Best Nasdaq Dubai Brokers 2026

There are no brokers that we are currently comfortable recommending that offer direct access to the Nasdaq Dubai stock exchange, however these top brokers offer indirect exposure through products like the iShares MSCI UAE ETF.

-

1Saxo Markets is a renowned trading brokerage, investment firm and bank. It offers over 72,000 trading instruments, investment products, and managed portfolios, ensuring ample opportunities for clients. It operates under the regulation of more than ten agencies including FINMA, FCA & ASIC, thus providing the best protection. The firm is well-known for its transparent pricing.

Compare Brokers

Safety Comparison

Compare how safe the Best Nasdaq Dubai Brokers 2026 are.

Mobile Trading Comparison

Compare the mobile trading features of the Best Nasdaq Dubai Brokers 2026.

Comparison for Beginners

Compare how suitable the Best Nasdaq Dubai Brokers 2026 are for beginners.

Comparison for Advanced Traders

Compare how suitable the Best Nasdaq Dubai Brokers 2026 are for advanced or professional traders.

Accounts Comparison

Compare the trading accounts offered by Best Nasdaq Dubai Brokers 2026.

Detailed Rating Comparison

Compare how we rated the Best Nasdaq Dubai Brokers 2026 in key areas.

Fee and Cost Comparison

Compare the cost of trading with the Best Nasdaq Dubai Brokers 2026.

Broker Popularity

See how popular the Best Nasdaq Dubai Brokers [year] are in terms of number of clients.

| Broker | Popularity |

|---|---|

| Saxo |

|

Why Trade With Saxo?

Saxo is ideal for frequent traders and large-scale investors due to its extraordinary range of tools, high-quality market research, and fee discounts. Moreover, its offering of 190 currency pairs with narrow spreads makes it suitable for forex traders.

Pros

- You can use thorough analysis tools like TradingView and Updata for trading.

- Sophisticated proprietary trading platforms with extensive charting options and advanced analytical tools.

- A reputable and strictly regulated brand from Switzerland.

Cons

- Do not accept clients from certain regions, specifically the US and Belgium, for trading activities.

- The trading accounts require substantial funding.

- To view Level 2 pricing, a subscription is necessary.

Filters

How We Chose The Best Brokers For Trading On Nasdaq Dubai

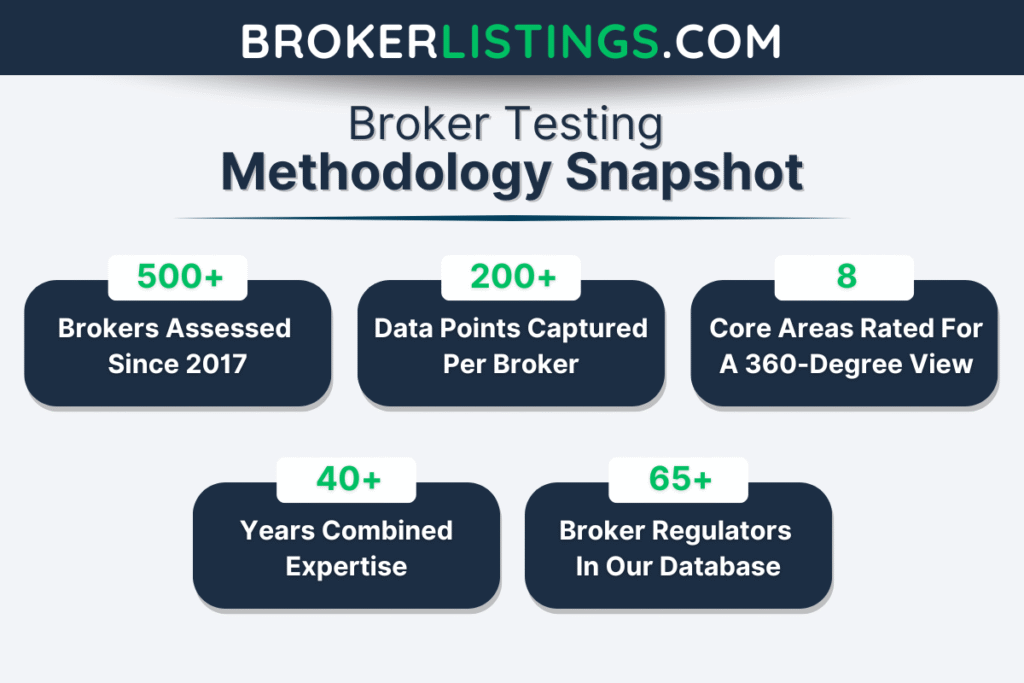

We ranked the best brokers for access to UAE markets, focusing on who actually lets you trade instruments linked to Nasdaq Dubai (e.g. UAE-listed funds and major regional names).

For each broker, we verified access ourselves – either directly inside the trading platform or by confirming details with the broker’s support team.

Only brokers that passed these checks made our list. Providers were then sorted by their overall ratings, calling on over 200 data points and the observations of our experienced stock traders.

What Is Nasdaq Dubai?

Nasdaq Dubai is the premier trading venue in the United Arab Emirates (UAE). The exchange is also one of the largest centres of Shariah-compliant securities on the planet.

Established in 2005 as the Dubai International Financial Exchange (DIFX), Nasdaq Dubai is located in the Dubai International Financial Centre (DIFC). This ‘financial free zone’ has industry regulations that closely match those of other major trading centers like London, New York and Hong Kong.

Nestled between East and West, Nasdaq Dubai was created to attract the interest of international traders and investors. Its global standing was improved in 2008 when the Nasdaq OMX Group invested in the then-DIFX, rebranded the exchange, and integrated it into the broader Nasdaq network.

Ways To Trade Nasdaq Dubai

Investors can trade equities, Bitcoin-backed exchange-traded products (ETPs), real estate investment trusts (REITs) and futures contracts on the Nasdaq Dubai.

Pro tip: The exchange’s benchmark stock index is the FTSE Nasdaq Dubai UAE 20 Index. This comprises of the largest 20 stocks by market capitalization across the Nasdaq Dubai, the Dubai Financial Market (DFM) and the Abu Dhabi Securities Exchange (ADX).

Unlike Nasdaq Dubai, the DFM and ADX exchanges were created with local rather than international traders in mind.

The FTSE Nasdaq Dubai UAE 20 Index. Source: Google Finance

Though stock trading attracts decent volumes, debt instruments like corporate and government bonds constitute the lion’s share of securities traded on Nasdaq Dubai.

More specifically, Nasdaq Dubai has positioned itself as the world’s foremost venue for Sukuk bonds.

Unlike conventional bonds, these financial instruments are Sharia compliant — this means that holders will not earn interest, but instead receive a share of the profits created by the underlying asset.

Choosing A Broker To Trade On Nasdaq Dubai

Traders must open an account with one of Nasdaq Dubai’s 20-plus member brokers to directly buy and sell securities on the exchange.

Among this select group are some of the world’s largest financial institutions including Citigroup, HSBC, Morgan Stanley and Standard Chartered.

Pro tip: Investors can still obtain exposure to shares in the Dubai and broader UAE indirectly with other brokers.

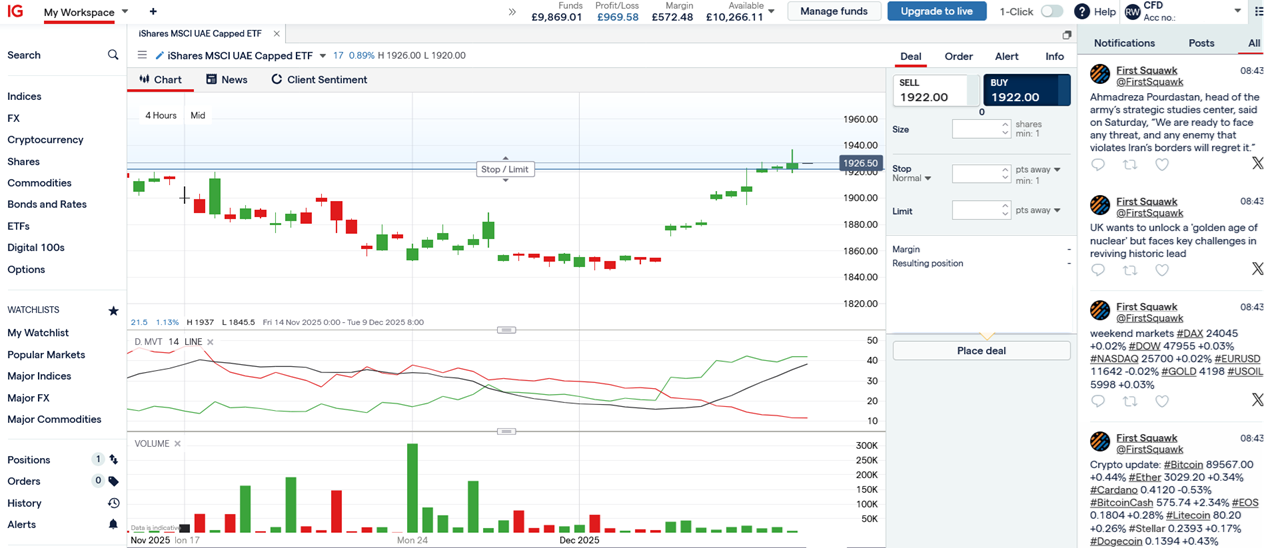

The iShares MSCI UAE ETF, for instance, is an exchange-traded fund (ETF) that leading brokers like IG and Saxo both allow customers to trade.

This fund – which trades on the Nasdaq index in the US –tracks the performance of 55 listed companies in the UAE. These include real estate developer Emaar Properties, financial services provider First Abu Dhabi Bank, and telecoms specialist e& (formerly etisalat).

But how do traders know which is the best brokerage for their needs? Here are some of the key things to consider when deciding which services provider to employ:

Trustworthiness

A non-negotiable for any trader is to ensure the brokerage is above board and closely monitored by a reputable regulator. This way, investors can help protect themselves from fraudulent actors and disreputable trading practices.

Investors can do this by checking the broker’s approval status with the Dubai Financial Services Authority (DFSA). The local regulator maintains a database of licensed operators on its website.

Pro tip: However, a better option may be to see if the broker under consideration is licensed in a region that provides greater trader protections.

Under BrokerListings.com’s Regulator Ranking System, the DFSA is designated Category B status. This indicates a ‘good’ rather than ‘excellent’ level of regulatory oversight.

For ultimate peace of mind, traders should look into using a brokerage that has achieved Category A status. Such bodies include the Financial Conduct Authority (FCA) in the UK, the Swiss National Bank (SNB), and the US Commodity Futures Trading Commission (CFTC).

IG is one of the world’s most trusted brokers. Operating across the planet, it is licensed by more than 10 top-tier regulators, including the three listed above.

Trading the iShares UAE ETF with IG. Source: IG

Asset Range

The selection of securities on offer can vary substantially among brokers. Whether you’re trading on a major venue like the London Stock Exchange or on smaller exchanges such as Nasdaq Dubai, that fact stays the same.

It’s important to consider not only assets you plan to focus on, but also other securities that may be available. Having a wider range of securities to trade will give you the chance to capitalize on more profit-making opportunities as they arise.

Trading Platform

The differences between broker platforms can be both subtle and substantial. Some of these might not matter to certain investors. For others, they can be dealbreakers.

That said, there are key characteristics and features that every trader should think about when choosing a broker based on trading platform. These include:

- Execution speeds.

- Platform stability, especially during busy trading periods.

- Availability of real-time and Level 2 (or order book) data.

- Ease of navigation and customizability.

- Access to advanced tools (like stock screeners, automated trading features and advanced charting).

- Depth of additional resources (such as analyst reports, news feeds and economic calendars).

- Risk management tools (such as take profit and stop loss instructions).

- Security features (for instance, does the broker require multi-step verification for signing in?).

Pro tip: If you wish to use a third-party platform like MetaTrader 5 and TradingView, check that the broker you’re considering operates a compatible trading system.

Some companies may only be compatible with particular software. Others might not be compatible at all.

Saxo provides a very good trading experience, offering a variety of advanced tools on its customizable desktop platform. It also offers a mobile app and demo accounts for traders to give it a test run. Users can plug in TradingView and ProRealTime if that’s their preferred route to trading, too.

Saxo offers an excellent trading experience. Source: Saxo

Trading Costs

Last but not least, traders need to carefully consider how much of their hard-earned cash the broker will take for providing their service. Devising careful investing strategies will only get you so far if high fees and charges take a big bite out of profits.

It’s therefore important to consider things like:

- Transaction fees.

- Deposit fees.

- Management fees.

- Overnight (swap) charges.

- Withdrawal costs.

- Inactivity charges.

On top of this, consider how wide the broker’s minimum bid and ask spreads are. Sure, a company may have zero or rock-bottom transaction charges. But large spreads can still make them more expensive to use than one with higher trading fees.

Pro tip: Traders in the UAE can eliminate unnecessary foreign exchange fees by using a broker that offers trading using the dirham (AED), the region’s local currency.

How To Begin Trading On Nasdaq Dubai

Broadly speaking, signing up with a brokerage follows a set formula:

- Finding a broker. Employing the criteria above, I’ll take time to find the services provider that best suits your needs. The market is large and highly competitive, though my choices may be more restricted depending on whether I want to directly or indirectly trade Dubai-listed securities.

- Opening an account. Once I’ve found my broker, I’ll need to send over digital copies of ID and proof of address to create a trading an account. I’m also likely to be asked questions on my trading objectives and experience, in line with regulatory requirements.

- Deposit some cash. Most brokers accept customer deposits using a variety of methods. These include traditional methods like bank transfer and debit card payment, to more 21st-century solutions like using cryptocurrencies, a third-party payment provider (like PayPal), or a digital wallet (such as Skrill).

- Begin trading. With cash on hand, I’ll be able to start trading. But rather than jumping in at the deep end, I may want to consider using a demo account to familiarize myself with the trading platform before putting any real money on the line.

- Observe the market. Whether I’m trading with actual or virtual cash, I’ll need to keep a close watch on prices. Financial markets move quickly, and I could lose a lot of money or miss profit-making opportunities in the blink of an eye.

Bottom Line

Whether trading directly or indirectly in Dubai and the UAE, traders have a large selection of brokerages to choose from. Consider using one that is licensed by a top-tier regulator for the best and safest trading experience.