accounts, or trading credit with no strings attached.

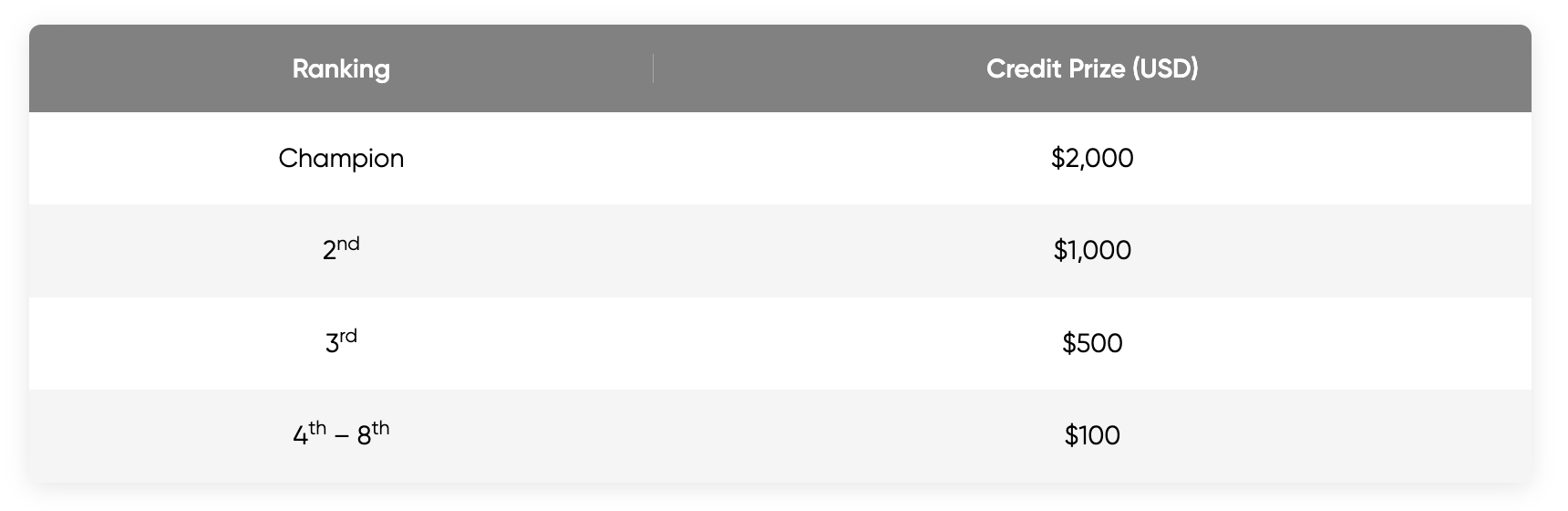

Top prizes in one of Vantage’s demo trading contests

Top Pick: Axi has hosted demo trading competitions over the years with genuinely attractive rewards, including live funded accounts for top performers. Instead of handing out gift cards or T-shirts, they give you something that can launch or level up your trading career. In some of their contests, the top traders are given live accounts with real capital to manage, essentially a foot in the door to becoming a funded trader.

Even when the reward is a cash prize or live trading credit, Axi is clear about the terms. The money isn’t locked behind volume requirements or buried in complicated conditions. They’ve taken steps to make sure the prizes feel like a step forward, not just a marketing gimmick.

And because Axi is known for supporting beginners and advanced traders with solid educational tools and analytics, that reward can go even further once you get it.

Ability To Track Progress Mid-Contest

One of the biggest frustrations in demo contests? Flying blind. You enter the competition, start trading hard, and then nothing happens. No feedback and no way to check how you’re doing until the contest ends.

That’s a missed opportunity, not just for motivation, but for learning. If you can’t track your progress in real-time, then adjusting your strategy or pacing yourself is impossible.

A good contest platform lets you see your stats as you go, not just your overall ranking, but your equity curve, drawdowns, trade history, and how others perform. That’s what keeps things engaging and educational.

Top Pick: FxPro’s demo competition interface really impressed during testing, making it easy to monitor your progress mid-contest. You can check your current balance, equity, open trades, and overall profit/loss in real-time, all from a clean, user-friendly dashboard. What’s more, they often display a performance history throughout the competition, so you can see how your strategy is evolving over time.

The platform also lets you compare your performance against others without revealing personal details, giving you that competitive nudge without compromising privacy.

Educational Resources

Not every trader joins a demo contest just to win. For many people, especially newer or developing traders, the real value is in the learning experience.

They want to test strategies, get a feel for performance under pressure, and walk away with insights they can use to improve. But that only happens if the broker supports the process after the contest ends.

Unfortunately, many brokers post a final leaderboard and call it a day. There are no trade breakdowns, feedback, or learning tools to help you determine what went wrong or right.

Top Pick: NordFX treats demo competitions as more than just promotional gimmicks. They provide educational value to participants, especially at the end of the contest. After the results are in, traders often get access to summaries of their trading stats and performance. In some cases, NordFX shares tips and insights based on what top-performing traders did differently, giving others a clear benchmark to learn from.

They also make educational tools accessible through their platform, including webinars, strategy guides, and platform tutorials. So whether you win or not, there’s a path forward to improving your skills and sharpening your approach. That support is rare from our analysis and valuable if you’re trying to grow as a trader, not just grab a quick prize.

FAQ

What Is A Demo Trading Competition?

Trading demo competitions let you test your trading skills in markets like forex, cryptocurrency, and commodities without using your own money. Brokers provide demo accounts, and the aim is typically to make as much profit as possible in a given timeframe.

These competitions use real-time market data to simulate actual trading conditions, offering a realistic experience.

These contests can vary in length, ranging from a day to several months, and involve different rules, such as limits on leverage or types of assets you can trade.

Are There Risks To Entering A Demo Trading Contest?

Demo trading competitions can encourage excessive risk-taking since no real money is at stake. This may lead to unrealistic strategies that don’t translate well to live trading. Always treat contests as learning tools, not as indicators of guaranteed success.