Best Brokers For Short Selling 2026

We’ve tested the top brokers that allow short selling, enabling you to capitalize on market downturns through products like contracts for difference (CFDs).

-

1

When testing Interactive Brokers, we found short selling of stocks, forex, and CFDs to be very flexible. Borrow costs were clear and often cheaper than other brokers, averaging 0.015% daily for forex CFDs and 1.1% for equity CFDs, with minimal restrictions. IBKR's platforms and market data are superior, making them suitable for advanced traders using precise short-selling strategies.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 In our evaluations, NinjaTrader excelled in simplifying short selling for futures and forex CFDs. Borrowing costs were about 0.02% daily for forex CFDs and around 1.3% for futures and equity CFDs. For short selling via futures, it offers more instruments and specific tools than nearly all other firms we tested.

-

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.0 When we tested Plus500US, short selling was simple: sell to open futures contracts like micro equity indices and crude oil, then buy to close. With futures, there are minimal borrow issues or fees; costs are clear (commission + exchange/NFA fees), margins update in real-time, and the web platform is intuitive with integrated research tools.

-

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.5 In our RoboForex tests, short selling in forex and CFD markets was smooth. Borrowing costs averaged about 0.035% daily for forex CFDs and around 1.8% for equity CFDs. Restrictions seldom hindered fast trades. Testing showed RoboForex is a reliable option for traders who act quickly against market trends.

-

5

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.8 In our tests with XM, short selling on forex and CFDs was smooth, with average borrow costs of 0.04% daily for forex CFDs and 2% for equity indices, with few restrictions. Execution remained tight even during high volatility, which is uncommon. XM's platform made identifying short opportunities easy, showing it is a reliable choice for traders aiming to profit from downturns effectively.

Compare the Best Short Selling Brokers by Core Features

We evaluated each broker offering short selling across the metrics that matter most. Here’s how the top platforms compare:

How Secure Are the Top Short Selling Platforms?

When engaging in leveraged strategies like short selling, platform security is critical. See how leading brokers protect your capital:

Best Short Selling Apps for On-the-Go Traders

We tested mobile platforms that support short selling, focusing on execution speed, reliability, and advanced functionality. Here’s how they ranked:

Are The Best Short Selling Brokers Good For Beginners?

New to short selling? These brokers offer user-friendly interfaces, educational resources, and built-in risk tools to help you get started:

Are The Best Short Selling Brokers Good For Advanced Traders?

See which short selling brokers deliver for pros, with advanced charting tools, ultra-fast execution, and access to a wide range of shortable markets:

Accounts Comparison

Compare the trading accounts offered by Best Brokers For Short Selling 2026.

Short Selling Broker Ratings – Our Complete Scorecard

Dive into the full ratings breakdown for the highest-performing short selling brokers, based on our independent tests and expert reviews:

Trading Fees Compared – Where’s the Best Value for Short Sellers?

We analyzed commissions and spread structures to find brokers offering the most competitive pricing for short selling strategies:

Most Popular Short Selling Brokers Among Active Traders

Want to know which platforms short sellers are turning to? These brokers are attracting the most clients:

| Broker | Popularity |

|---|---|

| Plus500US |

|

| XM |

|

| Interactive Brokers |

|

| NinjaTrader |

|

| RoboForex |

|

Why Trade With Interactive Brokers?

Interactive Brokers is ideal for seasoned traders due to its robust charting platforms, updated data, and adaptability, especially with the IBKR Desktop application. Its exceptional pricing and advanced order features appeal to traders, and its variety of stocks remains unmatched in the market.

Pros

- IBKR, primarily designed for skilled traders, has expanded its appeal recently by eliminating its initial $10,000 deposit requirement.

- There's a large selection of free or paid research subscriptions available to all traders. If you subscribe to Toggle AI, you will also receive commission refunds from IBKR.

- IBKR provides a cost-effective platform for traders by offering low fees, narrow spreads, and clear pricing.

Cons

- IBKR offers many research tools. However, the tools are not uniformly distributed across trading platforms and the web-based 'Account Management' page, causing confusion for the users.

- Customer service may take time to respond, and there may be delays in fixing problems based on tests. It could be difficult to reach the customer service promptly.

- TWS's platform may be difficult for beginners to grasp because of its complexity - we were overwhelmed during our initial tests by the sheer volume of tools, features and widgets.

Why Trade With NinjaTrader?

NinjaTrader consistently satisfies active futures traders with its low-cost service and high-quality analysis tools. It offers superior charting features, including hundreds of indicators and over 10 chart types.

Pros

- NinjaTrader provides detailed charting software for active traders, complete with custom technical indicators and widgets.

- NinjaTrader is a well-regarded and acclaimed futures broker, approved by the NFA and CFTC.

- Traders can access a free platform and trade simulation capabilities with the unlimited demo.

Cons

- You need to register with partner brokers to trade in securities other than forex and futures.

- The advanced trading tools require an additional fee.

- Some payment methods require a withdrawal fee.

Why Trade With Plus500US?

Plus500US is an excellent choice for beginners, offering a user-friendly platform, low trading margins, and access to the Futures Academy to improve trading skills. Its powerful tools and reliable service earned it second place in DayTrading.com's annual 'Best US Broker' award.

Pros

- The account setup, pricing structure, and web platform make futures trading simpler than competitors like NinjaTrader.

- Plus500 is a reputable publicly traded company with over 24 million traders and sponsors the Chicago Bulls.

- The trading app offers an excellent user interface with an updated design, straightforward layout, and charts optimized for mobile use.

Cons

- Plus500US offers competitive pricing but does not have a discount program for high-volume traders, unlike brokers like Interactive Brokers.

- Plus500US is expanding its investment options, but it currently only offers around 50+ futures and no stocks.

- The private trading platform is easy to use, but doesn't have the advanced analysis tools that platforms like MetaTrader 4 do.

Why Trade With RoboForex?

RoboForex offers a broad selection of over 12,000 trading markets along with ECN accounts, impressive charting, and loyalty incentives. It is also advantageous for stock traders due to its intuitive R StocksTrader platform, which provides access to over 3,000 shares, lower fees starting at $0.01, and advanced watchlists.

Pros

- RoboForex offers tight spreads starting at 0 pips and low minimum deposits from $10, making it affordable. Trading with micro lots additionally reduces entry barriers for new traders.

- The broker provides two free withdrawals each month in the Free Funds Withdrawal program, assisting traders in reducing transaction expenses.

- RoboForex offers more than 12,000 instruments for trading. This includes forex, stocks, indices, ETFs, commodities, and futures. Comparatively, this surpasses the trading opportunities available from most online brokers.

Cons

- RoboForex, despite having many platforms, does not yet support the commonly used cTrader. This can dissuade traders who favor this platform for trading, which is accessible with firms such as Fusion Markets.

- RoboForex, with more than 15 years in the industry, is authorized by the IFSC in Belize, a 'Red-Tier' regulator. This authorization provides a lower level of regulatory protection for traders.

- RoboForex provides fair spreads, but some of its account types have high trading commissions up to $20 per lot, which are more expensive compared to more affordable brokers like IC Markets.

Why Trade With XM?

With a $5 minimum deposit, advanced charting on MT4 and MT5, a growing range of markets, and a Zero account with spreads from 0.0, XM offers what traders need. They have even won our 'Best MT4/MT5 Broker' award recently.

Pros

- XM’s Zero account is ideal for trading with spreads from 0.0 pips, 99.35% of orders executed in <1 second, without requotes or rejections.

- XM offers over 1,000 instruments, giving traders various short-term opportunities, including turbo stocks, fractional shares, and thematic indices.

- XM has updated its platform with integrated TradingView charts and an XM AI assistant for faster execution, smarter analysis, and a more intuitive trading experience.

Cons

- XM is generally trusted and well-regulated but is registered with weak regulators such as FSC Belize. It no longer accepts UK clients, limiting its market reach.

- XM is lagging because it doesn’t offer cTrader and TradingView, which are now preferred over MetaTrader for their better user interface and charting tools.

- XM only uses the MetaTrader platforms for desktop trading, offering no in-house downloadable or web-based solutions with unique features for beginners.

Filters

How We Chose The Best Brokers For Short Selling

Short selling – or ‘going short’ – allows traders to potentially profit from falling markets. However, not all brokers support this approach, and the quality of the short selling experience can vary widely across platforms.

To identify the best brokers for short selling, we first filtered platforms that offer the necessary products, such as contracts for difference (CFDs). This initial step ensured that every broker we considered genuinely supports trading strategies designed to capitalize on market downturns.

From there, we ranked the eligible brokers using our comprehensive broker rating system, which takes into account over 200 data points across key categories like fees, execution speed, platform usability, regulatory standing, risk management tools, and more.

We also incorporated findings from our hands-on testing, where we assess each broker’s features in the trading environment.

What To Look For In A Broker Offering Short Selling

The key things to consider when selecting a brokerage to use for going short are:

Trust

Irrespective of your investing style or strategy, it’s critical to ensure that the brokerage in question is licensed to trade by a respected global regulator. You wouldn’t put your cash in a bank that’s not properly vetted and regulated by a trusted authority, right?

Regulators in regions with developed financial markets like the FCA in the UK and ASIC in Australia typically provide a cataloge of approved brokerages on their websites. Some also provide ‘warning lists’ of companies and individuals that have been prohibited from doing business in their territories.

Pro tip: Regulatory status isn’t the only thing to check when assessing a broker’s trustworthiness, however. Can a licensed company be considered reliable if, for instance, their trading platform stops working during a short sell, traders have issues withdrawing funds, or they offer a poor level of customer support?

It is therefore also a good idea to read through user reviews and analyses from respected financial websites to get a full picture of what to expect.

Top broker for trust: Pepperstone is among the most trusted brokers for short selling that we’ve tested. It’s authorized in multiple regions across the globe, including the FCA (UK), ASIC (Australia), BaFin (Germany, and DFSA (Dubai). It’s also scooped the financial education website, DayTading.com’s, ‘Best Overall Broker’ award.

Asset Range

When a trader chooses to go ‘short,’ having a wide selection of securities to choose from is often a good idea. This increases the chances you have of finding lucrative trading opportunities to capitalize on.

Retail investors have a multitude of asset classes they can trade today, including stocks, forex, bonds, commodities and cryptocurrencies. However, the range of securities on offer can differ greatly from broker to broker based on our tests.

Pro tip: Some brokerages restrict short selling on less liquid assets, however, as the availability of such securities for lending purposes can be extremely low.

For short sellers, it’s essential to check whether the broker offers trading using derivatives like contracts for difference (CFDs). With these financial instruments, investors can speculate on market movements without having to borrow any underlying asset.

Top broker for asset range: CMC Markets offers trading on more than 12,000 financial instruments – more than most short selling brokers we’ve evaluated. Investors can go short on currencies, equities, commodities, indices, exchange-traded funds (ETFs) and US government bonds (Treasuries).

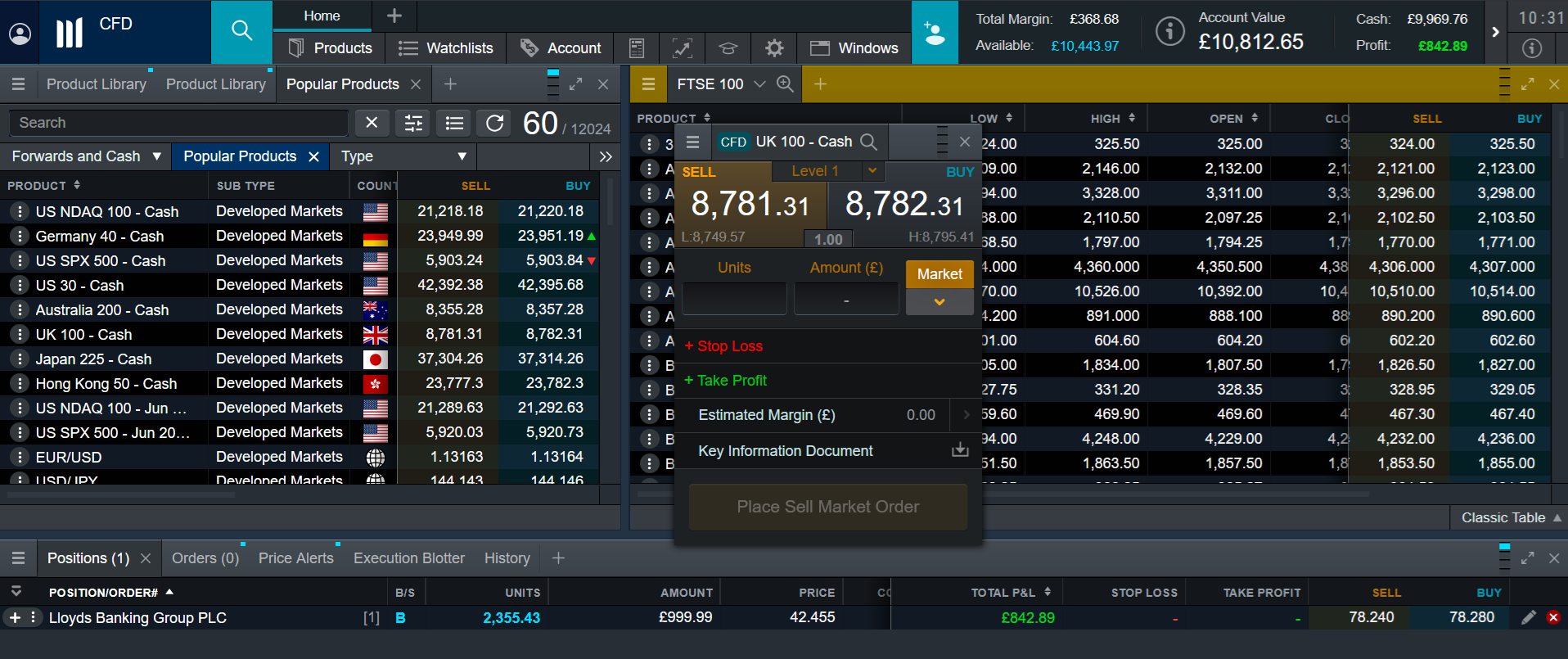

CMC Markets offers an easy-to-use interface for short selling via CFDs

Trading Platform

When it comes to assessing the broker’s platform, there are several important factors to consider, including:

- Is the trading software easy to navigate and customizable?

- Does the platform include real-time data and advanced charting tools?

- How quickly can short trades be executed?

- Is algorithmic/automated trading available?

- Does it provide price alerts and notifications on key events?

- How secure and stable is the trading platform?

Traders also need to ensure that the broker supports the use of a third-party trading platform (like one of the MetaTrader systems, cTrader and TradingView) if they wish to go down that path.

Short sellers especially need to pay close attention to the platform’s risk management tools, as there’s no ceiling on an asset’s potential price increases, bringing the risk of gigantic losses. Order types like stop loss and take profit instructions, for instance, are powerful weapons in helping traders to limit losses and book profits respectively.

Top broker for trading platform: While XTB no longer supports trading with MetaTrader, we’ve found its xStation proprietary system super simple to navigate and it offers a variety of tools (including a stock screener, configurable alerts and excellent charting software).

XTB also allows customers to effectively trade ‘on the go.’ Sophisticated smartphone apps for iOS and Android systems are available. Traders can even short sell through their smartwatch.

Importantly for short sellers, XTB also offers multiple order types to help them manage risk. These include stop loss orders, trailing stop losses and take profit instructions.

Dealing Costs

Keeping trading costs to a minimum is essential, especially for active short sellers. So closely analyze things like transaction fees, account charges, withdrawal and deposit fees when tallying up different brokerages.

It’s also important to consider the size of the broker’s bid (buy) and offer (sell) spreads. Paying a transaction fee can be more cost-effective than using an intermediary that inflates spreads to boost their profits.

Short sellers specifically need to pay close attention to borrowing fees. The broker will charge for locating and then borrowing a security for the trader to sell. Alternatively, for derivative contracts like CFDs, daily financing fees – also known as overnight costs or swap fees – will apply if the trader holds the position overnight.

Top broker for dealing costs: IC Markets is renowned for its narrow bid-offer spreads, beating out most of the competition in our tests, with its price generation system aggregating a selection from up to 25 separate price providers. Forex spreads begin at 0.0 pips on the MetaTrader 4 and 5 platforms, and average spreads of 0.1 pips on the EUR/USD (euro vs US dollar) currency pairing.

Trade commissions are also low, ranging from zero on a standard MetaTrader account to $3.50 on a raw spread MetaTrader account. Traders are also safeguarded from monthly inactivity fees, while overnight fees are pretty modest, an important factor for CFD short sellers.

FAQ

What Is Short Selling?

Traders take a ‘short position’ when they believe the value of an asset will fall. They will borrow the security from a counterparty, and sell it on the expectation of buying it back more cheaply (and returning it to the lender).

The difference between the selling price and the repurchase price – excluding trading fees – is the trader’s profit.

Who Is The Counterparty In A Short Sell Trade?

This is typically the broker, although ultimately they are not the true lender of the asset. They act as a financial intermediary between the borrower and the actual asset owner, locating and borrowing the security from a client account.

In this sense, the client (such as a retail investor or institutional investor) is the ultimate lender.

Do Traders Need To Own The Asset To ‘Go Short’?

Not always. In some markets, investors can speculate that an asset’s price will decline using a derivative product like a CFD.

Who Can Short Sell?

Institutional investors like hedge funds are the most active short sellers, though the number of retail traders using this strategy is growing.

According to stock screener MOMO, around 30% of total ‘short interest’ in US stocks was predicted to be held by retail traders in 2023. That was up from 10% in 2015.

What Are The Pros And Cons Of Short Selling?

Going short provides traders with added flexibility. All financial markets experience reversals, so short selling allows individuals to turn a profit when prices drop and not just when they appreciate.

On top of this, shorting can be used as part of a trader’s risk management strategy. ‘Hedging’ is where investors take a short position to limit potential losses when they also ‘go long’ (buy) on the same asset.

At the same time, however, short selling carries its own risks. This is because the security a trader borrows and sells could keep increasing in value over time, resulting in losses that keep on growing.

A rising asset price can also mean the brokerage issues margin calls, requiring the investor to deposit more cash. If the trader fails to do so, the broker may shut out the position before the asset price potentially falls again, thus locking in the individual’s loss.

Article Sources

Escalator Up, Elevator Down: Understanding the New Landscape of Retail Short Selling – MOMO