Best National Commission for Companies and the Stock Exchange (CONSOB) Regulated Brokers 2025

We’ve personally tested and ranked the top brokers regulated by Italy’s National Commission for Companies and the Stock Exchange (CONSOB), ensuring high standards of trust and reliability.

-

1Saxo Markets is a renowned trading brokerage, investment firm and bank. It offers over 72,000 trading instruments, investment products, and managed portfolios, ensuring ample opportunities for clients. It operates under the regulation of more than ten agencies including FINMA, FCA & ASIC, thus providing the best protection. The firm is well-known for its transparent pricing.

Compare the Best CONSOB-Regulated Brokers

Safety Comparison

Compare how safe the Best National Commission for Companies and the Stock Exchange (CONSOB) Regulated Brokers 2025 are.

Mobile Trading Comparison

Compare the mobile trading features of the Best National Commission for Companies and the Stock Exchange (CONSOB) Regulated Brokers 2025.

Comparison for Beginners

Compare how suitable the Best National Commission for Companies and the Stock Exchange (CONSOB) Regulated Brokers 2025 are for beginners.

Comparison for Advanced Traders

Compare how suitable the Best National Commission for Companies and the Stock Exchange (CONSOB) Regulated Brokers 2025 are for advanced or professional traders.

Accounts Comparison

Compare the trading accounts offered by Best National Commission for Companies and the Stock Exchange (CONSOB) Regulated Brokers 2025.

Detailed Rating Comparison

Compare how we rated the Best National Commission for Companies and the Stock Exchange (CONSOB) Regulated Brokers 2025 in key areas.

Fee and Cost Comparison

Compare the cost of trading with the Best National Commission for Companies and the Stock Exchange (CONSOB) Regulated Brokers 2025.

Broker Popularity

See how popular the Best National Commission for Companies and the Stock Exchange (CONSOB) Regulated Brokers 2025 are in terms of number of clients.

| Broker | Popularity |

|---|---|

| Saxo |

|

Why Trade With Saxo?

Saxo is ideal for frequent traders and large-scale investors due to its extraordinary range of tools, high-quality market research, and fee discounts. Moreover, its offering of 190 currency pairs with narrow spreads makes it suitable for forex traders.

Pros

- The ISA account is easily available and adaptable, without any charges for initiating or concluding transactions.

- You can use thorough analysis tools like TradingView and Updata for trading.

- High-quality learning materials like podcasts, webinars, and expert videos are available for traders.

Cons

- Do not accept clients from certain regions, specifically the US and Belgium, for trading activities.

- To view Level 2 pricing, a subscription is necessary.

- The trading accounts require substantial funding.

Filters

How BrokerListings.com Selected the Top CONSOB-Regulated Brokers

To identify the best brokers regulated by CONSOB (Commissione Nazionale per le Società e la Borsa), Italy’s financial markets authority, we used a three-step evaluation process:

- Regulatory Verification: We first confirmed each broker’s registration with CONSOB, ensuring they comply with Italian financial laws and MiFID II standards for investor protection within the EU.

- Broker Evaluation: Our team applied BrokerListings.com’s scoring system to assess over 200 factors, including trade execution, fee transparency, platform reliability, and client fund safeguards.

- Hands-On Testing: We conducted direct testing of CONSOB-regulated brokers to evaluate how they perform, giving us a clear view of their usability, speed, and overall experience for Italian traders.

What Is CONSOB?

In Italy, the financial services sector is regulated and supervised by the Commissione Nazionale per le Società e la Borsa, or CONSOB for short.

Translated as the National Commission for Companies and the Stock Exchange in English, the organization was created in 1974 and exists “to protect investors and the efficiency, transparency and development of the market.”

Italy’s membership of the European Economic Area (EEA) means CONSOB’s framework works harmoniously with that of the European Securities and Markets Association (ESMA). This body is responsible for setting regulatory standards across the European Union, Norway, Iceland and Switzerland.

This association means CONSOB is considered one of the world’s most trusted regulatory bodies. Under BrokerListings’ broker regulator ranking system, the body is classified as a Category A regulator.

What Powers Does CONSOB Have?

CONSOB’s role includes issuing licenses that allow financial services entities like brokerages, asset managers and financial advisors to do business. It then oversees their operations to ensure they are acting in accordance with regulations, and it has the power to take disciplinary action if it identifies breaches.

The organization has wide-reaching powers it can deploy during the investigation process. It can interview individuals and demand data and documents (like telephone records), conduct on-site inspections, and seize assets that can be subject to confiscation.

CONSOB also has a range of penalties and sanctions it can impose upon financial services providers. It can issue fines, block websites, remove individuals from company boards and revoke regulatory authorization, for instance.

Pro tip: CONSOB has ordered the ‘blackout’ of around 1,400 websites run by fraudulent financial intermediaries since July 2019. In July 2025, it blocked five websites through which it said “financial services are abusively offered or services for crypto-activities are abusively provided.”

One of the regulator’s most high-profile cases involved Hoch Capital (operating as TradeATF) in 2019. Breaches included using aggressive and misleading marketing material; failing to properly classify clients; ignoring negative balance protection directives; and pressuring customers to deposit more funds.

Under the Markets in Financial Instruments Directive II (MiFID II) – rolled out by ESMA a year before – CONSOB slapped a ban on Hoch Capital’s Italian operations. The company, which was licensed by the Cyprus Securities & Exchange Commission (CySEC), was permitted to deal in Italy under passporting rules.

Passporting allows financial services providers that operate in one EEA country to deal in others without having to acquire licenses in each market.

What Rules Must A CONSOB Broker Follow?

MiFID II rules were established in 2018 “to improve the competitiveness of EU financial markets by creating a single market for investment services and activities, and ensuring a high degree of harmonized protection for investors in financial instruments, such as shares, bonds, derivatives and various structured products.”

To safeguard clients, CONSOB-regulated brokers are required to:

- Target the most favorable result for clients when executing orders, taking into account asset prices, dealing costs, speed of trade execution and other relevant factors.

- Disclose trading fees, management costs and other expenses in a transparent and easy-to-understand format.

- Ascertain the customer’s trading or investing experience, knowledge, risk tolerance and goals before discussing which product or service may be most suitable for them.

- Ensure that all promotional material is clear and not misleading, and fairly disclose the risks associated with the products they offer.

- Establish procedures to prevent conflicts of interest between the company, individuals related to the company, and clients.

- Provide a simple-to-use complaints procedure for clients to raise concerns and obtain swift dispute resolution.

- Separate client funds from those of the company so as to protect the former’s assets in the event of insolvency.

How Can I Check If A Brokerage Is CONSOB Regulated?

Verifying a broker’s right to operate in Italy can be achieved by consulting the CONSOB website. The regulator operates two separate list for individuals to carry out their checks:

- The Register of Italian Investment Firms (SIMs) lists companies that are directly licensed by CONSOB.

- The Register of EU Investment Firms Without Branches comprises businesses that are licensed by regulators in other EEA countries, but which operate in Italy under passporting rules.

Let’s say I wish to check the regulatory status of BG Saxo, a trading platform developed by Saxo Bank and Banca Generali. The company is Italian in origin, so it makes sense to check The Register of Italian Investment Firms first.

Looking through The Register of Italian Investment Firms (SIMs). Source: CONSOB

The list is ordered alphabetically, meaning it takes just a few moments to find BG Saxo’s profile. Here I can see information including the company’s address, when it received CONSOB authorization, and the list of activities it’s permitted to conduct.

BG Saxo’s profile on the CONSOB register. Source: CONSOB

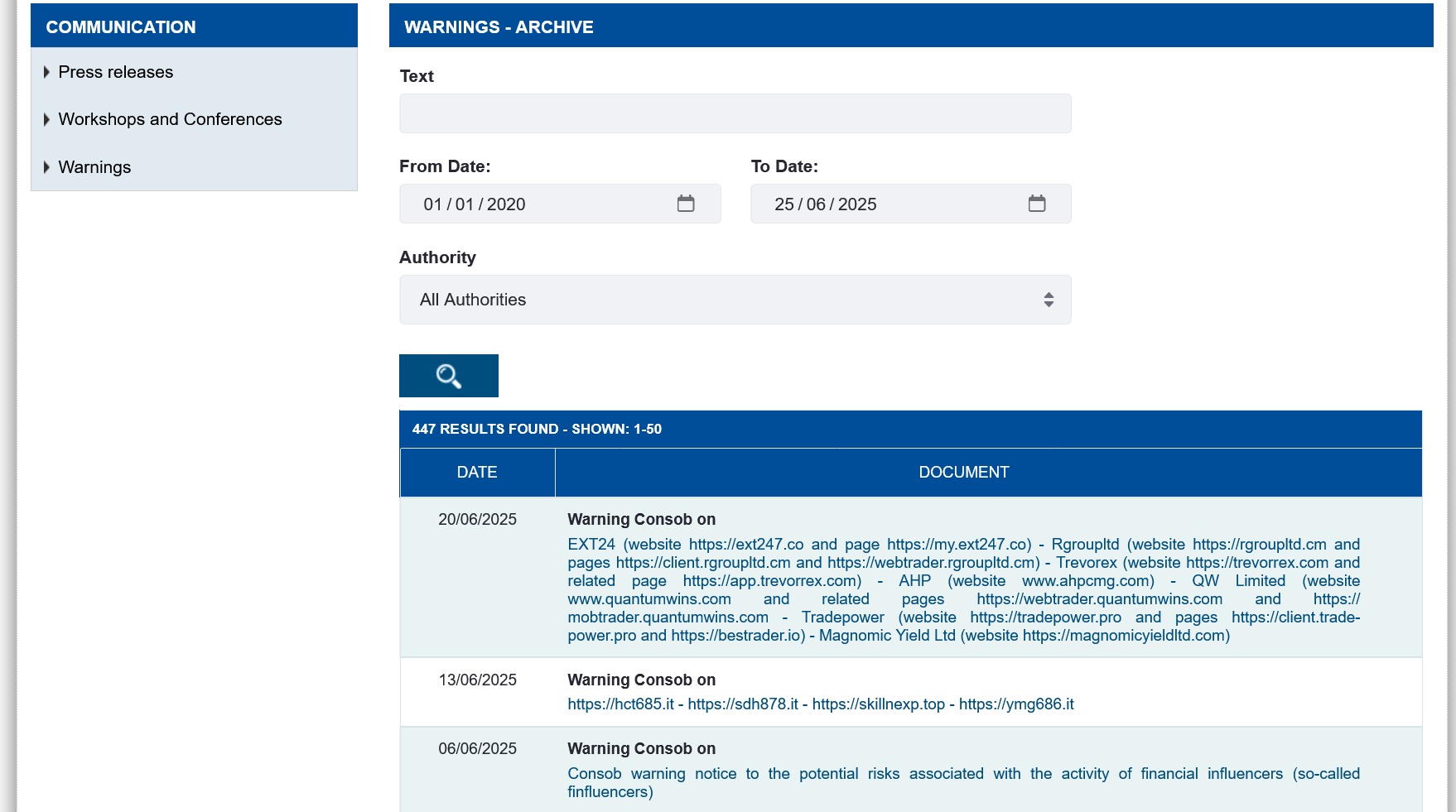

Pro tip: CONSOB also publishes a comprehensive list of warnings it’s issued to financial services companies on its website. Individuals can check latest warnings, or used an advanced search to check the warnings archive.

Searching the warnings archive. Source: CONSOB

Bottom Line

CONSOB’s robust regulatory oversight – underpinned by rules laid down by the ESMA – means that traders can expect high levels of protection from bad business practices and fraudulent activities if they choose a CONSOB-regulated trading platforms.

Brokers who fall foul of its regulations can expect swift and potentially severe repercussions.

Article Sources

Commissione Nazionale per le Società e la Borsa

European Securities and Markets Association (ESMA)

Italy – Global Investigations Review (GIR)

Markets in Financial Instruments Directive II (MiFID II) – ESMA