Best Brokers For Commission-Free Trading 2026

Dig into our exhaustively tested list of the top brokers for commission-free trading, made popular by the likes of Robinhood, but now available at various providers.

-

1

We confirmed Interactive Brokers offers commission-free trading in certain accounts and regions. With IBKR Lite (US), you pay $0 commission on US-listed stocks/ETFs. Outside Lite or the US, IBKR Pro charges per share, so costs are not "zero." However, fills match displayed prices, keeping costs predictable, and you get tight spreads without hidden fees common at other firms.

-

2

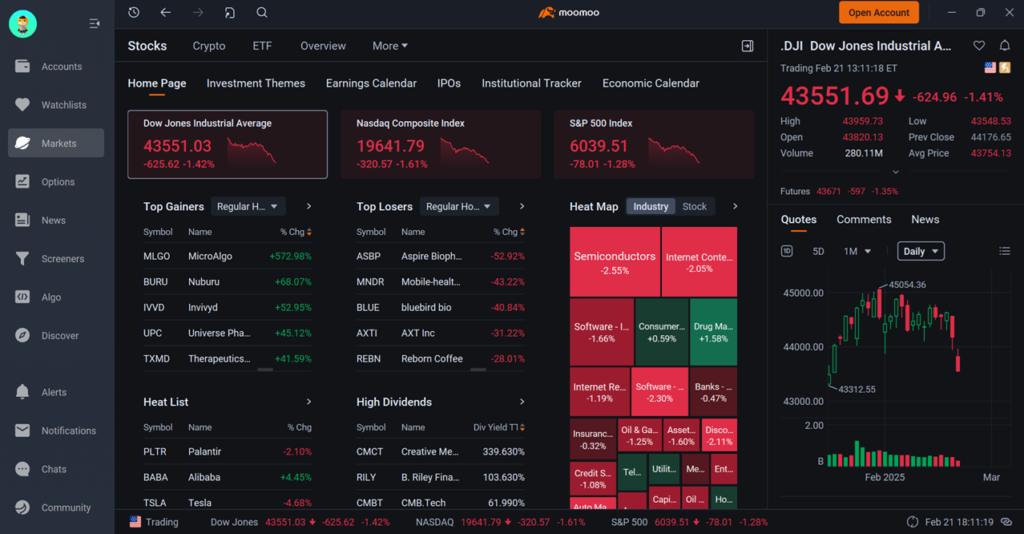

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.3 In our moomoo tests, commission-free trading performed well: $0 commissions on U.S. stocks/ETFs and $0 commissions and contract fees on U.S. equity options for U.S. residents trading in U.S. markets. Only SEC/FINRA fees apply, and there are no platform fees. Pricing remained as displayed before trade. Spreads are reliably tight, with no hidden fees appearing during busy sessions.

-

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.6 FXCC provides commission-free trading on forex, equities, commodities, indices, and crypto with its ECN XL account. There are no commissions, no minimum deposit, and access to the MetaTrader suite, ideal for traders who want to limit costs to spreads and rollover charges.

-

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.8 XTB offers zero commission on real stocks and ETFs for monthly turnovers up to €100,000. Above that, a 0.2% fee (minimum €10) applies, plus a 0.5% FX conversion if the currency differs. Exact costs are shown before ordering. XTB’s clear and reliable system helps active traders easily manage short-term fees.

Top Commission-Free Brokers Comparison

Safety Comparison

Compare how safe the Best Brokers For Commission-Free Trading 2026 are.

Mobile Trading Comparison

Compare the mobile trading features of the Best Brokers For Commission-Free Trading 2026.

Comparison for Beginners

Compare how suitable the Best Brokers For Commission-Free Trading 2026 are for beginners.

Comparison for Advanced Traders

Compare how suitable the Best Brokers For Commission-Free Trading 2026 are for advanced or professional traders.

Accounts Comparison

Compare the trading accounts offered by Best Brokers For Commission-Free Trading 2026.

Detailed Rating Comparison

Compare how we rated the Best Brokers For Commission-Free Trading 2026 in key areas.

Fee and Cost Comparison

Compare the cost of trading with the Best Brokers For Commission-Free Trading 2026.

Broker Popularity

See how popular the Best Brokers For Commission-Free Trading 2026 are in terms of number of clients.

| Broker | Popularity |

|---|---|

| Moomoo |

|

| Interactive Brokers |

|

| XTB |

|

Why Trade With Interactive Brokers?

Interactive Brokers is ideal for seasoned traders due to its robust charting platforms, updated data, and adaptability, especially with the IBKR Desktop application. Its exceptional pricing and advanced order features appeal to traders, and its variety of stocks remains unmatched in the market.

Pros

- IBKR, primarily designed for skilled traders, has expanded its appeal recently by eliminating its initial $10,000 deposit requirement.

- IBKR provides a cost-effective platform for traders by offering low fees, narrow spreads, and clear pricing.

- There's a large selection of free or paid research subscriptions available to all traders. If you subscribe to Toggle AI, you will also receive commission refunds from IBKR.

Cons

- Only one active session per account is allowed, which means you can't run the desktop version and mobile app at the same time. This can sometimes lead to a frustrating trading experience.

- Customer service may take time to respond, and there may be delays in fixing problems based on tests. It could be difficult to reach the customer service promptly.

- TWS's platform may be difficult for beginners to grasp because of its complexity - we were overwhelmed during our initial tests by the sheer volume of tools, features and widgets.

Why Trade With Moomoo?

Moomoo is a great option for beginner and intermediate traders aiming to diversify their investment portfolio. The brokerage's app is easily navigable and the trading fees are significantly low.

Pros

- The broker requires no minimum deposit, making it suitable for beginner traders.

- The fees for options contracts have been lowered from $0.65 to $0.

- Moomoo is a licensed entity with the US Securities and Exchange Commission (SEC) and the Monetary Authority of Singapore (MAS).

Cons

- The broker doesn't offer phone or live chat support, options typically provided by other brokers.

- Regrettably, even with its existing security features, this platform still lacks 2 factor authentication (2FA).

- The protection against negative balance, a standard security measure at highly regulated brokers, is not available here.

Why Trade With FXCC?

FXCC is a strong choice for traders, offering over 70 currency pairs, tight spreads from 0.0 pips, high leverage up to 1:1000 in the ECN XL account, and a free VPS for eligible traders.

Pros

- FXCC has expanded its services by including MT5 in its platforms, adding hundreds of stocks and more cryptocurrencies, as well as introducing copy trading and more margin trading options.

- Customer support still depends on human agents, providing live chat response times of under three minutes in our tests, with knowledgeable representatives. This is a welcome change from the often frustrating AI chatbots now common among brokers.

- FXCC's ECN XL account is designed for active traders, offering spreads from 0.0 without commission and meeting our execution speed standards.

Cons

- FXCC has expanded to include US, European, and Asian stocks, but offers limited metals and energy options, and no soft commodities.

- Despite improvements to the economic calendar, FXCC provides limited market research, offering only basic daily technical analysis and aggregated news. It lacks tools such as Autochartist and social sentiment data.

- FXCC imposes high withdrawal fees, such as $45 for bank transfers and 2% for cryptocurrency transfers, which can reduce the earnings of traders who frequently withdraw funds.

Why Trade With XTB?

XTB is an excellent option for new traders due to its xStation platform, low trading costs, no minimum deposit, and outstanding educational tools, many of which are integrated into the platform.

Pros

- Great customer support 24/5, including a live chat service. During tests, responses were typically provided in less than two minutes.

- XTB provides withdrawals within 3 business days, depending on the method and amount.

- XTB provides an extensive set of educational resources such as training videos and articles on its platform, making it suitable for traders of all skill levels.

Cons

- The inability to modify the default leverage on XTB products is disappointing. Manual adjustment can greatly reduce trading risks, especially in forex and CFD trading.

- XTB's research tools are decent but could be improved by expanding beyond their own features to include top external tools like Autochartist, Trading Central, and TipRanks.

- The demo account ends in four weeks. This is a limit for traders wanting to fully explore the xStation platform and try out strategies before using actual money.

Filters

How We Chose the Best Commission-Free Brokers

To identify the best brokers for commission-free trading, we conducted an evaluation based on over 200 data points for each provider, combined with hands-on testing by our experts.

Our rankings prioritized brokers that offer true commission-free trading with no hidden fees, ensuring cost-effective access to the markets.

We also assessed key factors such as platform features, regulatory oversight, and overall user experience to ensure traders get the best combination of zero-commission trading and a seamless investing experience.

Note, commission-free trading may only be available on certain assets and account types at listed providers.

What to Look For in a Top Broker With Commission-Free Trading

When choosing the best broker to use for commission-free trading, you need to pay particular attention to the five following things:

Regulatory Status

This should be the first thing on any trader’s checklist, regardless of the type of brokerage you wish to employ.

The booming popularity of online trading has led to an explosion in the number of fraudulent operators and brokers engaging in poor business practices.

Unsuspecting traders frequently see unscrupulous businesses and individuals disappear with their cash and reams of personal data.

Investors can protect themselves by ensuring the commission-free brokerage they choose is authorized by a respected global regulator. Great examples include the US Securities and Exchange Commission (SEC), and the UK’s Financial Conduct Authority (FCA).

Pro tip: Regulators often publish a list of licenced trading platforms – as well as a ‘warning list’ of disreputable parties – to help individuals avoid getting caught out.

FOREX.com is one of the most well-regulated commission-free brokers based on our tests, boasting licenses from 10 top-tier financial bodies, including the CFTC, NFA, and FCA.

Fee Structure

We’ve found that commission-free brokers often try to claw back the money they ‘lose’ by not charging transaction fees in other ways. For frequent traders, this can lead to higher dealing costs than they’d otherwise incur by using a brokerage that charges per trade.

As well as billing customers to deposit and withdraw cash, commission-free brokers can also slap fees on inactive traders, clients who wish to use margin, and traders who buy and sell assets that are denominated in particular currencies.

As a result, it’s important to look at all trading costs and consider how they will impact your profitability based on your trading style.

Expert take: Some commission-free brokers also only offer $0 charging fees on particular assets. IG, for instance, doesn’t charge traders for buying and selling US, European and Australian shares, but bills for transactions involving UK equities.

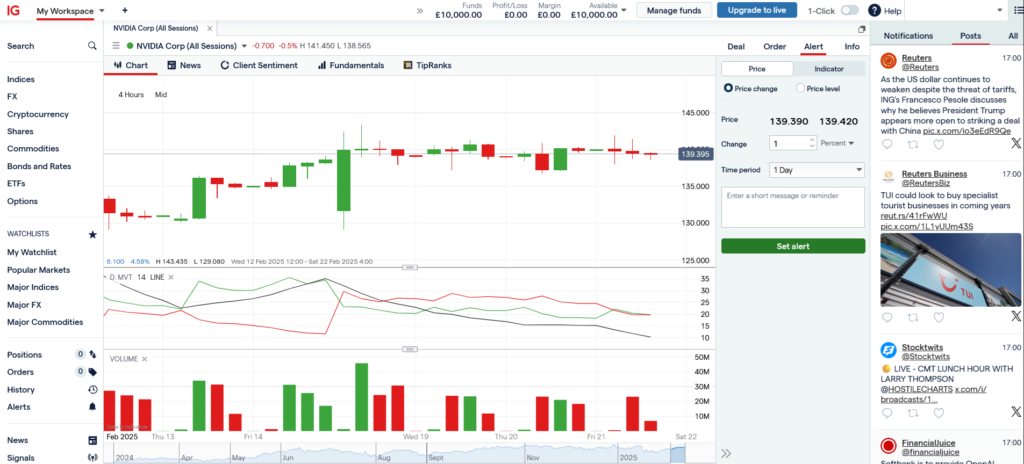

IG web platform

Trade Execution

Being able to execute orders rapidly is critical for all investors and traders. But with many commission-free brokers using payment for order flow (PFOF) to bump up revenues, buying and selling smoothly and cost effectively can be severely compromised.

The problem can be especially severe in fast-moving markets such as forex. In the worst case, the cost of buying or selling a security at a worse price than expected can eliminate the advantage of avoiding commission charges.

Individuals should therefore closely observe how effectively and reliably a trading platform carries out their trades.

Interactive Brokers can be an attractive option for traders in this regard, as it doesn’t engage in PFOF in certain account types.

Product Range

The range of tradeable assets can differ significantly across brokers so check the instruments you want to trade without commissions are supported.

This may not be an issue for focused traders, but those who wish to trade a variety of securities to build a diverse portfolio may find themselves severely restricted.

In general, you can trade a wide variety of markets commission-free, including:

- Stocks

- Forex

- Bonds

- Exchange-traded funds (ETFs)

- Cryptocurrencies

- Derivatives (like futures contracts and contracts for difference (CFDs))

Pro tip: Some commission-free brokers facilitate the trading of fractional shares, instruments that allow individuals to gain exposure to expensive stocks with just a few dollars.

eToro still provides commission-free trading on ETFs, including via its CopyTrader and Smart Portfolios. However, stocks now incur a small commission depending on your location and the stock exchange.

Trading Tools

Growing competition has created an arms race amongst brokers as to who can offer the best trading platform and the greatest selection of tools and other resources.

The best one may simply come down to personal preference, like a platform’s appearance. But other differences may be more consequential. For instance, if trading on the go is essential, we’ve found providers like Moomoo optimal because it offers excellent app-based trading.

Moomoo Platform

FAQ

What Is a Commission-Free Trading Broker?

A broker that provides commission-free trading allows the buying and selling of financial securities without paying transaction fees. This can have significant advantages for high-volume traders, and those who wish to make low-value transactions.

Yet while this can have significant cost advantages for traders, you need to beware of other potential steep costs and order execution delays.

The number of commission-free brokers has grown sharply after the first one – Robinhood – opened for business in the early 2010s.

What Are the Risks of Using a Commission-Free Broker?

There’s no such thing as a ‘free lunch,’ and many commission-free operators can make their money back in other ways. They can charge withdrawal or deposit fees, for instance, and their bid-offer spreads can also be wider than those of conventional brokers.

Commission-free brokerages also routinely sell their customers’ trade orders to market makers instead of routing them directly to an exchange.

This process, known as payment for order flow (PFOF), can result in higher buying and lower selling prices, as well as delays to order execution.