Best Korean Exchange Brokers 2026

Discover the best brokers with access to the Korean Exchange (KRX) following our rigorous hands-on testing.

-

1Interactive Brokers (IBKR) is a top brokerage firm offering access to 150 markets in 33 countries and a range of investment services. With 40 years in the field, this company listed on Nasdaq strictly follows the rules set by authorities such as the SEC, FCA, CIRO, and SFC. It's recognized as one of the most reliable brokers for global trading.

-

2

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.8 XM is a global forex and CFD broker with over 15 million clients in more than 190 countries. Since 2009, it has offered low trading fees on over 1000 instruments. The broker is well-regulated by authorities such as ASIC, CySEC, DFSA, and SCA in the UAE, and provides a full MetaTrader experience. -

3

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.8 Pepperstone, established in Australia in 2010, is a highly-regarded forex and CFD broker serving more than 400,000 international clients. It provides access to over 1,300 instruments through leading trading platforms such as MT4, MT5, cTrader, and TradingView, while keeping fees relatively low and transparent. The company is regulated by known authorities including FCA, ASIC, and CySEC, offering a safe trading environment for all. -

4

Trust Platform Assets Fees Accounts Research Education Mobile Support 4.0 is a leading multi-asset platform offering trading in thousands of CFDs, stocks, and cryptoassets. Established in 2007, it has millions of active global traders and is regulated by top authorities like the FCA and CySEC. It is well-known for its social trading platform. Crypto trading is provided through eToro USA LLC. Investments are subject to market risk, including potential loss of principal. CFDs are not available in the US. Crypto investments carry risk and may not be suitable for retail investors, with a possibility of losing your entire investment. Understand the risks here. 61% of retail CFD accounts lose money.

Compare Brokers

Safety Comparison

Compare how safe the Best Korean Exchange Brokers 2026 are.

Mobile Trading Comparison

Compare the mobile trading features of the Best Korean Exchange Brokers 2026.

Comparison for Beginners

Compare how suitable the Best Korean Exchange Brokers 2026 are for beginners.

Comparison for Advanced Traders

Compare how suitable the Best Korean Exchange Brokers 2026 are for advanced or professional traders.

Accounts Comparison

Compare the trading accounts offered by Best Korean Exchange Brokers 2026.

Detailed Rating Comparison

Compare how we rated the Best Korean Exchange Brokers 2026 in key areas.

Fee and Cost Comparison

Compare the cost of trading with the Best Korean Exchange Brokers 2026.

Broker Popularity

See how popular the Best Korean Exchange Brokers [year] are in terms of number of clients.

| Broker | Popularity |

|---|---|

| eToro |

|

| XM |

|

| Interactive Brokers |

|

| Pepperstone |

|

Why Trade With Interactive Brokers?

Interactive Brokers is ideal for seasoned traders due to its robust charting platforms, updated data, and adaptability, especially with the IBKR Desktop application. Its exceptional pricing and advanced order features appeal to traders, and its variety of stocks remains unmatched in the market.

Pros

- IBKR, primarily designed for skilled traders, has expanded its appeal recently by eliminating its initial $10,000 deposit requirement.

- Interactive Brokers was named Best US Broker for 2025 by DayTrading.com for its dedication to US traders, ultra-low margin rates, and affordable global market access.

- Interactive Brokers has introduced ForecastTrader, a zero-commission service allowing users to trade yes/no Forecast Contracts on political, economic, and climate events. Contracts offer fixed $1 payouts, 24/6 market access, and a 3.83% APY on held positions.

Cons

- IBKR offers many research tools. However, the tools are not uniformly distributed across trading platforms and the web-based 'Account Management' page, causing confusion for the users.

- Only one active session per account is allowed, which means you can't run the desktop version and mobile app at the same time. This can sometimes lead to a frustrating trading experience.

- Customer service may take time to respond, and there may be delays in fixing problems based on tests. It could be difficult to reach the customer service promptly.

Why Trade With XM?

With a $5 minimum deposit, advanced charting on MT4 and MT5, a growing range of markets, and a Zero account with spreads from 0.0, XM offers what traders need. They have even won our 'Best MT4/MT5 Broker' award recently.

Pros

- XM offers reliable customer support tested over the years, providing 24/5 assistance in 25 languages, responses in under 2 minutes, and an expanding Telegram channel.

- XM offers over 1,000 instruments, giving traders various short-term opportunities, including turbo stocks, fractional shares, and thematic indices.

- XM has updated its platform with integrated TradingView charts and an XM AI assistant for faster execution, smarter analysis, and a more intuitive trading experience.

Cons

- The XM app is user-friendly and offers unique copy trading products, but its technical analysis tools need enhancement for advanced traders.

- XM only uses the MetaTrader platforms for desktop trading, offering no in-house downloadable or web-based solutions with unique features for beginners.

- XM is generally trusted and well-regulated but is registered with weak regulators such as FSC Belize. It no longer accepts UK clients, limiting its market reach.

Why Trade With Pepperstone?

Pepperstone is a leading choice for trading with low spreads, quick execution, and advanced charting for experienced traders. New traders benefit from no minimum deposit, a wealth of educational resources, and 24/7 support. Operating under ASIC regulation, Pepperstone is a top option for Australian traders and won DayTrading.com's 'Best Aus Broker' award for 2025.

Pros

- Pepperstone provides impressive transaction completion speeds, averaging about 30ms. This allows for quick order processing and execution, making it suitable for traders.

- Get top-notch customer support through phone, email, or live chat. Expect responses within <5 minutes based on our trials.

- Support for numerous top-charting platforms such as MT4, MT5, TradingView, and cTrader. These cater to different short-term trading styles, including algorithmic trading.

Cons

- Pepperstone's demo accounts last for 30 days. This might be insufficient for learning the various platforms and testing trading strategies.

- Pepperstone does not support cTrader Copy, a popular feature in the cTrader platform available at alternatives like IC Markets, though it has launched an intuitive copy trading app.

- Despite expanding its market range, crypto options are limited compared to other brokers in this area, and there is no option to invest in actual coins.

Why Trade With eToro?

eToro's social trading platform ranks highly due to its excellent user experience and active community chat, useful for beginners seeking trading opportunities. The platform also offers competitive fees on a vast selection of CFDs and actual stocks, alongside beneficial rewards for skilled strategy contributors.

Pros

- The eToro Club now has a $4.99/month subscription that offers 18 benefits, including a debit card that converts purchases into stocks with 4% cashback in shares.

- eToro is a well-known brand with strong global regulation and a community of over 25 million users.

- The copy trading app provides an excellent social platform with an engaging feed and community chat.

Cons

- There are no guaranteed stop-loss orders, which would be a helpful risk management feature for beginners.

- Contact options are limited, except for the in-platform live chat.

- The minimum withdrawal amount is $30 with a $5 fee, impacting beginners with little capital.

Filters

How We Chose The Best Brokers For Trading On The Korean Exchange

We ranked the best brokers for access to Korean markets, focusing on who actually lets you trade instruments linked to the Korean exchanges (e.g. KOSPI, major Korean stocks).

For each broker, we verified access ourselves – either directly inside the trading platform or by confirming details with the broker’s support team.

Only brokers that passed these checks made our list. Providers were then sorted by their overall ratings, calling on over 200 data points and the observations of our experienced stock traders.

What Is The KRX?

The Korea Exchange – or KRX for short – is the main securities exchange in South Korea.

Established in 2005, the exchange allows traders and investors to deal across a wide range of shares and derivatives. It was formed after the merger of the Korean Stock Exchange (founded in 1956), the Korean Securities Dealers Automated Quotations (KOSDAQ) market, and the Korea Futures Exchange.

The KRX is home to the Korea Composite Stock Price Index (or KOSPI). This is the country’s main index, and home to more than 847 companies with a total market capitalization of 3,363,117 KRW.

Here you’ll find South Korea’s multinational, blue-chip companies like electronics giant Samsung Electronics, semiconductor manufacturer SK hynix and carmaker Hyundai.

The KOSPI index. Source: TradingView

The KOSDAQ, meanwhile, comprises small- and medium-sized shares. Like the NASDAQ, it operates with a distinct technological flavor, and includes software developers, semiconductor makers, gaming companies and biotech startups.

Traders can also trade South Korean shares on the KONEX market. Launched in 2013, companies here are subject to less stringent market regulations than those on the KOSPI and KOSDAQ.

Across these three indices, investors have access to around 2,765 companies.

Pro tip: Alongside equities, the KRX facilitates the trading of exchange-traded funds (ETFs), bonds, and real estate investment trusts (REITs).

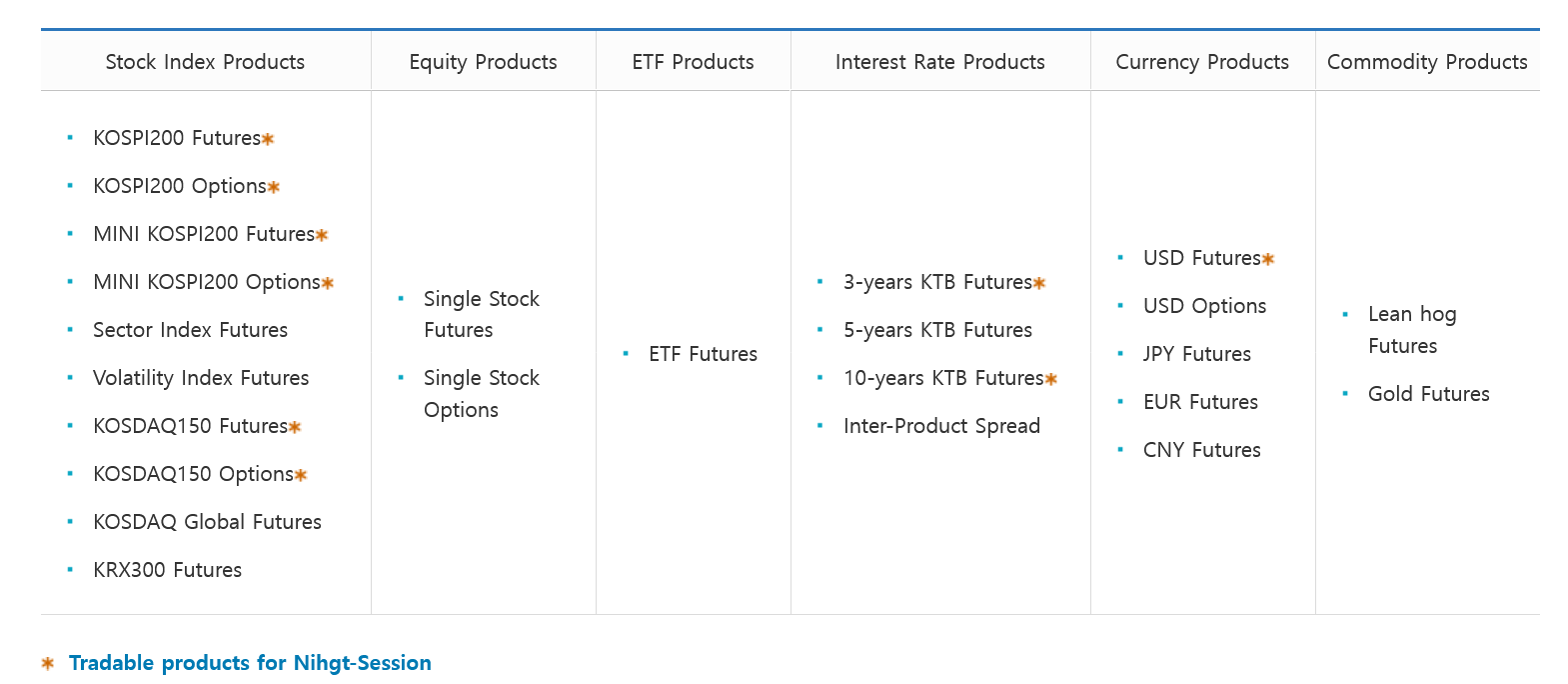

It also hosts derivatives products like futures and options contracts. These are available for multiple asset classes including shares, forex, commodities, bonds and indices.

Ways To Trade The KRX

The stunning growth of the Korean stock market in recent years means it’s much easier to buy and sell individual shares today than in times gone by.

That said, ETFs remain the most popular way that retail traders try to gain exposure to KRX shares. These funds can also span other asset classes, and in July 2025, the number of ETFs listed on the exchange surpassed 1,000 for the first time.

Pro tip: Korea’s ETF market has the highest percentage of active ETFs anywhere on the planet.

During 2024, investors put $61 billion into local ETFs, representing a 58% increase from the previous year’s assets under management (AUMs).

As in other markets, investors can buy thematic, share-based ETFs centered on specific sectors or themes. For instance, funds investing in artificial intelligence (AI), defense and green energy have surged in popularity of late.

It’s also possible to invest in ETFs that track specific local indices. These include funds that mimic the performance of the:

- KOSPI.

- KOSPI 200, which is the KOSPI’s 200 largest companies by market capitalization.

- KOSDAQ 150, representing the KOSDAQ’s 150 largest shares.

- KRX 100, comprising 100 large- and mid-cap stocks spanning the KOSPI and KOSDAQ.

- KOSPI MidCap 50, which cover 50 mid-sized companies on the KOSPI.

Derivatives are another popular way to trade on the KRX. Products like futures and options can be used to deal in specific stocks and the indices described, as well as other assets like forex and commodities.

A list of derivatives that can be traded on the KRX. Source: KRX

How To Pick A Broker To Trade On The KRX

Some of the key things to think about when choosing a KRX broker include:

Trustworthiness

Ensuring your capital is well protected and trades are executed securely and efficiently is the number one item to consider when choosing a brokerage.

The first port of call in this regard should be the website of South Korea’s Financial Supervisory Service (FSS). This supervisory agency was established in 1999 to protect consumers and ensure that financial service providers adhere to local rules and business standards laid down by the regulator (the Financial Services Commission (FSC)).

The FSS issues licenses to companies that meet its standards, and initiates enforcement action on those who breach regulations. Action can include suspending and revoking authorizations to deal.

Investors should check that a broker is licensed to deal using the FSS’s Financial Institutions Directory before handing over any money or personal data.

Having said that, the range of brokers directly authorized by the FSS is fairly limited. Traders can use reputable overseas operators while still enjoying robust protections by selecting overseas brokers that are licensed by top-tier regulators in other regions.

Pro tip: BrokerListings.com maintains a Regulator Rating System that traders can use to find Category A regulators.

As with the FSS, traders should check the broker they’re considering is authorized to deal using one of these other regulator’s websites.

Top broker for trustworthiness: eToro regularly obtains some of the highest trust scores from traders across the globe. Critically, it is also regulated by some of the world’s best financial regulators, including the UK’s Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), and the Cyprus Securities and Exchange Commission (CySEC).

Trading Costs

Taking steps to minimize dealing costs is imperative. Items like transactions fees, account charges, deposit and withdrawal fees, and overnight or swap fees can all add up to a significant sum over time.

This is especially important for high-volume traders, where costs like these can take a significant bite out of one’s profits.

Pro tip: Brokers who are regulated by reputable watchdogs must clearly and comprehensively publish all charges that customers can expect.

But it’s not just headline costs that need to be considered. Using a broker with wide bid (buy) and offer (sell) spreads can be less cost effective than employing one that charges higher transaction fees, for instance.

Top pick for trading costs: Pepperstone is one of the best-value brokers on the market today. Traders don’t pay transaction fees on forex trades, while deposit and withdrawal fees are excluded for almost all customers. Spreads are also fixed.

KRW Accounts

Those who operate in South Korea may wish to consider using a broker that offers a KRW account. Intermediaries providing such a service can save traders – and especially high-frequency ones – a large chunk of cash that would be lost in currency conversion charges.

Top pick for KRW accounts: Exness offers accounts supporting more than 40 base currencies, including the South Korean Won. It also offers low spreads and commission fees and super-low execution speeds (averaging below 25 milliseconds).

Trading Platform

Brokers have invested fortunes in the appearance and functionality of their trading systems in recent years. However, not all platforms are rated equally among traders, whether that be down to general usability or simply due to personal preference.

Some of the more general things to consider when evaluating a broker’s trading platform are:

- Trade execution speeds and reliability.

- Real-time data inclusion.

- Order types (like stop-loss and take profit instructions).

- Ease of navigation.

- Availability of cutting-edge tools (like algorithmic trading and advanced charting tools).

- Dashboard customizability.

- Security features (for example, multi-step verification).

- News and research integration.

- Customer support (such as online chat).

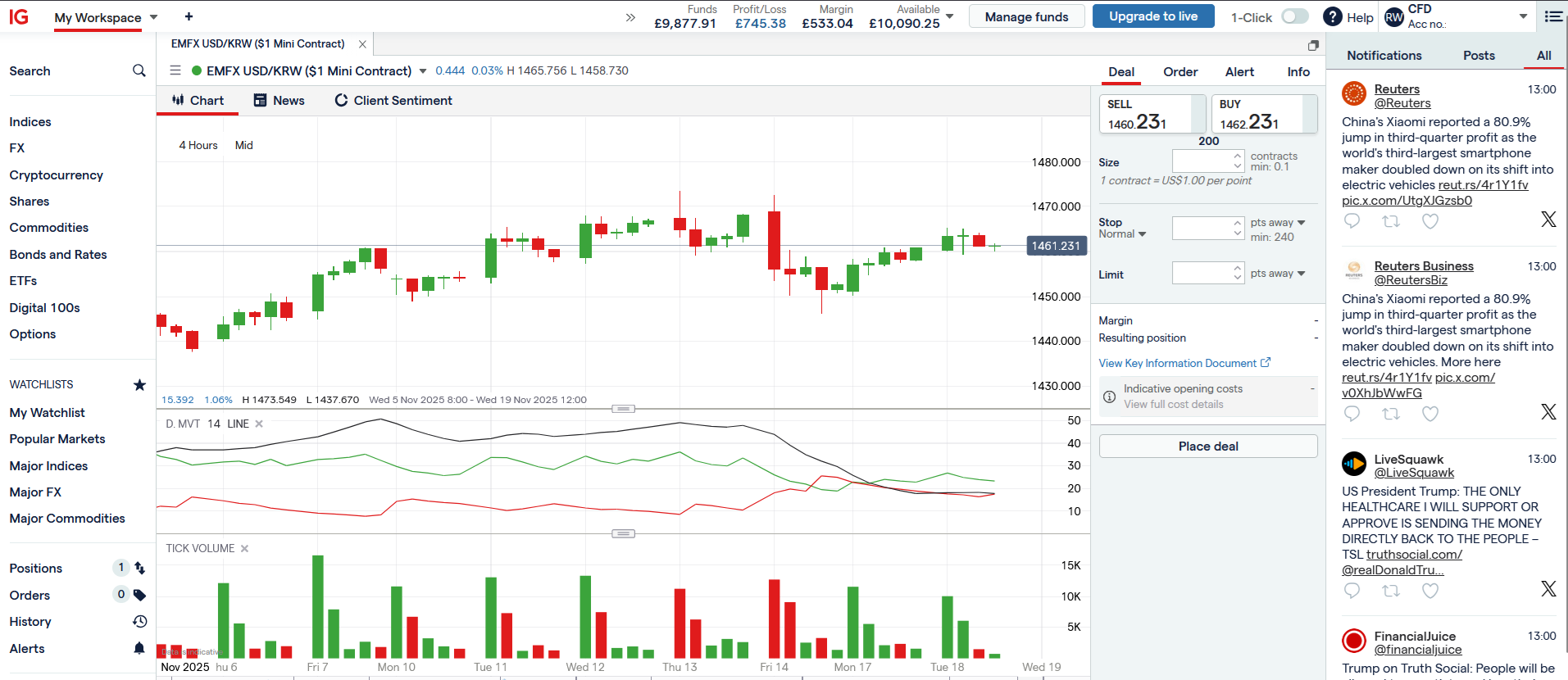

Top broker for trading platform: IG provides one of the best trading experiences out there. Its proprietary trading system offers fast execution, an easy-to-navigate interface, extensive customization, real-time market data and advanced charting tools.

Traders can also use IG’s excellent mobile app to capitalize on money-making opportunities on the go.

Finally, IG customers can plug in third-party platforms like MetaTrader4 (MT4) if that’s how they prefer to trade.

Trading the USD-KRW forex pair using an IG demo account. Source: IG

Asset Selection

As in other parts of the globe, the range of assets available to trade in South Korea differs substantially from brokerage to brokerage.

It can be especially tough to find a services provider that offers direct access to KRX shares. Liquidity issues mean that even brokers offering exposure to individual shares may struggle to offer stocks outside the country’s biggest blue chip companies.

Pro tip: In April 2025, the FSC announced rule changes that allow foreign investors to directly trade Korean stocks through overseas brokerages.

It’s important to consider using a broker that offers a wide choice of assets. This can allow one to capitalize on a greater range of trading opportunities that may arise outside one’s primary investment focus.

Top broker for asset selection: Interactive Brokers offers access to an enormous range of KRX assets, ranging from the typical ETFs most companies offer to individual stocks.

How To Begin Trading On The KRX

The process of signing up to a broker may differ slightly. However, the main steps one I’d expect when starting off trading South Korean assets looks something like this:

- Find a broker. Using the criteria described above, I’ll spend some time finding the best broker that suits my needs. The market is huge and it can pay to shop around.

- Register for an account. This process will involve submitting some personal information and providing proof of identification and address. It’s also likely I’ll need to answer questions on my investing goals and experience.

- Deposit some cash. With the account open, I’m ready to put some capital in my account to begin trading. I may be able to do this with a bank transfer, through a debit card transaction, or by using a third-party payment provider (such as PayPal).

- Start trading. After choosing which asset to trade on the KRX, and carrying out careful research on the market, I’ll be ready to place my first trade. I’ll need to consider using risk management tools to boost my chances of making a profit.

- Monitor price action. I’ll need to closely keep an eye on the market, and be ready to exit my position according to my investing strategy.

Bottom Line

The Korean Exchange is one of Asia’s largest and fastest-growing trading arenas. While overseas investors still face some hurdles when participating, regulatory changes are making it easier for those outside South Korea to trade the country’s securities.

Traders have a healthy selection of brokerages to choose from to trade KRX assets. Consider things such as regulatory status, trading platform, costs, and the range of securities on offer when deciding which company to go with.