Best New Zealand Financial Markets Authority (FMA) Regulated Brokers 2026

We’ve personally tested, verified and ranked the top brokers regulated by the New Zealand Financial Markets Authority (FMA), ensuring high standards of trust.

-

1BlackBull, based in New Zealand, is a CFD broker offering trading on over 26,000 instruments. After a 2023 rebrand, it now features a modern design with advanced trading tools and execution speeds averaging 20ms.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.1 Plus500, founded in 2008 and based in Israel, is a leading brokerage with more than 25 million registered traders across 50+ countries. The company specializes in CFD trading, provides a user-friendly platform and mobile app, and offers competitive spreads. It does not impose commission, deposit, or withdrawal fees. Plus500 holds the trust of its traders by being licensed by well-known regulators such as FCA, ASIC, and CySEC. -

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.7 Founded in 2007, Axi is a forex and CFD broker regulated by multiple authorities. It has enhanced its trading experience by expanding stock offerings, upgrading the Axi Academy, and launching a copy trading app. -

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.7 Established in 1989, CMC Markets is a reputable brokerage firm authorized by various top regulators such as the FCA, ASIC and CIRO, and is listed on the London Stock Exchange. They boast a global client base of over 1 million traders and have received numerous awards. -

5

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.4 TMGM is a broker supervised by ASIC, offering forex and CFD trading in a variety of markets such as stocks, indices, crypto, and commodities. Their account options offer a choice of either no commission or no spreads, with competitive rates overall.

Compare The Top FMA-Authorized Brokers

Safety Comparison

Compare how safe the Best New Zealand Financial Markets Authority (FMA) Regulated Brokers 2026 are.

Mobile Trading Comparison

Compare the mobile trading features of the Best New Zealand Financial Markets Authority (FMA) Regulated Brokers 2026.

Comparison for Beginners

Compare how suitable the Best New Zealand Financial Markets Authority (FMA) Regulated Brokers 2026 are for beginners.

Comparison for Advanced Traders

Compare how suitable the Best New Zealand Financial Markets Authority (FMA) Regulated Brokers 2026 are for advanced or professional traders.

Accounts Comparison

Compare the trading accounts offered by Best New Zealand Financial Markets Authority (FMA) Regulated Brokers 2026.

Detailed Rating Comparison

Compare how we rated the Best New Zealand Financial Markets Authority (FMA) Regulated Brokers 2026 in key areas.

Fee and Cost Comparison

Compare the cost of trading with the Best New Zealand Financial Markets Authority (FMA) Regulated Brokers 2026.

Broker Popularity

See how popular the Best New Zealand Financial Markets Authority (FMA) Regulated Brokers 2026 are in terms of number of clients.

| Broker | Popularity |

|---|---|

| Plus500 |

|

| CMC Markets |

|

| Axi |

|

Why Trade With BlackBull?

After upgrading its trading infrastructure with Equinix servers in New York, London, and Tokyo to reduce latency for traders, BlackBull is a top choice for trading stock CFDs with ECN pricing.

Pros

- BlackBulls’s research is excellent, particularly the daily ‘Trading Opportunities’ articles, which make complex market movements easy to understand and help traders capitalize on new trends.

- BlackBull has partnered with ZuluTrade and Myfxbook, enhanced its own CopyTrader, and enabled cTrader Copy, offering a comprehensive trading experience.

- BlackBull offers three ECN-powered accounts—Standard, Prime, and Institutional—catering to beginners, experienced traders, and professionals with flexibility for trading needs and capital requirements.

Cons

- Unlike most top brokers, BlackBull charges a $5 withdrawal fee, which can reduce cost-effectiveness, especially for active traders who often transfer funds.

- The Education Hub now includes webinars and tutorials, but the courses still need to better explain the broader economic factors that affect prices.

- BlackBull doesn't have its own platform and uses MetaTrader, cTrader, and TradingView. Though these are excellent, other brokers' platforms, like eToro’s, often offer unique features for beginner traders.

Why Trade With Plus500?

Plus500 provides a streamlined experience for traders through a modern and dynamic CFD trading platform. However, its research tools are limited, it charges higher fees compared to some brokers, and its educational resources can be improved.

Pros

- Plus500 recently expanded its trading products. This includes offering VIX options with increased volatility and extended trading hours for 7 stock CFDs.

- The customer support team reliably offers 24/7 assistance through email, live chat, and WhatsApp.

- The broker provides low-commission trading across various markets, reducing extra fees and attracting experienced traders.

Cons

- The lack of educational resources adds a challenge for new traders, unlike top-tier brokers like eToro that offer extensive learning materials.

- Compared to competitors like IG, Plus500's research and analysis tools are somewhat limited.

- The absence of MetaTrader or cTrader charting tools in Plus500 might deter experienced traders who value familiarity.

Why Trade With Axi?

Axi is an excellent choice for trading forex on the MetaTrader 4 platform. It offers over 70 currency pairs, the MT4 NextGen upgrade, and tight spreads from 0.2 pips with the Pro account.

Pros

- Advanced traders can now join the Axi Select funded trader program via the broker’s offshore entity, offering up to $1 million in funding with a 90% profit share.

- Axi provides an excellent MT4 experience, enhanced with the NextGen plug-in for advanced order management and analytics, featuring low execution latency of about 30ms.

- The expanding educational resources in the Axi Academy, including free eBooks, video tutorials, and interactive quizzes, effectively support beginner traders.

Cons

- Axi remains reliable, but recent issues with the ASIC and FMA require it to consistently ensure a secure environment while complying with licensing conditions.

- Axi lags behind because it only provides MT4, while many competitors now offer MT5, cTrader, TradingView, and custom software for a smoother experience with better tools.

- Even after expanding its stock CFDs in US, UK, and EU markets, it is far less extensive than firms like BlackBull, which offer thousands of equities for diverse opportunities.

Why Trade With CMC Markets?

CMC Markets offers a great online platform for traders. It has advanced charting tools and a wide variety of CFDs to trade, including a large selection of currencies and customized indices. It caters to traders at all levels.

Pros

- We upgraded its 'Assets & Markets' rating due to frequent product additions in early 2025, including extended hours trading on US stocks and new share CFDs.

- The CMC web platform offers an excellent user experience, featuring advanced charting tools and customizable options for trading. It suits both beginners and experienced traders. It supports MT4 and will add TradingView in 2025.

- CMC Markets is strictly overseen by respected finance entities, helping to ensure safe and reliable trading. Its excellent reputation ensures a secure trading environment.

Cons

- The CMC Markets app provides full trading services, but its design and user experience are not as good as leading competitors such as eToro.

- While the web platform has improved, it still needs more enhancements to be as user-friendly for trading as competitor software such as IG.

- CMC provides a commendable range of assets, but lacks support for actual stock trading and UK customers are unable to trade cryptocurrencies.

Why Trade With TMGM?

TMGM is an excellent choice due to its wide variety of assets, various account options, multiple platform choices, and reasonable pricing. It's well-suited for trading and traders.

Pros

- Get a free VPS for automated trading.

- The loyalty system offers a variety of bonuses and rewards through points-based trading.

- HUBx provides copy trading support for new traders and those with limited time.

Cons

- A $30 monthly fee applies to trading accounts that are either inactive for over 6 months or contain less than $500.

- Shares can only be traded on the IRESS account and are not tradeable through MT4 and MT5.

Filters

How BrokerListings.com Chose The Top FMA Brokers

To identify the best FMA-regulated brokers in New Zealand, we took a hands-on approach:

- Our team cross-referenced broker claims with the official Financial Markets Authority (FMA) register to verify the validity of licenses.

- From there, we filtered the list using our in-house ratings, applying both 200+ data-driven metrics and testing insight to rank platforms that meet our standards.

What Is The FMA?

Established in 2011, the Financial Markets Authority (FMA) is New Zealand’s official financial services regulator, overseeing online brokers

and other financial market participants.

It’s widely regarded as one of the most reputable authorities on the planet, and has secured Category A status under BrokerListings’ broker regulator classification system.

According to its website, the FMA (known as Te Mana Tātai Hokohoko in Maori) is committed “to promoting and facilitating fair, efficient, and transparent financial markets, characterized by fair access, suitable products, quality advice, transparent actions and integrity.”

Following a series of major failures in the financial services sector – brought about during the Great Financial Crisis – the FMA was created to replace the Securities Commission during the early 2010s.

The FMA issues licenses for financial services companies, such as trading brokers, to ensure they act responsibly and with their customers’ best interests at heart. It also acts in a supervisory capacity and takes enforcement action when it deems necessary.

What Powers Does The FMA Have?

If brokers are found to have breached regulations, the FMA can take a range of actions, from issuing fines to revoking financial services providers’ trading licenses.

It can choose to take informal measures “where such action is proportionate to the misconduct and will achieve an appropriate market outcome.” But it can choose to pursue a stronger recourse when the law is broken and minimum standards are not upheld.

Furthermore, the FMA can pursue regulatory action even if no ‘rules’ have actually been broken.

Examples include:

- In September 2024, the FMA cancelled Rockfort Markets’ derivatives issuer (DI) license after deeming it had contravened eight of its license obligations. These included “a failure to maintain adequate and effective systems, policies, processes, and controls to ensure compliance with its obligations under the standard conditions of its license,” and failing to remove false or misleading advertising from its website.

- In June 2023, the FMA issued a $900,000 fine to Tiger Brokers for breaching the Anti-Money Laundering and Countering Financing of Terrorism (AML/CFT) Act. The regulator alleged four counts of improper conduct, including failure to conduct customer due diligence and failing to report suspicious activities.

Pro tip: The regulator provides updates of enforcement action it’s carried out on its website.

What Rules Must An FMA Broker Follow?

The obligations that licensed brokers must abide by are helpfully provided in a comprehensive guidance note first published in 2014.

Under New Zealand’s Financial Advisers Act 2008, brokers are broadly defined as “a financial services provider who holds or deals with client money or property on behalf of clients.” This includes stock brokers, financial advisers and portfolio administration services providers.

The document outlines a wide range of broker requirements, including the need to:

- Demonstrate care, skill and diligence when dealing with retail investors.

- Keep adequate records of client assets.

- Only use or apply client money or property in a way as expressly directed by the customer.

- Avoid deceptive or misleading practices.

More specifically, some of the FMA’s requirements are that brokers must:

- Belong to one of four dispute resolution schemes approved by the New Zealand government’s Ministry of Business, Innovation and Employment.

- Meet minimum capital requirements (usually NZD$1 million).

- Have at least one director, and if there are several, at least one of them must be a New Zealand resident.

- Process Know Your Customer (KYC), Anti-Money Laundering (AML) and customer identity documents from New Zealand.

How Can I Check If A Brokerage Is FMA Regulated?

The Financial Service Providers Register is an online resource operated by the New Zealand Companies Office. It provides a comprehensive list of all companies licensed by the FMA, as well as those approved by the Reserve Bank of New Zealand (RBNZ), such as banks and insurance companies.

The Financial Service Providers Register on the New Zealand Companies Office website

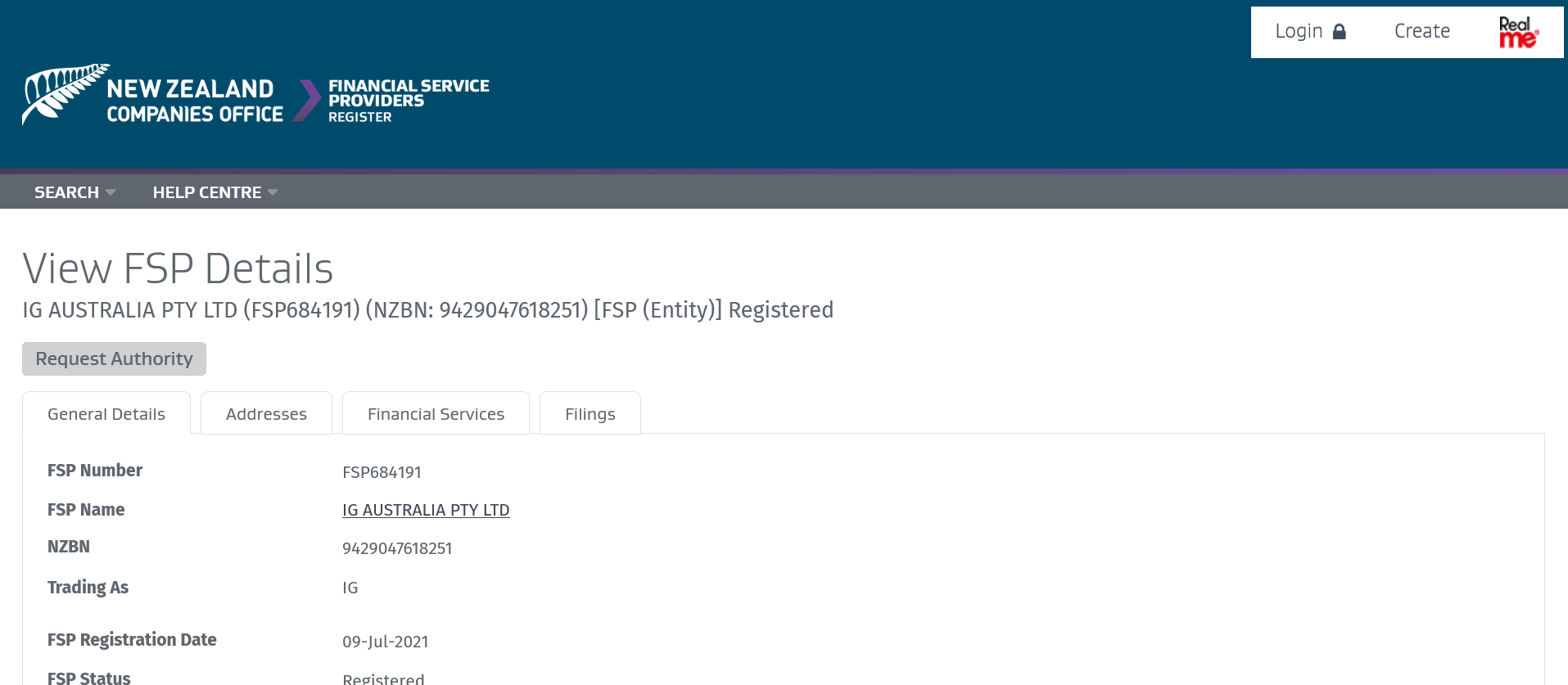

To search the register for a broker, simply punch in the company’s name, or a more familiar name under which it trades. Alternatively, you can use the brokerage’s Financial Services Provider (FSP) number or New Zealand Business Number (NZBN).

Under FMA rules, brokers are provided with an FSP number that they must include in key documents (like client agreements and onboarding forms) along with advertising and promotional materials for licensed services.

Individuals can also use an advanced search facility to narrow down results. For instance, by filtering for FSPs that are registered between specific dates, or for the financial services that firms are licensed to provide.

Once the result appears, individuals can see details like when the broker became FMA licensed, their business address and registered office, and the financial services that they are permitted to provide.

My search showing IG on the Financial Service Providers Register

Pro tip: The FMA also provides its own digital warnings and alerts list containing the names of known bad actors that traders should be on the lookout for.

The regulator publishes a list of unregistered companies it suspects of providing financial services without a license as well.

Bottom Line

The FMA has transformed oversight of New Zealand’s financial markets since its introduction more than a decade ago, providing traders with strong protections from rogue operators.

It’s essential that individuals, especially those in New Zealand, use a regulated brokerage that’s licensed to trade by the authority. Failure to do so could put their capital and their personal data in jeopardy.

Article Sources

Financial Markets Authority (FMA)

Forex license in New Zealand – Lawrange

Choosing a dispute resolution scheme (DRS) – New Zealand Companies Office

Guidance Note: Broker Obligations – FMA

Financial Service Providers Register – New Zealand Companies Office