Best Brokers For Penny Stocks 2025

Trading penny stocks can feel like striking gold – but the secret isn’t just finding the right stocks; it’s discovering our brokers that gives you the tools to succeed.

-

1

Stock Trading

IBKR offers a vast selection of equity products from 24 different countries. If you want to increase your capital, earn dividends, or have voting rights, you can invest directly in stocks. On the other hand, if you want to trade based on price movements, you can do so through CFDs, futures, and over 13,000 ETFs. Moreover, in 2024, IBKR expanded its European equity derivatives by including trading on CBOE Europe Derivatives (CEDX).

Stock Exchanges

Interactive Brokers offers trading on 16 stock exchanges:

- Borsa Italiana

- CAC 40 Index France

- Chicago Mercantile Exchange

- Euronext

- IBEX 35

- Japan Exchange Group

- Korean Stock Exchange

- London Metal Exchange

- London Stock Exchange

- Nasdaq

- Nasdaq Nordic & Baltics

- New York Stock Exchange

- Russell 2000

- Shenzhen Stock Exchange

- Tadawul

- Toronto Stock Exchange

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 Stock Trading

You can trade stocks using the NinjaTrader platform with supported brokers. The company also offers various index futures through regular and micro contracts, such as the E-Mini S&P 500 Index Futures and E-Mini Russell 2000 Index Futures.

Stock Exchanges

NinjaTrader offers trading on 2 stock exchanges:

- Chicago Mercantile Exchange

- New York Stock Exchange

-

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.4 Stock Trading

eToro US allows you to trade over 3000 renowned US stocks and ETFs without any commissions. You also have the option to trade with fractional shares. The broker is especially suitable for novice traders due to its extensive eToro Academy and easy-to-use stock market research tools.

Stock Exchanges

eToro USA offers trading on 3 stock exchanges:

- Dow Jones

- New York Stock Exchange

- S&P 500

-

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 Stock Trading

FOREX.com offers numerous US, EU, and UK stock CFDs with tight spreads starting from 1 point. You can trade in well-known companies as well as upcoming IPOs, promoting variety in your stock portfolio. You can access US stocks for a minimal cost of 1.8 cents per share.

Stock Exchanges

FOREX.com offers trading on 14 stock exchanges:

- Australian Securities Exchange (ASX)

- Borsa Italiana

- CAC 40 Index France

- DAX GER 40 Index

- Dow Jones

- Euronext

- FTSE UK Index

- Hang Seng

- Hong Kong Stock Exchange

- IBEX 35

- Japan Exchange Group

- Nasdaq

- S&P 500

- SIX Swiss Exchange

-

5

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.5 Stock Trading

Trade binary options and CFDs on worldwide stocks and 37 indices, including those in the US, Europe, Russia, and Asia. The available stocks surpass those offered by many binary options brokers.

Stock Exchanges

Videforex offers trading on 7 stock exchanges:

- Dow Jones

- FTSE UK Index

- Hong Kong Stock Exchange

- IBEX 35

- Nasdaq

- S&P 500

- SIX Swiss Exchange

Comparison of Best Penny Stock Brokers

Broker Details Comparison

Safety Comparison

Compare how safe the Best Brokers For Penny Stocks 2025 are.

Mobile Trading Comparison

Compare the mobile trading features of the Best Brokers For Penny Stocks 2025.

Comparison for Beginners

Compare how suitable the Best Brokers For Penny Stocks 2025 are for beginners.

Comparison for Advanced Traders

Compare how suitable the Best Brokers For Penny Stocks 2025 are for advanced or professional traders.

Accounts Comparison

Compare the trading accounts offered by Best Brokers For Penny Stocks 2025.

Detailed Rating Comparison

Compare how we rated the Best Brokers For Penny Stocks 2025 in key areas.

Fee and Cost Comparison

Compare the cost of trading with the Best Brokers For Penny Stocks 2025.

Broker Popularity

See how popular the Best Brokers For Penny Stocks 2025 are in terms of number of clients.

| Broker | Popularity |

|---|---|

| Interactive Brokers |

|

| eToro USA |

|

| NinjaTrader |

|

| FOREX.com |

|

| Videforex |

|

Why Trade With Interactive Brokers?

Interactive Brokers is ideal for seasoned traders due to its robust charting platforms, updated data, and adaptability, especially with the IBKR Desktop application. Its exceptional pricing and advanced order features appeal to traders, and its variety of stocks remains unmatched in the market.

Pros

- The new IBKR Desktop platform combines the advantages of TWS and adds unique tools like Option Lattice and Screeners with MultiSort to make trading accessible and impressive for traders of all levels.

- IBKR is a highly regarded brokerage, regulated by prime authorities. This ensures the safety and reliability of your trading account.

- IBKR provides a cost-effective platform for traders by offering low fees, narrow spreads, and clear pricing.

Cons

- TWS's platform may be difficult for beginners to grasp because of its complexity. Plus500's web platform, on the other hand, is more appropriate for those new to trading.

- Only one active session per account is allowed, which means you can't run the desktop version and mobile app at the same time. This can sometimes lead to a frustrating trading experience.

- IBKR offers many research tools. However, the tools are not uniformly distributed across trading platforms and the web-based 'Account Management' page, causing confusion for the users.

Why Trade With NinjaTrader?

NinjaTrader consistently satisfies active futures traders with its low-cost service and high-quality analysis tools. It offers superior charting features, including hundreds of indicators and over 10 chart types.

Pros

- Traders can access a free platform and trade simulation capabilities with the unlimited demo.

- Low costs, with $50 trading margins and commissions starting at $.09 per micro contract.

- NinjaTrader is a well-regarded and acclaimed futures broker, approved by the NFA and CFTC.

Cons

- Some payment methods require a withdrawal fee.

- The advanced trading tools require an additional fee.

- You need to register with partner brokers to trade in securities other than forex and futures.

Why Trade With eToro USA?

eToro is a top choice for traders due to its top-notch social investing and copy trading services. The broker caters well to new traders with its low deposit requirement, commission-free trading, and user-friendly platform.

Pros

- The broker's Academy provides extensive educational resources for traders, ranging from beginners to advanced levels.

- Traders can use Smart Portfolios for a simpler approach, covering multiple sectors and markets like renewable energy and artificial intelligence.

- A free demo account enables new users and potential traders to test the broker without risk.

Cons

- Average fees can reduce the profits of traders.

- There are fewer trading options available, including only stocks, ETFs, and cryptos, compared to competitors.

- The exclusive terminal does not accommodate trading bots and lacks extra equity market analysis tools.

Why Trade With FOREX.com?

FOREX.com is a top-tier brokerage suitable for forex traders of all skill levels. It offers more than 80 currency pairs, has small spreads starting from 0.0 pips, and features low fees. The platform provides powerful charting tools that include over 100 technical indicators and multiple research aids.

Pros

- The Web Trader remains one of the top platforms for budding traders, boasting a sleek design and more than 80 technical indicators for market analysis.

- FOREX.com provides top-tier forex pricing beginning at 0.0 pips. They also offer competitive cashback rebates up to 15% for dedicated traders.

- Numerous educational materials such as tutorials, webinars, and a comprehensive YouTube channel are available to assist you in learning about the financial markets.

Cons

- FOREX.com has expanded their trading offerings, but these remain limited to forex and CFDs. Unfortunately, they don't provide options to invest in actual stocks, ETFs, or cryptocurrencies.

- The funding options are not as extensive as those of top competitors such as IC Markets and lack several widely-used e-wallets, particularly UnionPay and POLi.

- FOREX.com's MT4 platform provides around 600 instruments for trading, which is considerably less than the 5,500+ options accessible on its other platforms.

Why Trade With Videforex?

Videforex caters to traders who want a simple platform for predicting the trends of major financial markets through binary options. With a swift registration process and web-based platform, it's easy to get started.

Pros

- Traders have the opportunity to earn up to 98% payouts on over 100 assets through the broker's binary options. This offering is comparable to competitors such as IQCent.

- Videforex often hosts trading contests. These competitions offer both new and experienced traders a chance to practice and win cash prizes. Trades can be made from as low as ¢0.01.

- Videforex is a rare brokerage with 24/7 multilingual video support, offering extensive help for active traders.

Cons

- Our latest tests indicate that the client terminal requires upgrades due to occasional slow and unresponsive widgets, which may negatively affect the experience for traders.

- The lack of educational resources is a significant disadvantage for new traders, as top trading platforms often provide useful content like blogs, videos, and live trading sessions.

- Videforex is not authorized by a reliable regulator. This means traders may not get important protections such as separate client accounts.

Filters

How We Chose the Best Brokers for Trading Penny Stocks

To list the top brokers for trading penny stocks, we evaluated over 200 key metrics across our extensive brokerage directory.

Our analysis focused on critical factors such as trading fees, platform usability, and access to niche markets like penny stocks.

After in-depth hands-on testing of each broker’s software, we assigned overall scores and ranked them to help traders find the best platforms for trading penny stocks.

What to Consider When Searching For a Top Penny Stock Broker

Important factors to think about when selecting a platform for penny stock trading include:

Regulatory Status

Whether considering a bog-standard stock brokerage or specialist firm like a penny stock broker, it’s important to check that the firm you choose is licensed to deal by a reputable financial regulator, such as the SEC in the US, FCA in the UK, or ASIC in Australia.

This can stop a fraudulent operator from running off with your money and personal details. It can also shield you from bad trading practices, like poor price transparency and inadequate customer service.

Unfortunately, OTC and ‘pink sheet’ trading involves far less oversight than share dealing on major exchanges. This in turn can attract a higher proportion of scam operators versus the broader brokerage industry, meaning penny stock traders should be especially vigilant.

Range of Penny Stocks

We’ve found the spectrum of tradable penny stocks can differ substantially across trading platforms.

For instance, while Interactive Brokers provides access to a huge number of exchange-listed shares, it provides limited exposure to OTC markets.

By contrast, Firstrade is renowned for being an excellent gateway to OTC stocks, although it only allows the purchase and sale of US companies.

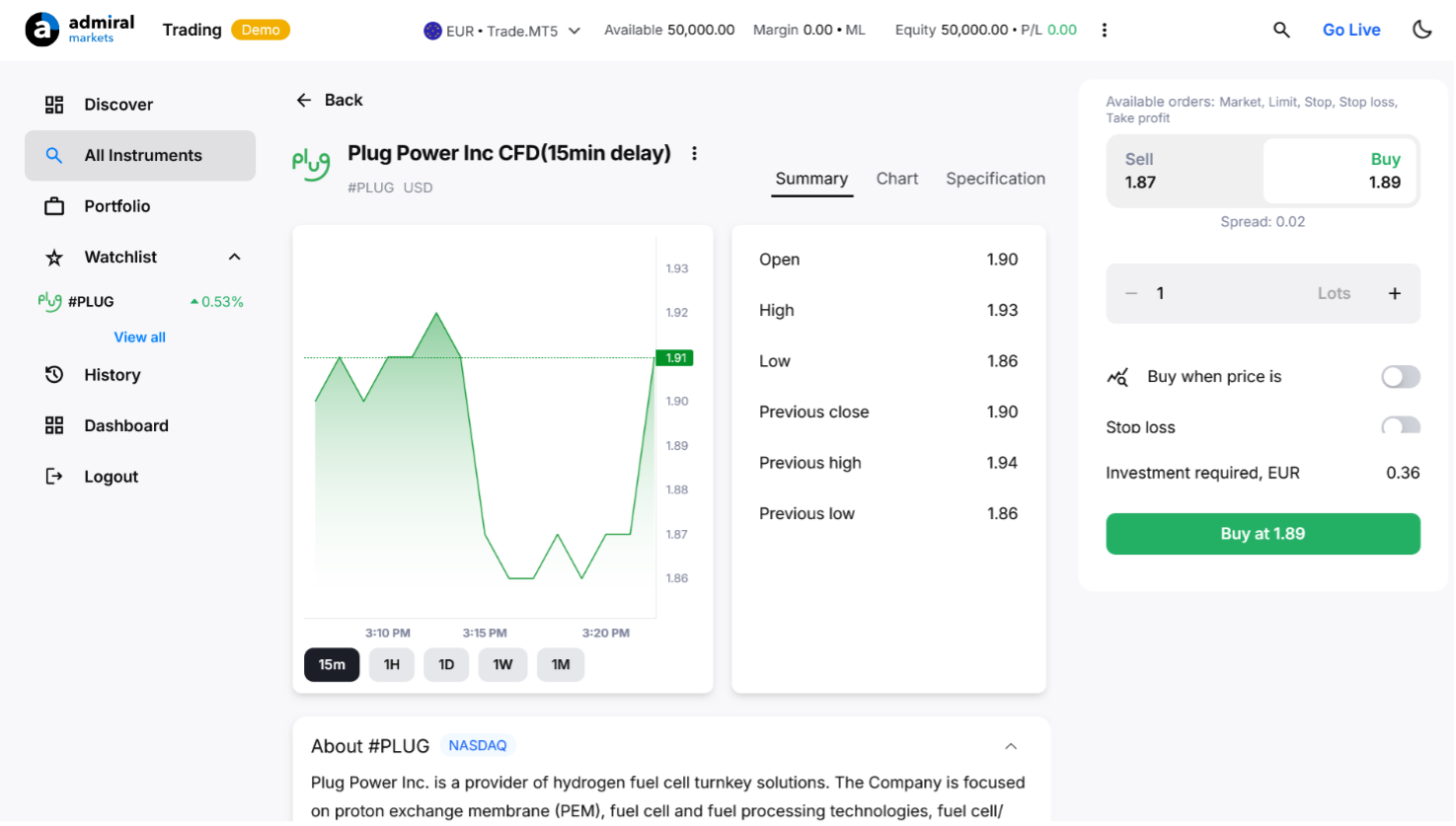

In addition, some brokers don’t provide direct access to penny shares themselves. Admiral Markets, for instance, only allows traders to speculate on these small caps through contracts for difference (CFDs), a form of financial derivative.

Resources

All brokers try to attract customers with extra resources and tools that effectively inform their trading decisions. This can range from general guides to share trading, all the way through to specific research on penny stocks.

In our tests, we discovered that Saxo Bank provides quality market analysis for penny share traders, though largely speaking, finding information on smaller companies is typically more scarce than research covering large-cap businesses.

Trading Costs

As with any broker, trading costs can differ significantly amongst these penny stock specialists. Traders need to keep a close eye on transaction fees, bid and ask spreads, account management fees, and trading inactivity fees.

When it comes to penny stocks, many brokerages charge low trade commissions. Some – like Firstrade – even offer zero commission on trading this asset class.

Expert take: Trading OTC penny stocks usually incurs higher transaction costs than dealing in those listed on large exchanges.

Trading Platform

It’s important to find a broker whose platform you like to use. Easy navigation, a wide range of tools, and reliable execution speeds are essential features.

What does or doesn’t make a good trading platform can be a very individual thing. So it can be a great idea to ‘road test’ a broker’s software with the use of a demo trading account before one begins trading for real.

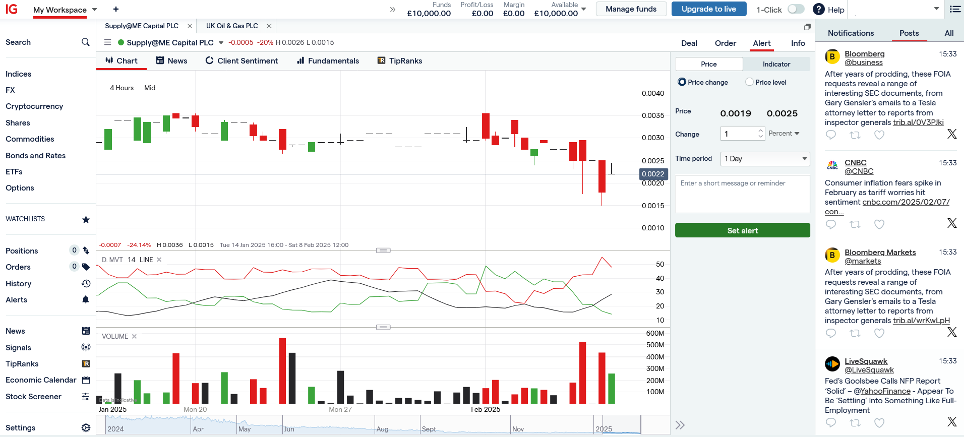

IG is well known for its easy-to-use trading interface and rapid execution speeds. Meanwhile, Saxo Bank is a popular choice with more experienced investors thanks to its more advanced platforms (like SaxoTraderPRO).

Expert take: If I’m hoping to trade penny stocks ‘on the go,’ I would ensure that the broker I use also provides a top mobile trading app.

FAQ

What Is a Penny Stock?

Broadly speaking, a penny share is one that changes hands at below £1 in the UK, or $5 in the US.

Penny shares can deliver substantial capital gains if their earnings take off. Tesla, Ford and Monster Energy are a few former penny stocks whose stratospheric price gains have made investors rich over the years.

However, they are also high-risk – you could lose any money you invest.

What Is a Penny Stock Broker?

Major global exchanges (like the London Stock Exchange (LSE) or New York Stock Exchange (NYSE) offer a wide spectrum of penny shares that investors can typically buy or sell with standard trading platforms.

However, strict listing requirements mean that a considerable number of these small-cap companies are excluded from highly regulated exchanges. Instead, their shares are traded on smaller exchanges and/or in over-the-counter (OTC) markets.

Many penny stock brokers specialize in helping traders reach these harder-to-reach businesses.

Should I Trade Penny Stocks?

Trading penny stocks is a high-risk trading strategy due to frequent market volatility and the greater chance of company failure.

What’s more, the world of penny shares is replete with so-called pump-and-dump schemes, price manipulation by bad actors and bogus companies.

For these reasons, dealing in these smaller companies should be avoided by novice investors. Traders in these small-cap securities should also put in place proper risk management strategies (like using stop loss orders and take profit instructions).