Best Litecoin Brokers 2026

Find the best Litecoin brokers and exchanges, that we’ve rigorously tested for reliability, security, and top-tier trading platforms.

-

1Interactive Brokers (IBKR) is a top brokerage firm offering access to 150 markets in 33 countries and a range of investment services. With 40 years in the field, this company listed on Nasdaq strictly follows the rules set by authorities such as the SEC, FCA, CIRO, and SFC. It's recognized as one of the most reliable brokers for global trading.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.4 eToro is a platform for social investing that provides options for both short and long-term trading on stocks, ETFs, options, and crypto. The platform is recognized for its easy-to-use, community-oriented interface and reasonable fees. With oversight from FINRA and SIPC, and used by millions globally, eToro is a reputed name in the industry. Trading on eToro is facilitated by eToro USA Securities, Inc. -

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 OANDA is a well-known broker that excels in quick trade executions, a low deposit requirement, and impressive charting and trading platform functions. The highly-regarded brand has over 25 years of expertise and is overseen by reliable authorities like the NFA/CFTC. It provides 24/7 support for traders and offers flexible contract sizes with automated trade executions. -

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 Established in 1999, FOREX.com is part of StoneX, a global financial services company that serves over a million customers. It's regulated in the US, UK, EU, Australia, and other countries. The broker offers a wide range of markets beyond forex and provides competitive pricing on advanced platforms. -

5

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.9 Kraken is a major cryptocurrency exchange that offers a unique trading terminal and over 220 cryptocurrencies for trading. It provides up to 1:5 leverage for spot crypto trading with consistent rollover fees, and up to 1:50 leverage on futures. Additionally, it offers crypto staking services and features an interactive NFT marketplace.

Best Litecoin Brokers Comparison

Broker Details Comparison

Safety Comparison

Compare how safe the Best Litecoin Brokers 2026 are.

Mobile Trading Comparison

Compare the mobile trading features of the Best Litecoin Brokers 2026.

Comparison for Beginners

Compare how suitable the Best Litecoin Brokers 2026 are for beginners.

Comparison for Advanced Traders

Compare how suitable the Best Litecoin Brokers 2026 are for advanced or professional traders.

Accounts Comparison

Compare the trading accounts offered by Best Litecoin Brokers 2026.

Detailed Rating Comparison

Compare how we rated the Best Litecoin Brokers 2026 in key areas.

Fee and Cost Comparison

Compare the cost of trading with the Best Litecoin Brokers 2026.

Broker Popularity

See how popular the Best Litecoin Brokers 2026 are in terms of number of clients.

| Broker | Popularity |

|---|---|

| Kraken |

|

| Interactive Brokers |

|

| eToro USA |

|

| FOREX.com |

|

Why Trade With Interactive Brokers?

Interactive Brokers is ideal for seasoned traders due to its robust charting platforms, updated data, and adaptability, especially with the IBKR Desktop application. Its exceptional pricing and advanced order features appeal to traders, and its variety of stocks remains unmatched in the market.

Pros

- The new IBKR Desktop platform combines the advantages of TWS and adds unique tools like Option Lattice and Screeners with MultiSort to make trading accessible and impressive for traders of all levels.

- IBKR, primarily designed for skilled traders, has expanded its appeal recently by eliminating its initial $10,000 deposit requirement.

- The TWS platform is designed for intermediate to advanced traders. It includes over 100 order types and a dependable real-time market data feed that rarely experiences downtime.

Cons

- TWS's platform may be difficult for beginners to grasp because of its complexity - we were overwhelmed during our initial tests by the sheer volume of tools, features and widgets.

- Only one active session per account is allowed, which means you can't run the desktop version and mobile app at the same time. This can sometimes lead to a frustrating trading experience.

- Customer service may take time to respond, and there may be delays in fixing problems based on tests. It could be difficult to reach the customer service promptly.

Why Trade With eToro USA?

eToro is a top choice for traders due to its top-notch social investing and copy trading services. The broker caters well to new traders with its low deposit requirement, commission-free trading, and user-friendly platform.

Pros

- The low minimum deposit and simple account setup allow beginners to start trading quickly.

- A free demo account enables new users and potential traders to test the broker without risk.

- Traders can use Smart Portfolios for a simpler approach, covering multiple sectors and markets like renewable energy and artificial intelligence.

Cons

- Average fees can reduce the profits of traders.

- There are fewer trading options available, including only stocks, ETFs, and cryptos, compared to competitors.

- The exclusive terminal does not accommodate trading bots and lacks extra equity market analysis tools.

Why Trade With OANDA US?

OANDA is a reputable broker for US traders. It offers user-friendly tools for analysis and a simple sign-up process. It is very trustworthy due to heavy regulation.

Pros

- The broker provides clear pricing without any concealed fees.

- The broker's API provides access to extensive historical data from the past 25 years and rates from over 200 currencies for traders.

- The OANDA web platform offers an exceptional charting environment with over 65 technical indicators provided by TradingView.

Cons

- Customer support is not accessible during weekends.

- The trading markets are limited to only forex and cryptocurrencies.

- Few payment options are available and e-wallets are not supported.

Why Trade With FOREX.com?

FOREX.com is a top-tier brokerage suitable for forex traders of all skill levels. It offers more than 80 currency pairs, has small spreads starting from 0.0 pips, and features low fees. The platform provides powerful charting tools that include over 100 technical indicators and multiple research aids.

Pros

- FOREX.com provides top-tier forex pricing beginning at 0.0 pips. They also offer competitive cashback rebates up to 15% for dedicated traders.

- The in-house Web Trader is a top platform for new traders, featuring a sleek design and over 80 technical indicators for market analysis.

- FOREX.com has over 20 years of experience with strong regulatory oversight, and has received multiple awards, including second place in our 'Best Forex Broker' awards. As such, FOREX.com is globally reputed as a reliable trading brokerage.

Cons

- Demo accounts have a limited time duration of 90 days, which may not be sufficient for thoroughly testing trading strategies.

- FOREX.com's MT4 platform provides around 600 instruments for trading, which is considerably less than the 5,500+ options accessible on its other platforms.

- US clients do not have negative balance protection, so you can potentially owe more than your original account deposit.

Why Trade With Kraken?

Kraken is suitable for traders seeking a variety of cryptocurrencies, including Bitcoin, and a strong history of security.

Pros

- A highly safe and secure service, with no recorded breaches in the ten years since it was established.

- Trade futures with 50x leverage.

- Crypto staking

Cons

- Pro account's verification process is slow.

- Doesn't support many new alternative coins.

- Low leverage on spot trading

Filters

How We Chose the Best Litecoin Brokers

To list the top brokers, we ranked the providers in our database offering Litecoin by their overall ratings.

These ratings take into account over 200 metrics per trading firm, spanning 8 core areas, from crypto spreads and security features to the usability of each firm’s trading software following our hands-on tests.

What To Look For in a Top Litecoin Broker

Launched in 2011, Litecoin is one of the world’s favorite cryptocurrencies. It’s frequently inside the list of the top 10 most traded digital currencies by trading value.

As a result, the Litecoin broker market is extremely competitive, and the range of services, costs, levels of leverage and other phenomena can vary substantially.

Here are five key things to reflect on when choosing which company to use:

1. Regulatory Status

Unfortunately, regulation of the broader cryptocurrency arena isn’t as diligent as what we see in other financial markets. This makes the trading of digital currencies like Litecoin much riskier, with traders needing to be on constant guard against fraudulent activity.

Having said that, respected regulators in certain regions – such as the Financial Conduct Authority (FCA) in the UK – have in recent years introduced rules that govern Litecoin brokers. This provides some protection for market participants.

Therefore, always check the broker you are considering using is authorized to deal. Those who can’t find a regulated Litecoin-only broker can choose a company that is licensed to deal by one or more reputable authorities in other markets. While not ideal, it can help you steer clear of bad actors.

Top pick: Year after year IG stands out as our most trusted Litecoin broker, providing trading in the popular digital currency with peace of mind. It’s multi-regulated, listed on the London Stock Exchange, and has decades of experience in the industry.

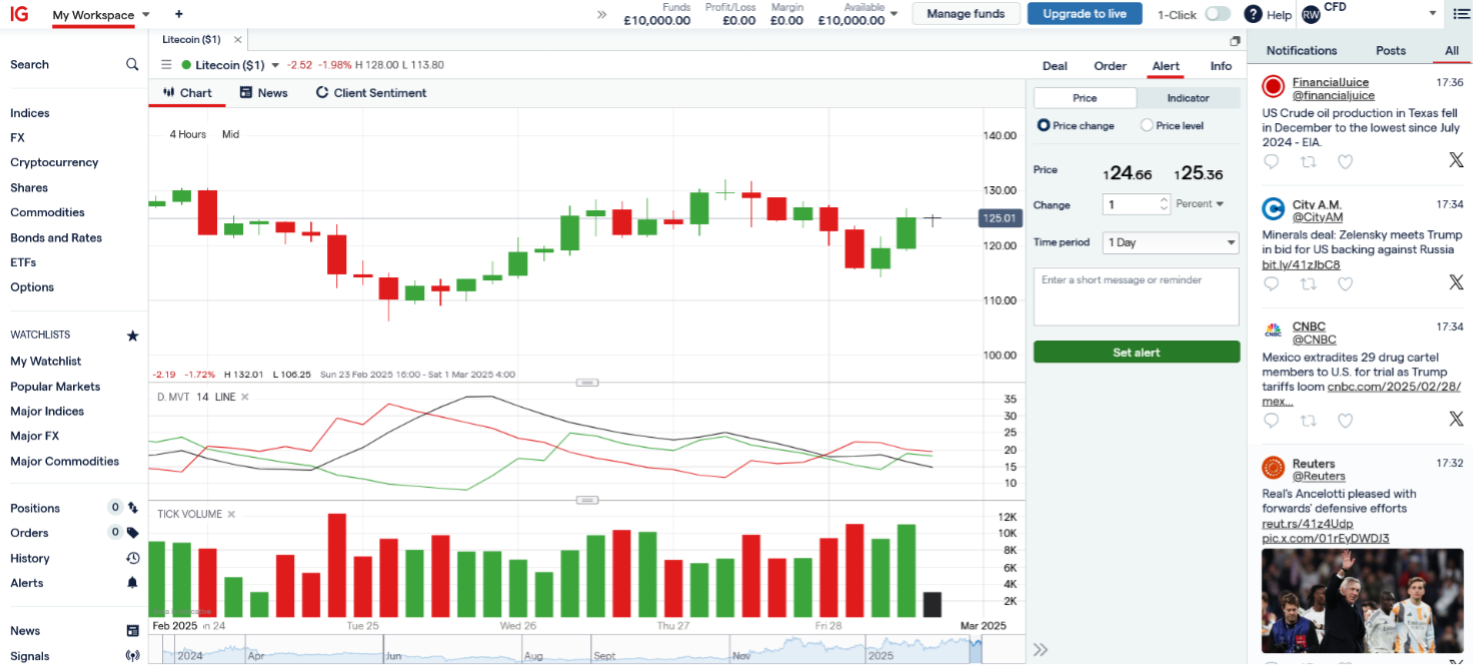

IG is a heavily regulated broker offering Litecoin trading on a user-friendly platform

2. Trading Platform

We know from personal experience that it’s important to choose a broker whose trading software makes for a comfortable dealing experience. Key things to consider include ease of navigation, availability of real-time data, customization options and the quality of the charting tools.

Selecting a broker that facilitates rapid execution speeds is also critical, especially for active traders. Cryptocurrency markets like Litecoin move rapidly, so traders need a platform that helps them avoid price slippage.

Top pick: Brokers like AvaTrade offer a terrific in-house platform and allow you to use third-party software to execute trades, like MetaTrader 4 and 5. Its app also impressed during testing, providing charts, indicators, alerts and more to manage Litecoin trades on the go.

3. Market Access

There are literally thousands of cryptocurrencies that individuals can trade today, and not just the headline makers like Litecoin. However, not all brokers provide access to a wide range of these.

This won’t be a problem for traders who wish to stick to one or two of the major digital currencies. However, those who wish to deal Litecoin as part of a broader crypto-dealing strategy should check out the spectrum of digital currencies available.

Top pick: Eightcap is a great option for those with versatile trading strategies. It offers trading in more than 200 crypto CFDs, from major tokens like Litecoin to emerging coins, helping you build a diverse portfolio.

4. Dealing Costs

Our tests show the cost of dealing Litecoin can differ greatly among brokers. Traders – and especially those with high-volume dealing strategies – need to be mindful of the impact that costs can have on overall returns.

It’s important, therefore, to study each broker’s table of charges for items like trade commissions, management fees, fund withdrawal charges and account inactivity costs.

It’s also critical to consider the size of bid and offer spreads, as wide spreads can also significantly impact profits.

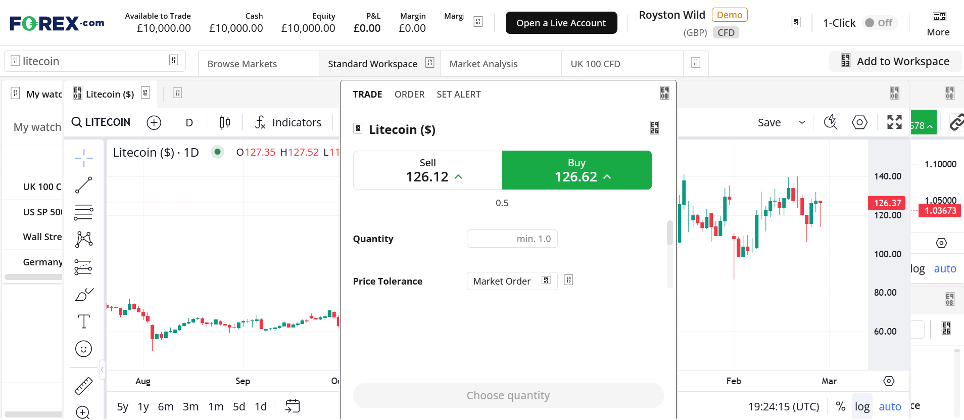

Top pick: FOREX.com offers a minimum spread of 0.5 points on Litecoin, making it a compelling option for active traders. It also offers rebates for high-volume traders with no hidden charges.

FOREX.com features an intuitive web platform with an easily customizable Litecoin chart

5. Leverage

The use of leverage (borrowed funds) is a popular strategy with Litecoin traders. This high-risk strategy can supercharge an individual’s dealing profits by allowing them to control larger positions.

However, our research shows some brokers offer lower leverage for Litecoin transactions than those involving Bitcoin. FXCC, for instance, provides leverage of 1:10 for trading the BTC/USD (Bitcoin/US dollar) cross but 1:5 for LTC/USD (Litecoin/US dollar).

Tip: While leverage can boost trader returns, it can also amplify losses when the market moves in the ‘wrong’ direction. For this reason, follow a strict risk management program to reduce the chances of thumping losses.

It’s also important to compare margin requirements among service providers. This is the amount of funds you need to deposit to open a leveraged position.

Top pick: IC Markets offers very generous uniform leverage of 1:200 across all cryptocurrency pairings featuring USD, including Litecoin. Although, such high leverage isn’t available in some regions, such as the UK.

FAQ

What Is a Litecoin Broker?

A Litecoin broker acts as a middleman between traders who want to buy the virtual currency and those wishing to sell. In this way, they differ from cryptocurrency exchanges where dealers interact directly with one another.

However, Litecoin brokers don’t involve themselves with the exchange of the coins themselves. Instead, they often allow traders to speculate on Litecoin price movements through the use of financial derivatives like contracts for difference (CFDs).