Best Vanuatu Financial Services Commission (VFSC) Regulated Brokers 2026

We’ve personally tested and ranked the top brokers regulated by the Vanuatu Financial Services Commission (VFSC).

Royston Wild

Tobias Robinson

James Barra

September 15, 2025

-

1Fusion Markets, an online broker since 2017, is regulated by the ASIC, VFSC and FSA. Known for its low-cost forex and CFD trading, it offers a variety of accounts and copy trading options for all types of traders. New traders can register and begin trading in three easy steps.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.7 Founded in 2009, Vantage provides trading on over 1000 CFD products to more than 900,000 customers. Forex CFDs can be traded from 0.0 pips on the RAW account using TradingView, MT4 or MT5. Vantage is regulated by ASIC and keeps client funds separate. The company also offers a variety of social trading tools for those interested in copy trading. -

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.4 TMGM is a broker supervised by ASIC, offering forex and CFD trading in a variety of markets such as stocks, indices, crypto, and commodities. Their account options offer a choice of either no commission or no spreads, with competitive rates overall. -

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 3.8 Global Prime is a widely regulated trading broker providing access to over 150 markets. With a minimum deposit of $200, traders can leverage up to 1:100. The company is highly trusted and reputable, holding a license from the ASIC.

Compare The Top VFSC-Authorized Brokers

Safety Comparison

Compare how safe the Best Vanuatu Financial Services Commission (VFSC) Regulated Brokers 2026 are.

Mobile Trading Comparison

Compare the mobile trading features of the Best Vanuatu Financial Services Commission (VFSC) Regulated Brokers 2026.

Comparison for Beginners

Compare how suitable the Best Vanuatu Financial Services Commission (VFSC) Regulated Brokers 2026 are for beginners.

Comparison for Advanced Traders

Compare how suitable the Best Vanuatu Financial Services Commission (VFSC) Regulated Brokers 2026 are for advanced or professional traders.

Accounts Comparison

Compare the trading accounts offered by Best Vanuatu Financial Services Commission (VFSC) Regulated Brokers 2026.

Detailed Rating Comparison

Compare how we rated the Best Vanuatu Financial Services Commission (VFSC) Regulated Brokers 2026 in key areas.

Fee and Cost Comparison

Compare the cost of trading with the Best Vanuatu Financial Services Commission (VFSC) Regulated Brokers 2026.

Broker Popularity

See how popular the Best Vanuatu Financial Services Commission (VFSC) Regulated Brokers 2026 are in terms of number of clients.

| Broker | Popularity |

|---|---|

| Vantage |

|

| Fusion Markets |

|

Why Trade With Fusion Markets?

Fusion Markets is a top choice for forex traders seeking competitive prices with near zero spreads, minimal commissions, and new TradingView integration. The company, based and regulated in Australia by the ASIC, is especially suitable for Australian traders.

Pros

- Fusion Markets provides superior support with quick and friendly responses during evaluations. There is no need to deal with annoying automated chatbots.

- The variety and quality of charting platforms and social trading features are superb. TradingView, MT4, MT5, and cTrader cater to diverse trading preferences.

- The Market Buzz and Analyst Views features are useful tools for finding opportunities. They are easily accessible within the client dashboard.

Cons

- Fusion Market lags behind alternatives like IG in education, offering limited guides and live video sessions to help new traders improve.

- Non-Australian traders need to register with global entities that have less regulation, limited safety measures, and no protection against negative balances.

- The broker provides a wide selection of currency pairs, surpassing most competitors. However, their alternative investment options are just average and offer no stock CFDs outside of the US.

Why Trade With Vantage?

Vantage is a solid choice for CFD traders looking for a strictly-controlled broker that offers the dependable MetaTrader platforms. The registration process is swift and there’s a $50 minimum deposit, making it easy for traders to start quickly.

Pros

- This broker is suitable for new traders due to its low minimum deposit of $50 and no funding fees.

- Opening a live trading account is a swift and straightforward process that takes less than 5 minutes.

- The ECN accounts offer competitive terms, including spreads from 0.0 pips and a commission of $1.50 per side for traders.

Cons

- Test results show that average transaction speeds of 100ms-250ms are slower than other trading options.

- Unfortunately, some customers may have to sign up with an offshore company, providing less regulation protection.

- To enjoy optimal trading conditions, a significant deposit of $10,000 is required. These conditions include a commission fee of $1.50 per side.

Why Trade With TMGM?

TMGM is an excellent choice due to its wide variety of assets, various account options, multiple platform choices, and reasonable pricing. It's well-suited for trading and traders.

Pros

- Wide variety of assets available, encompassing 10,000 international stocks. Suitable for all types of traders.

- The platform has top-tier support for MetaTrader 4, MetaTrader 5, and IRESS trading systems.

- Get a free VPS for automated trading.

Cons

- Shares can only be traded on the IRESS account and are not tradeable through MT4 and MT5.

- A $30 monthly fee applies to trading accounts that are either inactive for over 6 months or contain less than $500.

Why Trade With Global Prime?

Global Prime is a good fit for both novice and experienced traders, providing leading market access, low costs, and features such as copy trading.

Pros

- ECN account

- Invest from a variety of over 150 assets, including crypto.

- $0 minimum deposit

Cons

- US and Canada-based clients are not eligible for trading services.

- No MetaTrader 5 integration

- Limited account choices for trading.

Filters

How BrokerListings.com Chose The Top VFSC Brokers

To identify the best VFSC-regulated brokers in Vanuatu, we:

- Checked broker claims with the official VFSC register to verify licenses.

- Filtered the list using our overall ratings, applying both 200+ data-driven metrics and hands-on testing insights to rank platforms that meet our quality benchmarks.

What Is The VFSC?

The Vanuatu Financial Services Commission (VFSC) is responsible for ensuring financial markets in the South Pacific country operate in an orderly, transparent and fair manner, including online brokers.

Established in 1993, the organization describes itself as being “responsible for the regulation and supervision of investment business and trust and company service providers, as well as “the development of the financial services industry in Vanuatu.”

Despite this, the VFSC is classified as Category C regulator under BrokerListings’ regulator ranking system. This means traders and investors can expect extremely limited safeguards from bad business practices, fraudulent actors, and poor financial protections in case their broker encounters financial difficulties.

What Powers Does The VFSC Have?

To protect market participants, financial services providers like trading platforms should receive approval from the VFSC to do business. Companies that fail to adhere to industry standards can have their licenses suspended or revoked.

Pro tip: Under the Financial Dealers Licensing Act, individuals operating in Vanuatu’s financial markets without a license can be hit with fines up to 25 million Vanuatu vatu (VUV) as well as 15 years in prison. The penalty increases to 125 million VUV for companies.

Penalties can also be issued for other breaches, such as providing false and misleading information to the VFSC, and failing to maintain proper records or submit required reports.

The organization has the power to conduct on-site inspections to investigate claims of industry malpractice. It can also request documents and other information related to its investigation, and those who fail to comply face possible financial penalties and custodial sentences.

In one high-profile case in 2019, the VFSC revoked the license of forex broker, Capital City Markets, for:

- “Suspicious activity being reported to the local registered office and agent of the licensee.”

- “Failure of the licensee to respond to correspondences or applications for withdrawal of funds by clients.”

- “Failure of the licensee to respond to correspondences or notices of the complaints received by the local registered office and agent and the Commission.”

What Rules Must A VFSC Broker Follow?

The VFSC describes its duties as “to seek, through the provision of effective services for the supervision of financial business to protect the public in Vanuatu and elsewhere against financial loss arising out of dishonesty, incompetence or malpractice on the part of persons engaged in financial business in or from within Vanuatu.”

Under local regulations, brokers must:

- Ensure that any statements pertaining to the buying or selling of financial securities are not false, deceptive or misleading.

- Keep clients’ funds and assets separate from those of the firm.

- Implement robust internal controls and risk management systems.

- Maintain a physical premises in Vanuatu, and have its own address, records, equipment and management.

- Submit quarterly reports to the VFSC on items like the brokerage’s owners and shareholders, its customers, client funds, trade volumes and client complaints.

- Conduct due diligence on customers, keep records and conduct staff training in accordance with anti-money laundering and financing of terrorism rules.

- Hold a bond of 5 million VUV to cover potential losses covered by clients.

Despite reforms in recent years, Vanuatu’s regulatory systems are still considered weak by international standards, and particularly in relation to anti-money laundering and terrorist financing rules.

Accordingly, the European Commission has placed the South Pacific nation on its list of ‘High-Risk Third Countries.’ The US Department of State has also described Vanuatu’s financial services sector as “vulnerable to money laundering.”

How Can I Check If A Brokerage Is VFSC Regulated?

It’s quick and easy to check a brokerage’s regulatory status in Vanuatu using the VFSC’s website.

Let’s say I wish to ascertain whether Vantage holds a Financial Dealer License. I navigate to the ‘Registry Services’ tab at the top of the regulator’s webpage, then move down to the ‘Companies’ option. Clicking on the latter gives me the option to then select ‘Register Search.’

Selecting Register Search on the VFSC website. Source: VFSC

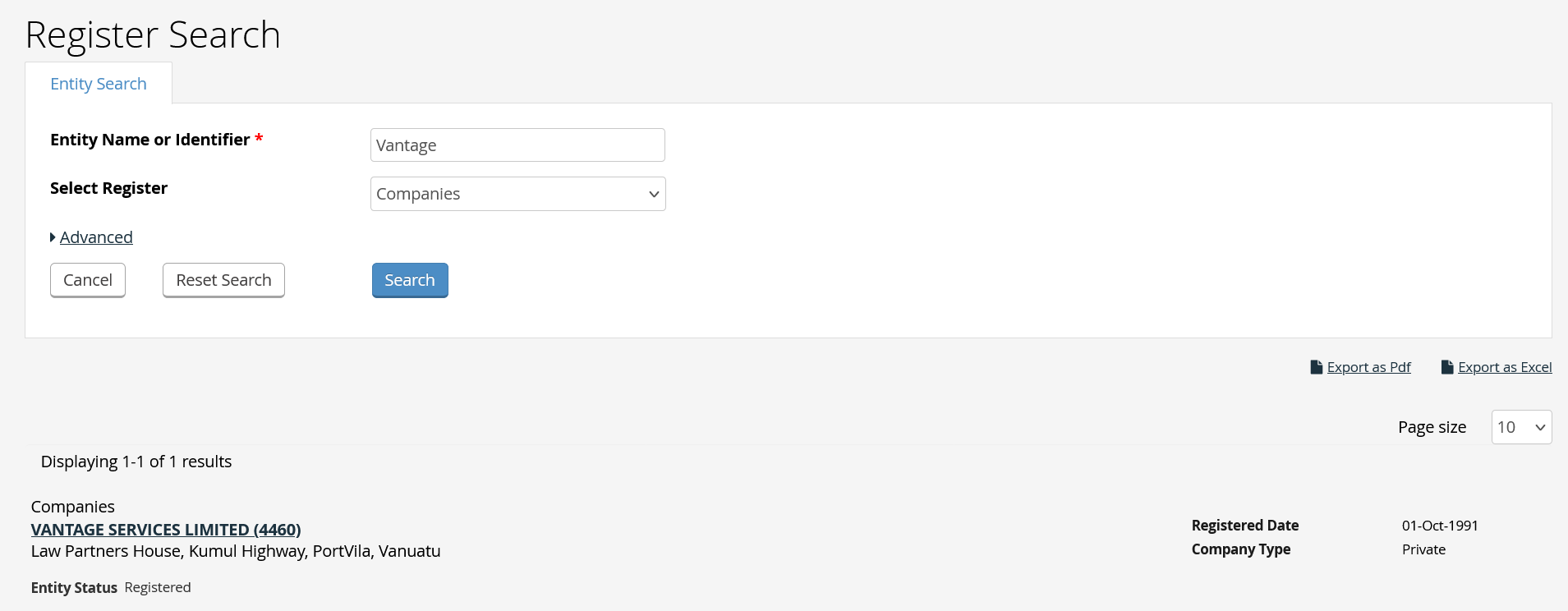

After typing Vantage into the search bar and clicking ‘Search,’ I am greeted with the following results.

Locating Vantage Services using the Register Search. Source: VFSC

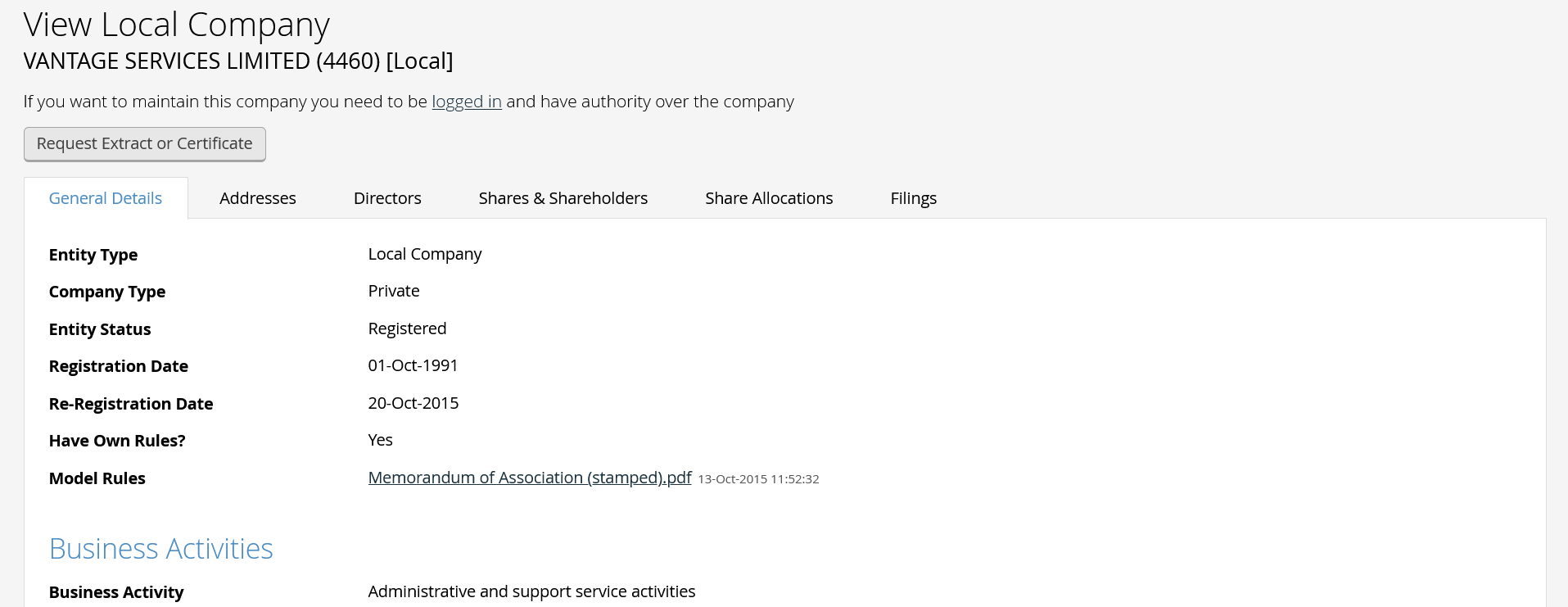

Clicking on Vantage Services Limited provides me with a wide range of information on the company. This includes date of registration, the company’s licensed business activities, its registered address and annual returns.

Vantage Service’s VFSC profile. Source: VFSC

Unlike many regulators, the VFSC does not provide warning lists of unauthorized firms, or of companies found to have breached regulatory requirements.

However, the Financial Markets Association Vanuatu maintains a database of firms that are no longer authorized to deal in the country. It also provides details of companies that have been illegally posing as a Financial Dealer License holder.

The Financial Markets Association Vanuatu describes itself as “a charitable organization… founded by six Registered Agents of the Financial Dealer Licensing (FDL) scheme.”

Bottom Line

Vanuatu’s low taxes and modest registration costs make it a popular destination for brokerages. Unfortunately, this also makes it a haven for less reputable individuals and companies.

Lawmakers in the country have tried to clamp down on bad actors in recent years. But the VFSC still has a long way to go, meaning investors and traders should consider using a broker that’s licensed by regulators with whose stricter rules offer better protections.

BrokerListings.com’s top regulated brokers offers a wide selection of Category A organizations from across the globe.

Article Sources

Vanuatu Financial Services Commission (VFSC)

Chapter 70 Financial Dealers Licensing Act – VFSC

Notice of Intention of Revocation of the Financial Dealers License – VFSC

Notice of Intention to Revoke – VFSC

Licensing regulations & guidelines – Financial Markets Association Vanuatu

Countries/Jurisdictions of Primary Concern – Vanuatu – US Department of State

Financial Markets Association Vanuatu

Inactive licenses (revoked, lapsed or rejected) – Financial Markets Association Vanuatu